It’s uncertain what caused the selloff in Chinese markets yesterday. Was it rumours the government was going to pull market support? Concerns about Sinosteel missing its interest payment? Or did we just see some profit taking after a 20% rise in the Shanghai Composite? I would lean towards a combination of the latter two.

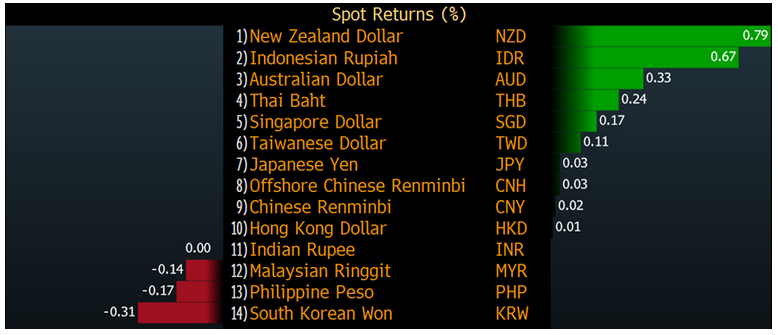

In any case, the strong open of the Chinese markets was met with some relief by markets today, with strong gains seen by commodity-related currencies in particular. The Kiwi dollar, Indonesian Rupiah and Aussie dollar were the three best-performing currencies in Asia today.

The Kiwi dollar seems to have found key support at US$0.67. It was knocked off its $0.6840 perch yesterday by the drop in the Global Dairy Trade dairy auction, falling to $0.6750. Then news that Fonterra’s credit rating had been cut by Fitch following a cut to its rating a few weeks earlier by Standard and Poor’s saw it touch $0.67. However, the Kiwi dollar has now bounced off the $0.67 handle and looks likely to push back up into a test of $0.6880.

The strong Chinese open and comments by Bill English, New Zealand’s Finance Minister, both supported the jump in the Kiwi dollar. Bill English stated that the New Zealand dollar has already adjusted quite considerably and the government budget is around balance, implying more room for fiscal support. This did seem to indicate that there would be less onus on the RBNZ to stimulate the economy through monetary policy, furthering strengthening the case that the RBNZ will leave rates on hold next week.

Japanese markets rallied to close at a seven-week high yesterday on speculation that the Bank of Japan would be forced to step up its Quantitative and Qualitative Easing (QQE) after trade data disappointed. The Nikkei 225 and the TOPIX looked set to remain at these high levels, with relatively muted trading keeping them both in positive territory on the day. This was despite a major selloff in the healthcare sector, which declined 1.1% following the lead from US markets after Valeant’s stock was hammered in the wake of a report from notorious short-seller Citron Research.

The ASX opened down after the negative leads from the US, the poor performance by gold and oil overnight were pointing to some trouble for those sectors today as well. However, the surprise takeover bid for Santos Ltd (AX:STO) by private equity group Scepter Partners re-ignited energy sector M&A excitement.

Santos surged 20.6% at the open, within touching distance of Scepter Partners’ 26% premium to yesterday’s close. Santos rejected the bid, stating it undervalued the company, but the bid re-ignited M&A speculation in the sector as a whole. Karoon Gas Australia Ltd (AX:KAR), Beach Energy Ltd (AX:BPT) and Origin Energy Ltd (AX:ORG) were all some of the best performing stocks on the index, rising 6.6%, 6.3% and 4.8%, respectively. The energy sector as a whole rose 3%.

Gold miners continued to see outsized volatility following the moves in the spot gold price overnight. Gold lost roughly US$9.00 overnight, which saw gold miners as a whole fall 3.5%. Newcrest Mining Ltd (AX:NCM) and Oceanagold (AX:OGC) both saw major falls, losing 4% and 5%, respectively.

The consumer discretionary sector also saw a major fall, losing 1%. Favourite shorts on the index, Metcash Ltd (AX:MTS) and Myer Holdings Ltd (AX:MYR), lost 3.5% and 1%, respectively. While Domino`s (AX:DMP) took a breather after its recent run, losing 2.9%.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.