Asian trade has gone strongly risk off today. Markets and currencies started to weaken from the open as nervousness about the Chinese trade data was heavy in the air. Chinese exports were better-than-expected and imports were slightly worse, but both continued to decline in year-on-year terms. It was basically a fairly mixed report, but with last week’s impressive rally starting to look stretched, mixed Chinese data was taken as bad Chinese data.

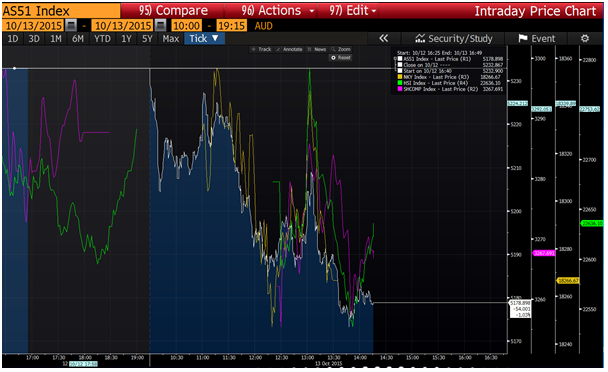

The S&P/ASX 200 has struggled to hold on above the 5200 level today, capitulating back into the 5100 level. Both the ASX and the Nikkei 225 rallied briefly as Chinese exports data came in better-than-expected, but soon continued to selloff with the overall data release painting a fairly mixed picture. The Hang Seng and the Shanghai Composite both opened down, despite a strong showing by China ETFs in US trade. A lot of Chinese data is expected this week and is clearly creating nervousness in Asian equity markets. Markets looked primed for China to disappoint them, which does not bode well for the inflation and money supply numbers expected this week.

White ASX, yellow Nikkei 225, green Hang Seng Index, purple Shanghai Composite

The broader negative outlook for commodities seems to be reasserting itself in markets after last week’s rally. WTI oil declined 5.4% overnight, while Dalian Iron Ore futures dropped 4.3%. Commodity and China-focussed Asian currencies also came off strongly in Asian trade. The Indonesian Rupiah (IDR) and Malaysian Ringgit (MYR) both sold off sharply ahead of China’s trade data.

White AUD/USD, yellow NZD/USD, purple IDR/USD, green MYR/USD

The Aussie dollar was coming off quickly ahead of the Chinese data. Speeches by voting Fed members Lockhart and Evans last night were keen to emphasise that the October meeting was live. While the Fed will not hike rates in October, a December hike is still feasible and Yellen in particular has emphasised her concerns about overheating the US economy if there is no hike in 2015.

The sharpness of the rally in the Aussie dollar last week did not bode well for its sustainability. For the rally to continue, the Aussie would need to consolidate around the 0.7350 level. Instead, the Aussie has started to selloff sharply. If one looks at the daily Relative Strength Index (RSI) for the Aussie, 9 October was only the second time this year that the RSI touched the 70 level.

When the RSI rallied up to 68 (almost at 70) in mid-May, it was the last gasp before the Aussie steadily declined below $0.70. If the Aussie does begin to reverse from here, it is quite likely to continue to decline until it meets resistance around the $0.72 level or the 50-day moving average, both of which previously served as resistance.

The CNY/USD mid-point fix was not taken well by the market today. After rallying 0.4% up to 6.3165 yesterday, the USD/CNH started to come off sharply after the official fixing was announced at 12.15 pm AEST. There were reports that Chinese banks were selling US dollars heavily yesterday, but traders were clearly rejecting those moves today. With China still predicted to cut interest rates and the reserve requirement ratio (RRR) before the end of the year, the prior seven-days of strengthening in the currency did not look like it could last.

ASX

After the ASX saw its best week since January last week, concerns were high that it would struggle to continue to trade above the 5200 level. The ASX was down 1% through much of the day, trading consistently around the 5180 level. It managed to rally back up over the 5200 level in afternoon trade. But with commodity prices starting to come off, and concerns over the large amount of Chinese data released this week, a push back in the index to at least the 5100 level seems likely.

Much of the gains last week were driven by the energy and resources sectors, as commodities rallied strongly. The selloff in oil overnight did not bode well for the open today. Unsurprisingly, the energy sector has seen the sharpest selloff today, down 2.3%. The big energy names, Origin Energy Ltd (AX:ORG) and Santos Ltd (AX:STO), saw some of the sharpest falls on the index. Origin was down 6.2% and Santos was down 5.7%.

The materials sector also saw significant selling as the iron ore price declined overnight. The sector was down 1.8%. But Fortescue Metals Group Ltd (AX:FMG) saw some of the heaviest selling in the sector, falling 8.3%. Concerns about the imminent beginning of exports from Gina Rinehart’s Roy Hill mine this month are clearly affecting FMG. Roy Hill has a better breakeven price than FMG, and as it greatly adds to global iron ore supply is likely to threaten FMG’s survival.

Telcos also sold off 1.1%. TPG Telecom Ltd (AX:TPM) dropped over 2% and Telstra Corporation Ltd. (AX:TLS) lost 1% in the wake of the ACCC decision forcing Telstra to share is fixed lines. Margins are likely to be squeezed between all the big telco players as competition looks set to drastically heat up with the NBN roll out.