(Adds short interest data, details, quotes)

By Atul Prakash

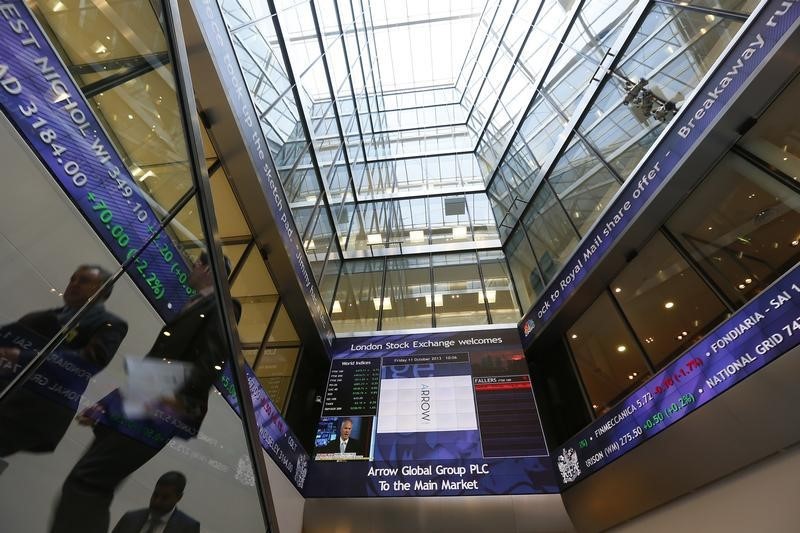

LONDON, Jan 20 (Reuters) - European basic resources and energy share indexes slumped to their lowest levels in more than 12 years on Wednesday, with a sharp decline in oil and metals prices scaring investors away from commodities stocks.

The STOXX Europe 600 Basic Resources index .SXPP fell 4 percent, while the region's oil and gas index .SXEP slipped 3.8 percent, with both touching their lowest levels since 2003.

Shares in commodities-related companies such as BHP Billiton BLT.L , Anglo American AAL.L , Glencore GLEN.L and Royal Dutch Shell RDSa.L fell 5.7 percent to 6.9 percent.

"We do not see any lasting potential for these sectors to outperform and believe any recovery might be short-lived," Christian Stocker, equity strategist at UniCredit, said.

"The trend of earnings estimates is declining strongly, relative valuation versus the overall market is still very high, and a lasting trend reversal in commodity prices is not in sight. We recommend remaining underweight on commodity stocks."

Mining and energy stocks have been hit by a slowdown in China, which is the world's second-biggest economy and a major global consumer of metals and oil.

According to Thomson Reuters Datastream, the basic resources and oil and gas indexes trade on 13.5 times and 13.9 times respectively their 12-month forward earnings, against 14.2 times for the broader STOXX Europe 600 index .STOXX .

Short interest - namely bets on a future fall in a stock - in mining and energy companies has also risen, according to data from Markit.

Short interest in BHP Billiton rose to 0.4 percent of shares available for loan on Monday, against 0.15 percent the previous session.

Companies such as Glencore and BP BP.L have also seen a rise in short interest as measured by the amount of shares out on loan.

To profit from a stock going down, short sellers can borrow a stock and then sell it, expecting it to decrease in value so they can buy it back at a lower price and keep the difference.

The European basic resources index has fallen more than 20 percent in just three weeks of 2016 after slumping 35 percent in the previous year, while the oil and gas index is down 13 percent so far this year after falling 8 percent in 2015.

Technically, Britain's commodity-heavy FTSE index .FTSE has also slipped into a "bear-market" territory after falling 20 percent since its record high in April last year. The index was down more than 3 percent on Wednesday, in line with a fall in other major European stock indexes.

"We still do not believe the (mining) sector has arrived at a 'value point' as we consider that many commodity prices have not yet bottomed," Investec analysts said in a note.

"As we accentuate the negative and eliminate the positive, we have naturally made further downgrades to our equity target prices and caution that making key valuation judgments is challenging until the latest round of asset impairments, dividend cuts and downgrades by credit agencies is complete."