By Lewis (JO:LEWJ) Krauskopf

NEW YORK (Reuters) -Nvidia Corp's results in the coming week could guide the U.S. stock market on its next path, as investors turn their focus to the technology sector and artificial intelligence trade after an election-fueled rally stalled.

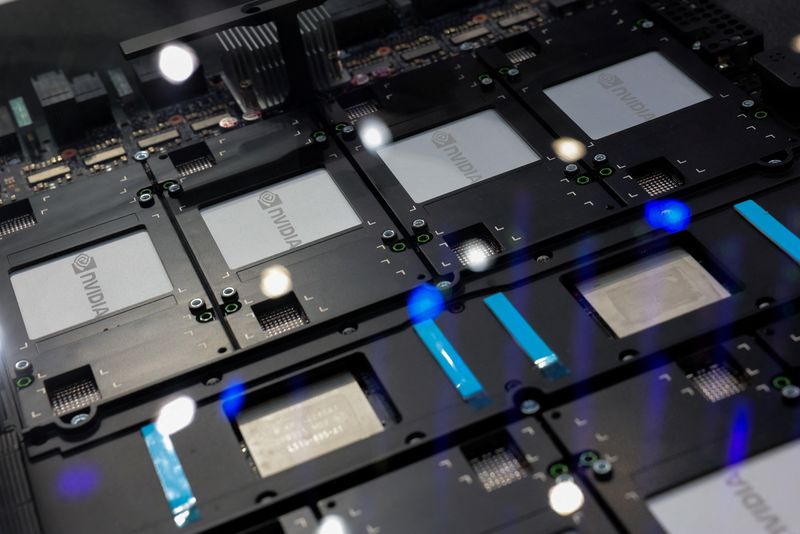

A nearly 800% run in shares of Nvidia over the past two years, driven by its gold standard AI business, has propelled the semiconductor company to the world's top spot by market value.

That heft gives Nvidia huge sway in market benchmarks, such as the S&P 500 and Nasdaq 100, while its results on Nov. 20 will also be a gauge for the market's appetite for tech stocks, the AI trade and sentiment for equities broadly, investors said.

The benchmark S&P 500 has pulled back from record highs following the Nov. 5 U.S. election that gave Donald Trump a second term as president and his fellow Republicans control of Congress.

Markets are "looking for direction right now," said Garrett Melson, portfolio strategist at Natixis Investment Managers. "If those results are pretty strong, that tells you that there's still momentum behind that investment and that trade and I think that helps to broaden out risk appetite."

Nvidia's dominant AI position has catapulted its share price and led to an astonishing financial performance. For its fiscal third quarter, the company is expected to post net income of $18.4 billion as revenue jumped over 80% to $33 billion, according to LSEG data.

However, after soaring past analysts' earnings estimates last year, Nvidia's surprises have become more modest, with earnings beating by 6% in its most recently reported quarter, LSEG data showed.

"It's getting harder to hurdle those expectations," said Mark Luschini, chief investment strategist at Janney Montgomery Scott.

Nvidia's results cap a mixed third-quarter earnings season for U.S. companies. S&P 500 earnings are on pace to have risen 8.8% from a year earlier, with 76% of companies beating estimates compared to an average of 79% in the past four quarters, according to LSEG IBES data.

As in recent quarters, results from Nvidia and a small group of other megacap tech and related companies are carrying the load. Those so-called Magnificent 7 companies, which also include Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT), are expected to have increased earnings by 30% in the third quarter compared to 4.3% for the other 493 companies in the index, said Tajinder Dhillon, senior research analyst at LSEG.

"It's really the Mag 7 led by Nvidia that's done the heavy lifting to address the kind of earnings growth that has supported the advance we've seen in stock prices," Luschini said.

Nvidia's results may also be crucial to support the broader market's lofty valuation, with the S&P 500's forward price-to-earnings ratio above 22 times and near its highest level in more than three years, according to LSEG Datastream.

The benchmark index is up 23% this year. Trump's victory initially sparked broad stock gains on optimism about his agenda of lower taxes and deregulation.

But stocks have pulled back this week as markets continue to digest the implications from the election.

Investors will keep focus on Trump's transition plans, including his picks for key cabinet roles, after some of his initial appointees drove weakness in areas of the market such as pharmaceutical and defense shares.

Stocks also fell after Federal Reserve Chair Jerome Powell said on Thursday that the central bank does not need to rush to lower interest rates, which will keep monetary policy at the forefront for markets in coming weeks.

"Given that the stock market has become so expensive, the fact that the Fed is signaling that they're not going to be as accommodative as they had indicated before the election ... will create at least some headwinds in the days and weeks ahead," Matthew Maley, chief market strategist at Miller Tabak, said in a note on Friday.