The ASX is expected to fall today after turning its fortunes around in late trade yesterday.

The ASX200 finished 2 points (0.03%) higher yesterday at 7,311, led by Health Care (0.59%), IT (+0.21%) and Energy (+0.16%). On the flipside, Consumer Staples (-0.30%), Real Estate (-0.19%) and Industrials (-0.10%) were the weakest.

“A disappointing session for the ASX200, giving up most of its 30 points of early gains on a combination of dour economic data and mixed earnings reports,” IG Markets' Tony Sycamore said.

“The RBA's on-hold decision last week and softer inflation reading last month were expected to fuel a bounce in yesterday's consumer confidence release. However, it surprisingly slipped to 81 (from 81.3 prior) to remain in deeply pessimistic territory as households strained under cost-of-living pressures.”

In the US overnight, indices fell after Moody’s cut its credit rating on several small to midsized US banks. Bad Chinese Trade Data was also met poorly by the markets.

“Trade data in China showed that exports fell for a third straight month in July, while imports fell for a fifth consecutive month. A warning shot across the bow ahead of the release of Chinese inflation data today, which is expected to fall in July by -0.4% YoY,” Sycamore said.

Notably, Bloomberg reported that this was the first time in around 20 years that the US imported more from Mexico than from China.

The outlook isn't bright on that front, with "most measures of export orders point to a much greater decline in foreign demand than so far reflected in the customs data," said Capital Economics' head of China Economics Julian Evans-Pritchard.

What happened overnight?

Here’s what saw (source Commsec):

US markets

Tumbled on Tuesday as downgrades of several lenders by credit rating agency Moody's reignited fears about the health of the US banking sector, sparking a wider sell-off. The agency cut ratings on 10 small to mid-sized lenders by one notch and placed six banking giants, including Bank of New York Mellon (NYSE:BK) (-1.3%), US Bancorp (NYSE:USB) (+0.3%), State Street (NYSE:STT) (-1.6%) and Trust Financial (-0.6%), on review for possible downgrades.

Big banks Goldman Sachs (NYSE:NYSE:GS) and Bank of America (NYSE:BAC) eased 2.1% and 1.9%, respectively. Shares of UPS lost 0.9% after the US economy bellwether cut its annual revenue forecast. Eli Lilly (NYSE:LLY) shares surged 14.9% to hit a record high after the pharmaceutical firm posted upbeat quarterly profits. The Dow Jones index fell by 159 points or 0.5% after dipping 466 points at session lows.

The S&P 500 index slid 0.4% and the Nasdaq index shed 110 points or 0.8%.

European markets

Ended lower on Tuesday. Bank stocks shed 2.7%, led lower by Italian lenders after the government introduced a surprise 40% windfall tax or levy on banks "extra profits" this year.

Shares of Italian banks such as Intesa Sanpaolo (BIT:ISP), Banco BPM and UniCredit fell between 5.9% and 9.1%. Shares of Novo Nordisk (CSE:NOVOb) (NYSE:NVO) jumped 17.3% to a record high after the Danish drugmaker said a large study had shown its obesity treatment Wegovy also had a clear cardiovascular benefit.

The continent-wide FTSEurofirst 300 index fell by 0.2%. In London, the UK FTSE 100 index slipped 0.4%.

Currencies

Were mixed against the US dollar in European and US trade.

- The Euro fell from US$1.1008 to US$1.0929 and was near US$1.0955 at the US close.

- The Aussie dollar firmed from US64.96 cents to session highs near US65.43 cents at the US close.

- The Japanese yen eased from 142.83 yen per US dollar to JPY143.48 and was near JPY143.40 at the US close.

Commodities

Global oil prices rose by 1% on Tuesday after a monthly report from the US Energy Information Administration (EIA) projected US crude production to rise by 850,000 barrels per day to record 12.76 million bpd in 2023, overtaking the last peak at 12.3 million bpd in 2019.

- The Brent crude price rose by US83 cents or 1% to US$86.17 a barrel.

- The US Nymex crude price added US98 cents or 1.2% to US$82.92 a barrel.

Base metal prices sank on Tuesday.

- The copper futures price slid 1.7% after weak Chinese trade and auto sales data heightened concerns over demand from the world's biggest metals consumer.

- The aluminium futures price dipped 1.6%.

- The gold futures price fell by US$10.10 or 0.5% to US$1,959.90 an ounce. Spot gold was trading near US$1,924 an ounce at the US close.

- Iron ore futures slid US32 cents or 0.3% to US$104.41 a tonne.

- China's imports of iron ore in July slipped 2% from the previous month, as sintering curbs in major steel production hub Tangshan dampened demand for the steel-making ingredient.

Sentiment and confidence

Westpac released its Consumer Confidence report alongside NAB’s Business Confidence report yesterday.

Here’s CreditorWatch economist Anneke Thompson’s take.

“Consumer confidence continues to bump along at near record low levels, falling by 0.4% in July 2023. Consumers are unlikely to report any improvement in confidence until inflation looks to be firmly in the rearview mirror.

"Unfortunately, NAB’s Business Survey for July 2023, indicates that cost pressures upon businesses remain elevated, with both price and cost growth rising sharply over the month.

“Unsurprisingly, Business Confidence is weakest in the Retail Sector, at -12 index points. In trend terms, business confidence remains at below-average levels, although it did rise slightly in the July 2023 figures released.

"The retail sector looks to be entering a period of increased business risk, and we are likely to hear more stories of insolvencies and business liquidations in the retail sector in the coming months.

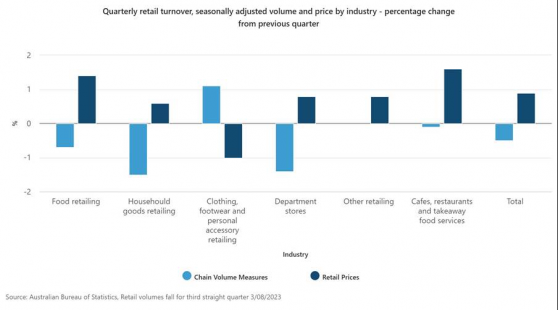

“The continued price pressures coupled with anaemic consumer confidence are weighing heavily on profitability, particularly in the household goods and department store sectors. Both of these sectors are selling less product than they did the previous quarter, despite very strong population growth.

"For furniture, electrical, appliance retailers as well as residential construction wholesalers, conditions are very challenged, as consumers can quite easily tighten spending in these areas, and also did a lot of their household good spending during the lockdown periods. Low residential sales volumes and new dwelling completions also weigh heavily on these sectors.

On the small cap front

The S&P ASX Small Ordinaries lost 0.55% yesterday and it’s been a quiet start to the day on the news front. You can read more about the following throughout the day.

Read more on Proactive Investors AU