-

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth.

-

Soft Q1 guidance and valuation worries may limit the stock’s upside.

- Weak network and gaming sales added to investor caution.

- Get the AI-powered list of stock picks that smashed the S&P 500 in 2024 for half price as part of our FLASH SALE.

Nvidia (NASDAQ:NVDA) crushed earnings expectations on Wednesday, yet its stock wobbled for a brief period in after-hours trading, before recovering in pre-market action. The mixed reaction signals uncertainty as investors brace for today’s session.

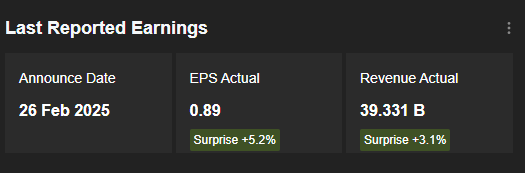

At first glance, the AI chip giant delivered a stellar performance. Q4 2024 revenue soared to $39.33 billion, easily surpassing the $38.05 billion estimate. Earnings per share landed at $0.89, edging past forecasts of $0.85. But despite the strong numbers, the market’s hesitation suggests investors may be looking beyond the headline beat.

However, increasingly demanding investors seem to have focused on other, less optimistic details.

Why is the market reaction mixed to Nvidia’s excellent results?

First of all, the company announced that it expects sales of $43 billion for the first quarter of 2025, slightly above the average forecast ($42.3 billion), but below the high estimate of $48 billion.

The company also warned that its non-GAAP gross margin should reach 71% for the current quarter, 1 point below consensus.

It should also be noted that Q1 sales of $43 billion would correspond to annual sales growth of just over 65%, which would certainly be impressive, but would confirm the slowdown in growth.

Indeed, Q4 2024 revenues published last night corresponded to annual growth of 77.8%, itself lower than Q3 (+94.4%) and Q2 (+130%).

Details of sales by division also prompted investors to exercise caution. Revenues from the networks division missed expectations, at $3.02 billion versus $3.51 billion anticipated, and down 9.2% year-on-year.

The same was true of video game sales, down 14% year-on-year to $2.5 billion, against expectations of $3.02 billion.

Results were therefore not perfect across the board, and the slowdown in growth suggests that maturity is approaching for Nvidia, suggesting that we shouldn’t expect the stock to repeat its stellar performance of 2024 (+194%) this year.

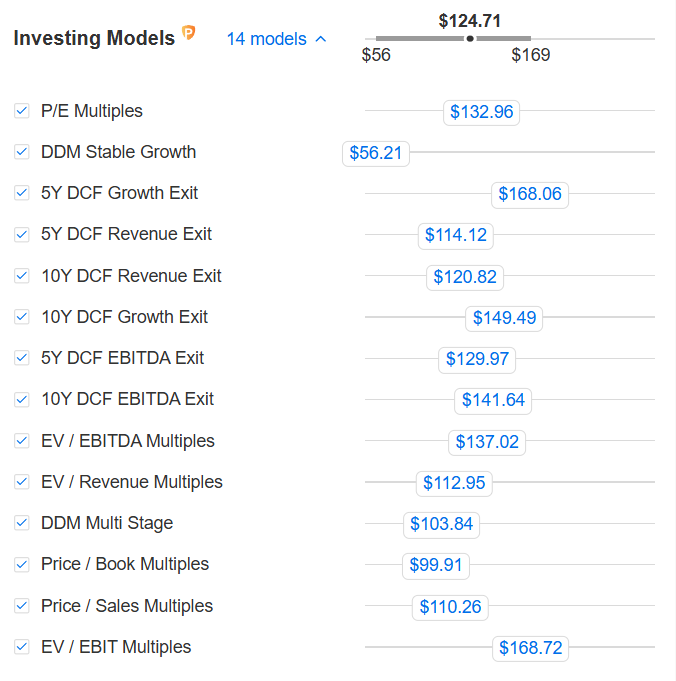

Nvidia shares overvalued according to models

On the other hand, valuation models consider the share to be overvalued at the current price, with an InvestingPro Fair Value (which synthesizes several recognized models) at $124.71, 5% below Wednesday’s closing price.

This doesn’t mean we should necessarily expect a plunge either, but it does imply that there are now more interesting opportunities to bet on this year.

ProPicks AI sends a warning

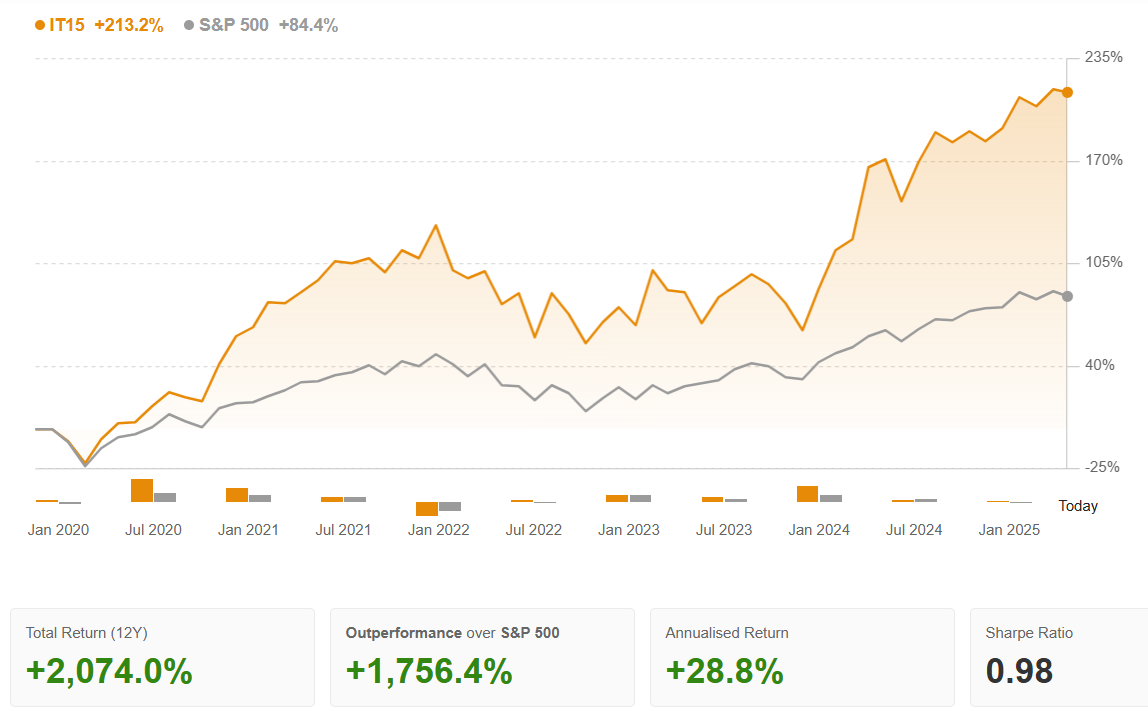

It’s also worth noting that Nvidia shares were removed from ProPicks AI’s Tech Titans strategy earlier this month.

InvestingPro’s AI-managed strategy added Nvidia shares as early as November 2023 and later closed the position with a staggering 229% gain in just 14 months.

Since its real-world launch in November 2023, the Tech Titans strategy has delivered an impressive 95.08% overall return—far outpacing the S&P 500’s 38.79% gain through its February 2025 update.

Updated monthly—just like all 30+ ProPicks AI strategies on InvestingPro—the Tech Titans strategy gets its next refresh on Monday. That makes now the perfect time to get in at a steep discount through this link and start profiting.

***

DISCLAIMER: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor