The number of ‘extreme rent hikes’ in Australia’s capital cities slowed in the final quarter of 2023, Domain research reveals, as a streak of quarterly rises that began in 2020 came to an end.

- Median asking rents across Australian capital cities have come off the gas for the first time since 2020

- It's a 'glimmer of hope' for tenants in 2024, according to Domain's Dr Nicola Powell

- Canberra and Darwin are among the rental markets with the the healthiest vacancy rates and a more balanced supply-demand equation

Median asking rents remained at $600 per week across the nation’s capital cities in the final quarter of last year.

On top of that, the number of vacant properties appears to have lifted.

Seasonal shifts saw vacancy rates in Sydney, Melbourne, and Brisbane hit 12-month highs in December, reaching 1.3%, 1.2%, and 0.9% respectively.

Meanwhile, Darwin’s vacancy rate rose to a 3.5 year high of 1.7% and that of Canberra reached a record 2%.

“While the strain on Australia’s rental market remains evident, there’s a glimmer of hope that conditions are easing and rental price growth is slowing,” Dr Powell said.

“Nationally, potential tenants will find greater choice, consistent with the seasonal lift in vacant rentals that occurs at the end of the year as the rental market moves into the busy changeover period.”

In further good news, rental affordability is expected to continue to improve in 2024.

Driving factors include a ‘price ceiling’ (that is, tenants choosing to prioritise affordability over other factors), an increase in people opting for share houses, and the ongoing return of investors.

On top of that, Domain expects the Help to Buy scheme, Queensland’s recently doubled First Home Buyer grant, and a potential cash rate cut to encourage a wave of first home buyers to enter the market.

Still, to achieve a balanced rental market with vacancy rates of 2% to 3%, Australia now needs between 30,000 to 60,000 extra rentals, Domain found.

Though, renters in some cities might find themselves in better stead than those in others. Here’s what Domain is forecasting for Australia’s capital city rental markets in 2024.

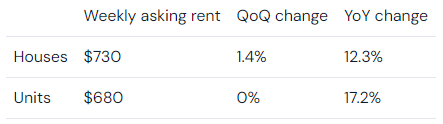

Sydney’s vacancy rate slipped 10 basis points lower over the course of last year to end 2023 at 1.3%.

Meanwhile, rental price growth has well and truly slowed in the Harbour City, with the speed of rent hikes slowing quarter-on-quarter for two consecutive periods.

For the first time in two and a half years, Sydney's unit rental costs stayed put in the three months to December.

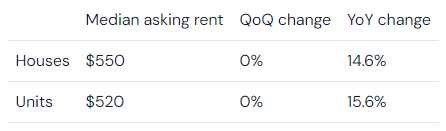

For the first time in two years, asking rents remained steady in Melbourne last quarter.

The reprieve ended the longest stretch of price growth in the city, as vacancy rates lifted to their highest in 12 months at 1.2%.

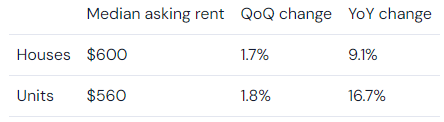

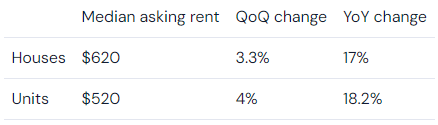

Further north in the river city, there’s been no such relief for Brisbane, with rental costs in the Queensland capital recording another record high for both units and houses.

However, the city’s vacancy rate has lifted off an all-time low of 0.6%, reached in February, to end December at 0.9%.

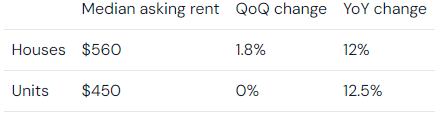

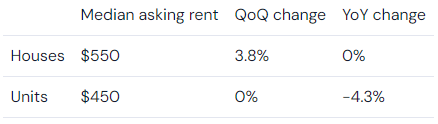

Joining Brisbane in posting a new record median rental cost in the December quarter was South Australian counterpart, Adelaide.

On a brighter note, however, the growth in the cost of renting a house waned to its slowest pace in three-years.

Meanwhile, Adelaide was found to be the cheapest city to rent a unit, a title it holds in conjunction with Hobart.

Adelaide posted a vacancy rate of just 0.4%, meaning it houses one of Australia’s most competitive rental markets.

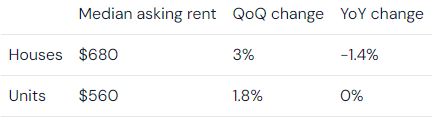

There’s also been little relief for renters in Perth.

The Western Australia capital has continued its longest stretch of rising rents on record, while its vacancy rate lifted ever so slightly to 0.4%.

It appears to be a tale of two property types in the Apple (NASDAQ:AAPL) Isle capital, as the cost of renting a house recovered to record levels and rental costs of units continued to flatline.

Hobart’s vacancy rate hit a high of 0.8% in December.

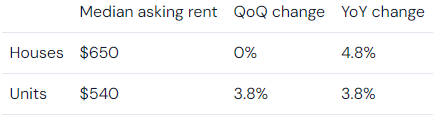

For the first time in 12 months, asking rents in Canberra increased in December.

Those of houses remain slightly below their record high, posted in March, and those of units returning to record levels reached in late 2022.

Canberra had a relatively healthy vacancy rate of 2% in December.

Finally, while the cost of renting a house in Darwin stagnated last quarter, the asking price of renting a unit surged to within $10 of its 2014 record.

Darwin offered renters a 1.7% vacancy rate at the end of 2023.

"New year, new rental market: Domain reveals best cities for tenants" was originally published on Savings.com.au and was republished with permission.