By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The Federal Reserve raised interest rates by 25bp Wednesday and instead of rising, the dollar sold off aggressively against all of the major currencies. In Tuesday’s note, we talked about how the dollar could fall with a rate hike but in actuality, it wasn’t the economic projections or the dot-plot forecast that took the dollar down. Instead, it was Janet Yellen’s concerns about low inflation, which she feels could be more ingrained than temporary and the 2 dissents that prevented the dollar from rallying. The Fed's dot-plot forecast for 2018 and 2019 remained unchanged but rates are expected to reach 3.1% in 2020. Policymakers kept their inflation projections steady but also raised their GDP forecast for this and next year while lowering their unemployment-rate forecast to 3.9% for 2018 from 4.1%. All in, these forecasts make the Fed more hawkish but investors cared more about Evans and Kashkari, who voted against a hike this month because of low inflation – neither will be voting members of the FOMC in 2018. Although Fed Fund futures did not change materially after the rate decision, the sharp sell-off in 10-year Treasury yields and corresponding dollar weakness tells us that investors were not impressed. The prevailing thought is that with no further action expected at the January meeting, the next time we’ll get fresh guidance could be as late as mid March when Powell chairs his first monetary policy meeting. For these reasons, the dollar tanked after the rate hike and we believe it could extend its slide over the next 24 to 48 hours. U.S. retail sales are due for release on Thursday and while economists are looking for a pickup in demand, unless the increase is very significant on a core basis (ex autos and gas), the positive impact on the dollar post-FOMC could be limited. The Senate and House have reached a deal on the tax bill and they are on track for final voting next week, but the dollar has taken the news in stride.

