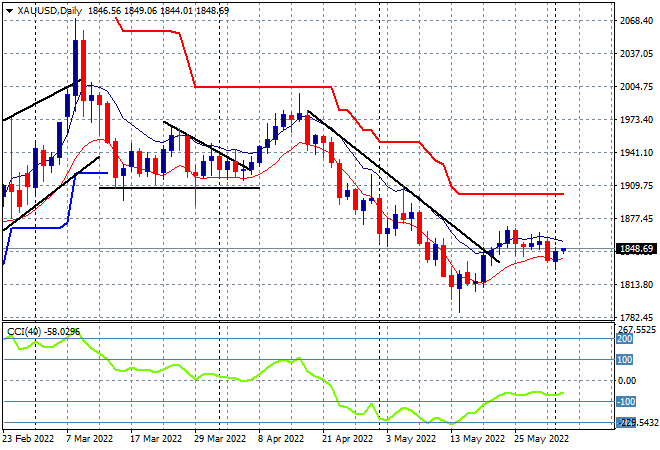

It’s a sea of red across Asian share markets as confidence falters after another poor lead from Wall Street and European shares overnight as inflation and growth concerns dominate. In currency land, the Australian dollar is slowing losing ground as Euro and Pound Sterling moved lower against USD. Oil prices are sliding with Brent crude continuing its pullback from overnight to be at the $114USD per barrel level while gold is trying to get back up to the $1850USD per ounce level:

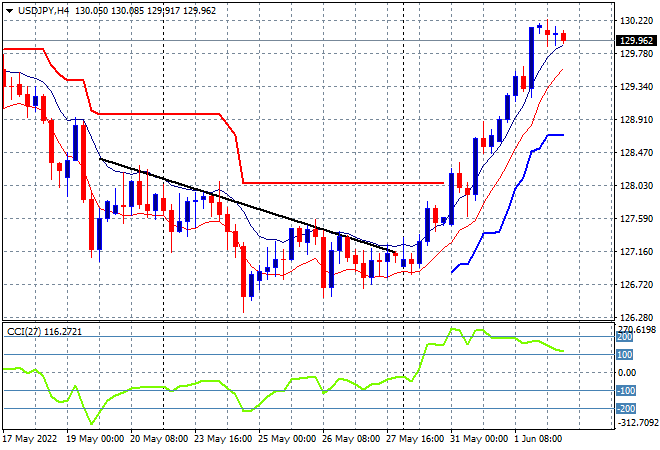

Mainland Chinese share markets started off poorly but have gradually made ground throughout the session with the Shanghai Composite closing some 0.4% higher at 3196 points while the Hang Seng Index has been unable to hold on to its recent gains, down 1.3% to 21018 points. Japanese stock markets however are treading water, with the Nikkei 225 index closing 0.2% lower at 27413 points while the USDJPY pair has consolidated after its big zoom up last night, retracing just below the 130 handle and looking way overextended:

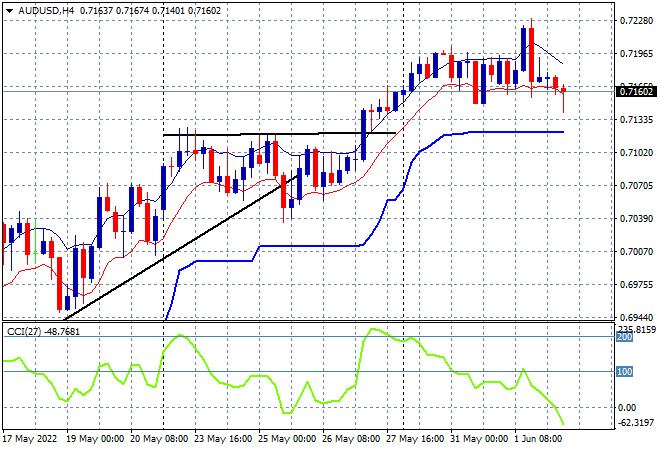

Australian stocks have sold off all day with the ASX200 closing 0.8% lower at 7185 points while the Australian dollar briefly dipped to the mid 71s before just coming back to where it started overnight, still stuck just below the 72 level as momentum abates:

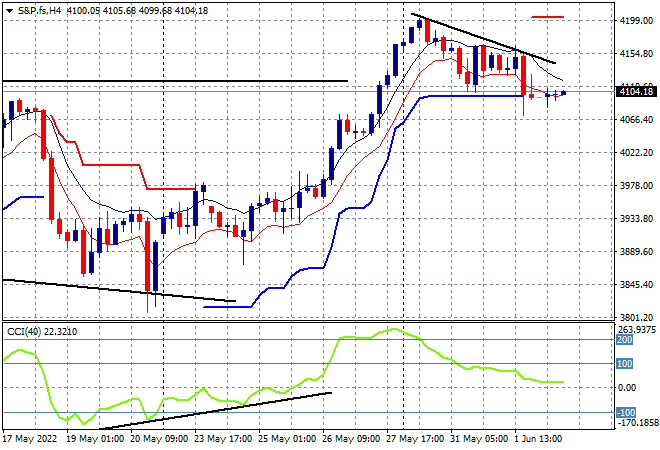

Eurostoxx and Wall Street futures are looking wobbly as we head into the European with the S&P500 four hourly futures chart showing price still holding on after selling off overnight with that 4100 point level the key area to watch. Short term momentum has retraced from a very overextended position, but is not yet negative, so a flat start is likely on the open tonight:

The economic calendar includes US initial jobless claims and factory orders in the lead up to Friday nights US non-farm payrolls print.