All eyes on Martin Place today as the RBA held fire on another interest rate rise and indicated a probable pause ahead as Asian stock markets generally continued their solid start to the new trading week after absorbing last week’s triple whammy of central bank meetings, with the all important US jobs print to look forward to on Friday. The Australian dollar was pushed back to the mid 66 cent level on the pause and other undollars remain under the pump of a strong King Dollar.

Oil prices are holding on to their recent gains as Brent crude remains above the $85USD per barrel level while gold is failing to clawback its recent losses, still floating around the $1950USD per ounce level and looking very weak here:

Mainland Chinese share markets are having flat sessions with the Shanghai Composite about to close just 0.1% lower at 3286 points while in Hong Kong the Hang Seng Index has pulled back 0.7% or more to again reject the 20000 point barrier.

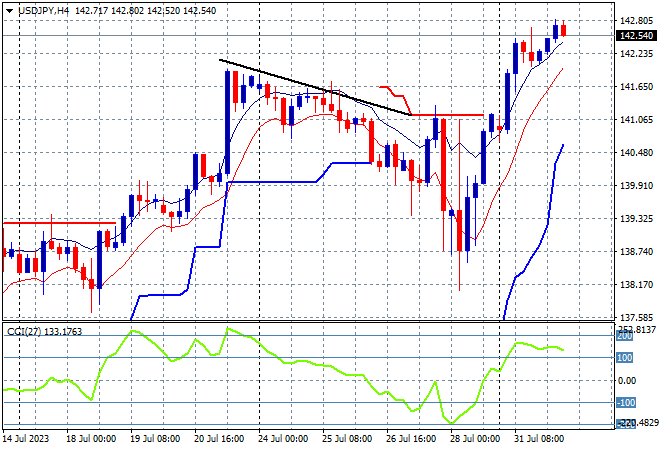

Japanese stock markets are lifting strongly again with the Nikkei 225 closing nearly 1% higher at 33472 points while the USDJPY pair has continued its rebound to surpass its previous weekly high above the 142 handle in a big turnaround from last week’s low:

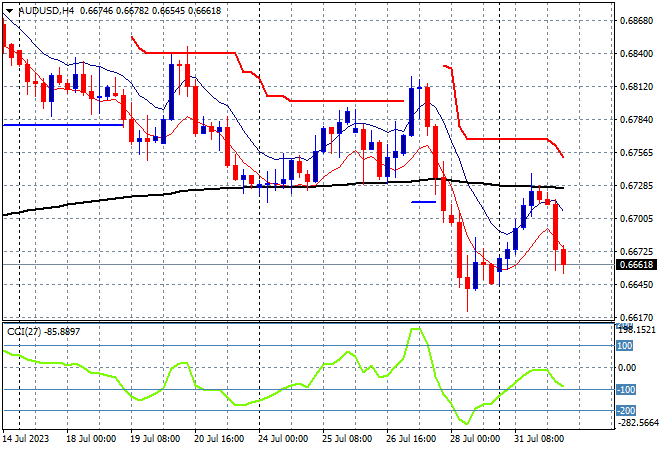

Australian stocks really like the RBA pause with the ASX200 closing 0.5% higher at 7450 points. The Australian dollar however retreated despite everyone expecting the pause with a fallback to the Friday night lows just above the mid 66 cent level vs USD, confirming the current downtrend:

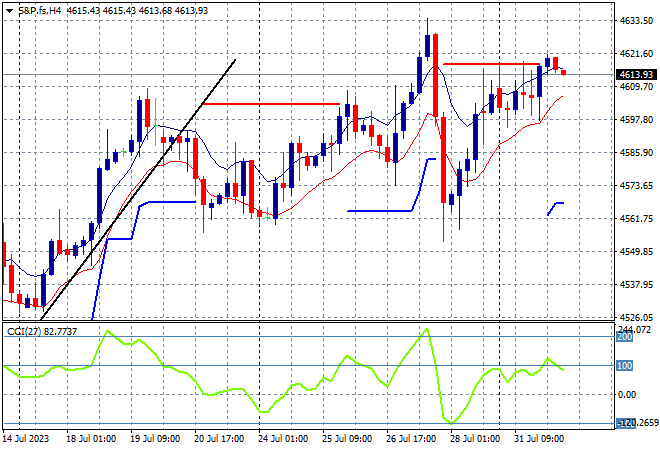

Eurostoxx and S&P futures are down about 0.1% as traders start a new month with the S&P500 four hourly chart showing another attempt at staying above the 4600 point level as earnings season continues into this week’s NFP print on Friday:

The economic calendar continues with the latest German unemployment print and then US ISM manufacturing PMI for July.