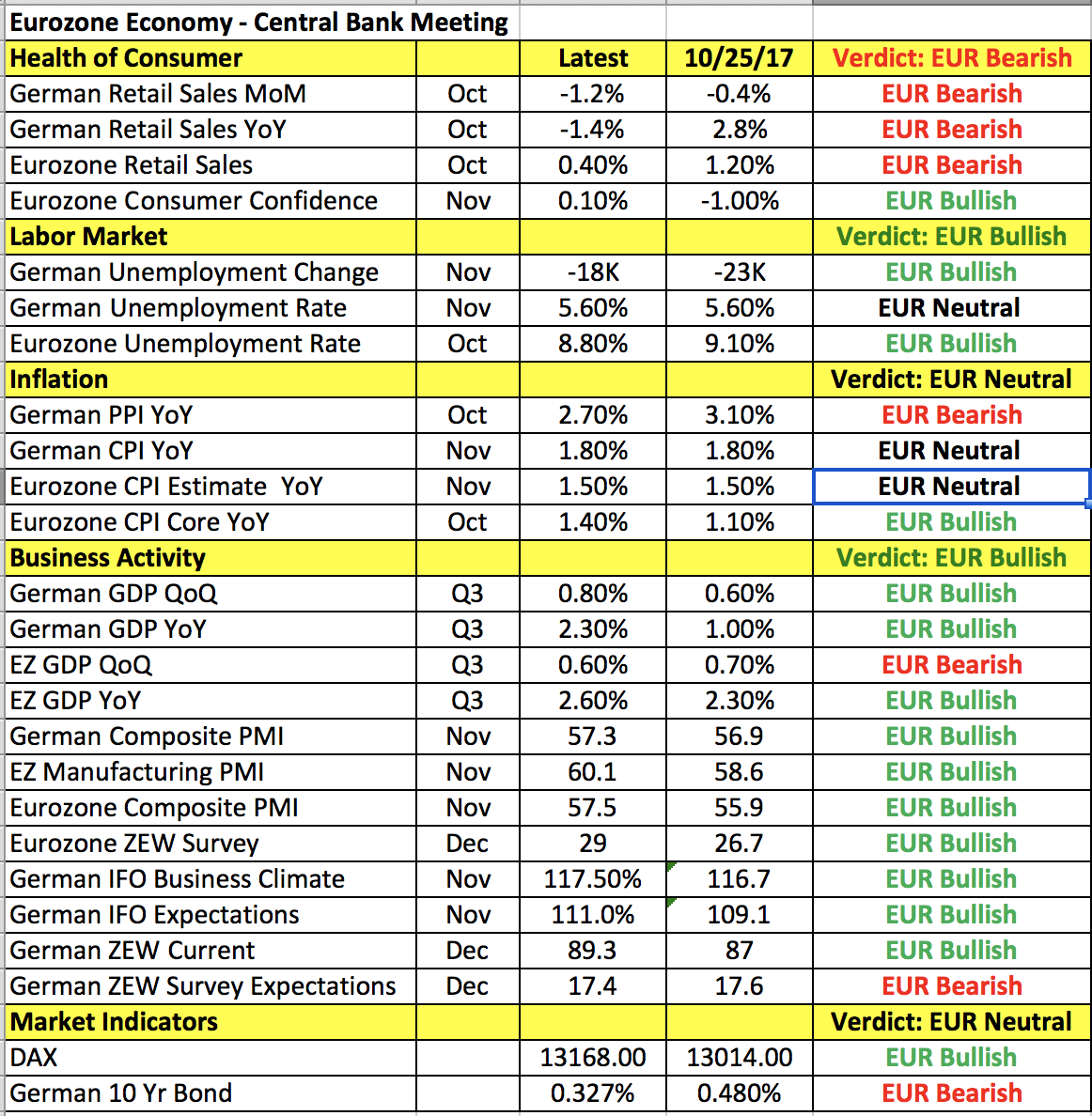

With the Fed meeting behind us the focus now turns to the European Central Bank and the Bank of England monetary policy meetings. Of the two, we expect ECB to have a greater impact on currencies. No changes are expected from the central bank but unlike the BoE, the President of the ECB will hold a press conference. Mario Draghi’s outlook and the central bank's updated economic forecasts should be the primary focus for anyone trading ECB as the rate decision itself should be a nonevent. Having just cut its asset-purchase program at the last meeting, there’s very little desire to make any additional changes – especially since it sees the need for continued accommodation in the months to come. Draghi made it very clear that the central bank has no plans to raise interest rates until QE ends and this outlook will remain unchanged. With that in mind, there’s been widespread improvement in the economy so Draghi and/or the staff forecasts may address that. In which case, optimism from the ECB president could take EUR/USD to 1.19. December Eurozone PMIs will be released before the monetary policy announcement and they could affect how traders position for the main event. The Swiss National Bank also has a monetary policy announcement and like the BoE, it is not expected to have a significant impact on the currency. The SNB has long believed that the USD/CHF needs to remain weak and this view is not expected to have changed.

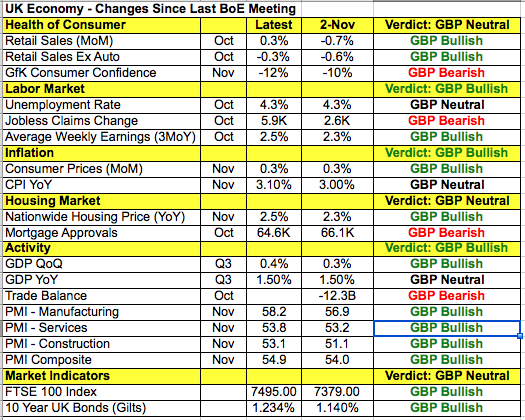

Sterling is trading strongly ahead of the Bank of England’s monetary policy announcement. At its last meeting, the Bank of England raised interest rates for the first time in a decade but instead of rising, sterling crashed because Governor Carney said inflation peaked in October. Although the November CPI numbers say otherwise (CPI accelerated 0.3%), the latest increase may only strengthen BoE's view that price pressures will start easing in the coming months. Since the last monetary policy meeting, the U.K. economy firmed with wages rising, inflation increasing, house prices accelerating and most importantly, economic activity strengthening in the manufacturing, service and construction sectors. However we don’t expect the central bank to change its tone and a steady outlook could hurt more than help the pound. Brexit negotiations – Prime Minster May was dealt a hard blow Wednesday when she lost a key Brexit vote. Lawmakers will now get final approval of the Brexit deal before withdrawal begins. May has long argued that this would delay the process and jeopardize their chances of a smooth exit but sterling traders were unfazed by the news. The EU is widely expected to give their approval to move to the second phase of Brexit negotiations at this week’s summit.

Last but certainly not least, the commodity currencies traded higher Wednesday with the Australian and New Zealand dollars rising approximately 1% on the back of U.S. dollar weakness. Australian labor-market numbers were due for release Wednesday evening. Although the manufacturing and construction sectors saw stronger job growth, the service sector experienced slower growth. The labor market has been the primary area of strength for Australia’s economy and if the momentum continues, it could take AUD/USD to 77 cents. However after many months of solid full-time job growth, the momentum is bound to wane and if it eased in November, AUD/USD could sink back down to 76 cents. The New Zealand dollar soared to fresh 6-week highs on nothing more than dollar weakness and continued short covering. USD/CAD pulled back slightly, shrugging off the decline in oil prices.