South Africa

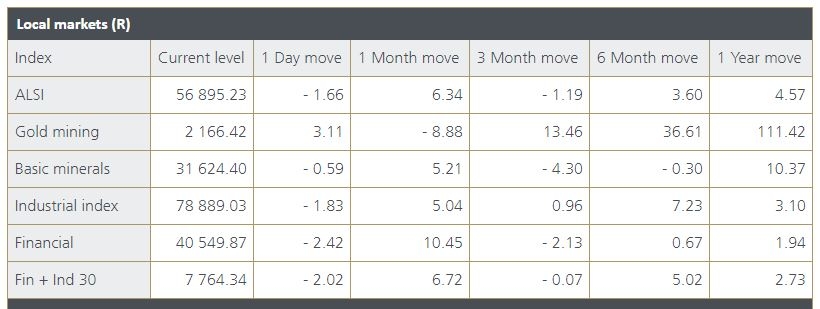

The local market lost ground on Tuesday because of the oil price dropping after reports that Saudi is close to restoring 70% of its crude productions, and investors acted with caution ahead of the US Federal Reserve Bank’s (Fed) monetary policy decision. At the closing bell, the All Share was down by 1.66%.

United States

Wall Street opened lower on Tuesday as investors avoided making predictions of what the Fed will announce after their two-day policy meeting; however, a cut in interest rates is widely expected. Shortly after the JSE closed, the Nasdaq was 0.02% higher.

Europe

Tuesday was a flat trading day for European markets due to banks and energy shares losing steam ahead of the Fed’s upcoming interest rate announcement. At the end of trade, the STOXX 600 stood 0.05% in the red.

Hong Kong

Asian indices ended Tuesday in the red after Beijing announced that it would not be changing China’s monetary policies, despite readings indicating additional pressure to lower rates. The Hang Seng closed down 1.47%.

Japan

Japanese markets rose slightly on Tuesday, boosted by oil and gas companies as well as the mining, oil and coal sectors on the back of Saturday’s Saudi Arabian attacks. The Nikkei stood 0.06% in the green.

On Tuesday, the local currency fell to a one-week low as it extended losses due to the soaring tensions in the Middle East, related to the crude facility attacks in Saudi Arabia. At 18h50, the rand traded at R14.75 per dollar.

Precious metals

Bullion prices steadied towards the end of Tuesday as investors waited for the Fed’s monetary policy decision to be released this week. At 18h50, an ounce of spot gold traded at $1 505.61.

Oil

The oil price lost some of Monday’s gains on Tuesday after reports surfaced that Saudi crude productions could be restored within weeks – much faster than anticipated. At 18h50, a barrel of Brent crude traded at $66.04