Asian share markets are pushing through the volatility around the latest BOJ rate hike and local inflation figures with green across the board. The USD is obviously in retreat against Yen as a result but the Australian dollar has cracked below the 65 cent level as core inflation was less than expected, increasing chances of a rate cut at the next RBA meeting.

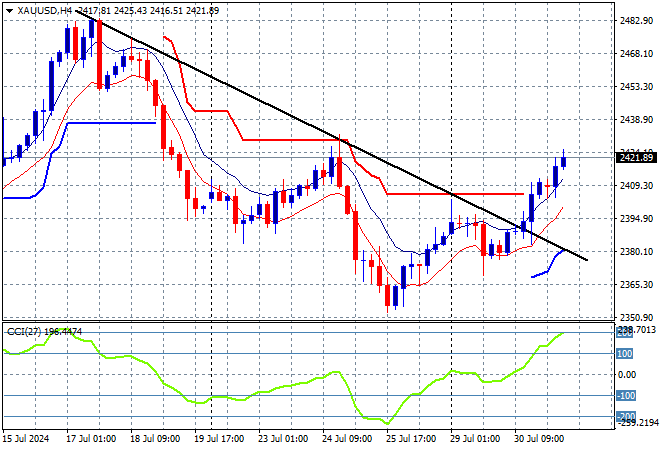

Oil prices are trying to stabilise after several down sessions with Brent crude just able to get back above the $79USD per barrel level while gold has continued its bounceback above the $2400USD per ounce level:

Mainland Chinese share markets are no longer struggling with the Shanghai Composite zooming more than 2% higher while the Hang Seng Index is up nearly the same amount, bouncing off the 17000 point barrier, to close at 17338 points. Meanwhile Japanese stock markets are liking the rate hike with the Nikkei 225 up more than 1.5% to close at 39101 points as the USDJPY pair had a wide range during the BOJ meeting and rate hike, eventually settling below the 153 level:

Australian stocks stumbled around the local inflation print amid working out what the RBA will do next but eventually led higher with the ASX200 closing 1.7% higher to 8092 points while the Australian dollar finally broke out of pause mode as inflation data undershot, sending it below the 65 cent level:

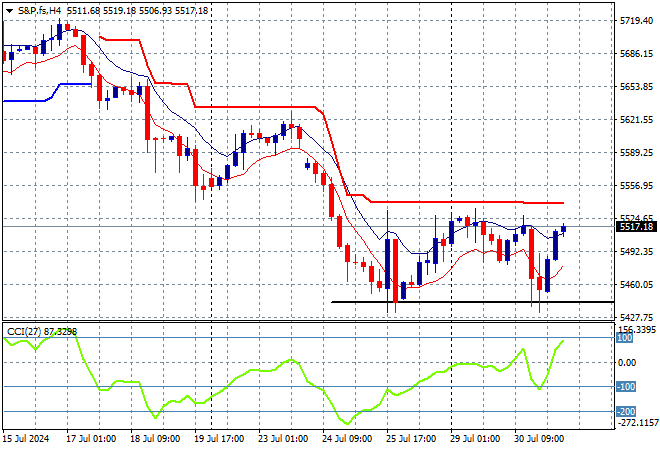

S&P and Eurostoxx futures are up slightly as we head into the London session with the S&P500 four hourly chart showing how a potential bottom at the 5400 point level is forming but if it doesn’t break through overhead short term resistance, the next target below is 5200 points:

The economic calendar ramps up again tonight with German unemployment and Euro wide core inflation figures, then the big one – the latest Federal Reserve Meeting.