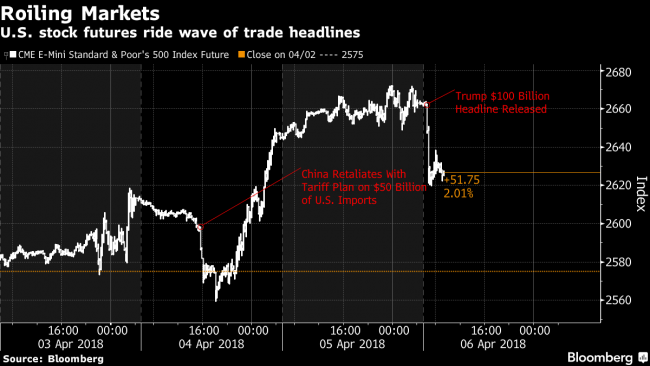

(Bloomberg) -- Just when investors thought stock markets across the globe had calmed before the weekend, Donald Trump urged his administration to impose tariffs on an additional $100 billion in Chinese imports.

While U.S. stock-index futures fell after Trump’s move, investor reaction in equity markets across Asia wasn’t as big. Japan’s Topix index and South Korea’s Kospi gauge both slipped 0.3 percent, while Hong Kong’s Hang Seng Index rose 1.1 percent after a holiday Thursday. China’s stock and currency markets are shut until Monday due to its annual tomb-sweeping holidays. China later said it would counter U.S. protectionism “to the end, and at any cost.”

“It’s becoming childish,” said Nader Naeimi, Sydney-based head of dynamic markets at AMP Capital Investors Ltd. “At some point investors will say enough is enough, there’s just too much political volatility now.”

‘Out of Love’

"The U.S. stock market is taking Trump’s escalation poorly, eroding support amongst the plutocracy," said Gary Greenberg, London-based head of global emerging markets at Hermes Investment Management. On the other hand, China’s tariffs on U.S. are well targeted as voters in agricultural states are “falling out of love” with Trump.

China, as world’s second largest economy, can afford to lose 25 basis points of growth for two or three years due to higher tariffs, he added.

Just Noise

“The reality is that the fundamental backdrop for markets hasn’t changed,” said Kerry Craig, Melbourne-based global market strategist at JPMorgan Asset Management. It will be increasingly important for investors to know what stocks they own as fraying trade relations will lead to more market volatility, he added.

“The noise is distracting when nothing else is happening, a solid 2Q earnings season in the U.S. could see investors refocus on fundamentals and the corporate outlook,” Craig said.

Up at 3 a.m.

“I get up up everyday to write my note and it turns completely in opposite direction. I am getting up more often than not at 3 a.m.,” said Stephen Innes, head of trading for Asia Pacific at Oanda Corp.

“There is a perception of overvaluation in equities markets. Currency markets do not care about trade war, they care about central banks. They will care when there is some timeline, some proof to the pudding.”

De-Sensitized

“One should not be surprised to find markets growing increasingly de-sensitized to such talks,” said Jingyi Pan, a market strategist at IG Asia Pte.

A Bluff

“I continue to believe the trade war won’t happen in the end. I think it’s more like bluffing. That’s typical Trump. I read one of his books and he said he’d always act unpredictable before negotiation so he could get more bargaining power,” said Kenny Wen, strategist at Everbright Sun Hung Kai Co.

“No date has been fixed on this. It’s a complete bluff ahead of the negotiations," Norihiro Fujito, a senior strategist at Mitsubishi UFJ Morgan Stanley Securities Co.

Asean Favor

“We expect Asean markets -- in particular Singapore and Thailand -- to continue to outperform due to to their low listed equities revenue sensitivity to the U.S.,” said Jonathan Garner, strategist at Morgan Stanley.

Greed and Fear

"Be greedy when others are fearful," as there are many value stocks to pick such uncertain times, said Aaron Oh, Singapore-based investment analyst at Aggregate Asset Management in Singapore. Fund in focused on buying stocks in Thailand, Singapore and Malaysia amid the trade war led uncertainty, Oh added.