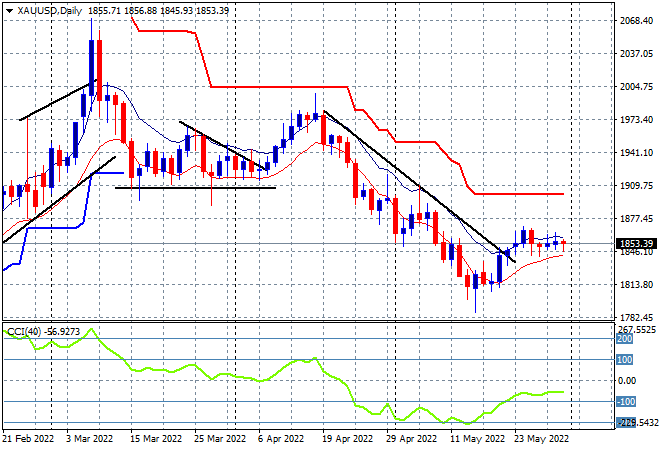

A mixed session for Asian share markets after the previous solid start to the trading week, as traders await the return of the lead of Wall Street after a long weekend holiday. In currency land, USD is still moving lower against the majors, with Euro and Pound Sterling continue to lift while the Australian dollar is trying to push up through the 72 cent barrier. Oil prices are pushing higher with Brent crude about to break the $120USD per barrel level while gold is absolutely stuck at the $1850USD per ounce level:

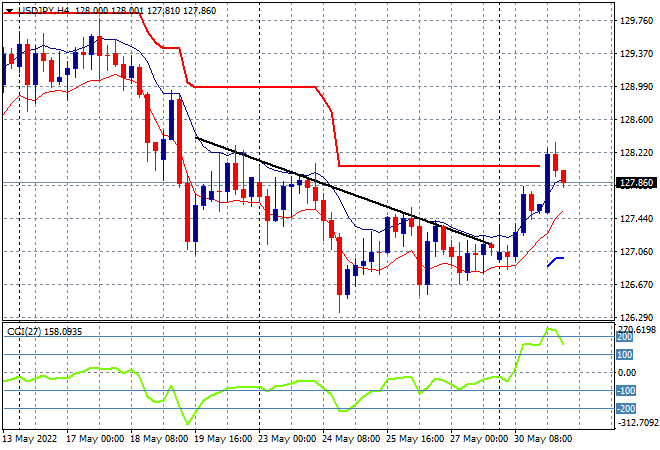

Mainland Chinese share markets are surging again with the Shanghai Composite currently up 0.8% to 3173 points while the Hang Seng Index is building on its recent gains, up 0.9% to 21314 points. Japanese stock markets have pulled back slightly after a great start in the previous session, with the Nikkei 225 index down more than 0.2% at 27302 points while the USDJPY pair has also pulled back from its overnight breakout gains, retracing back below the 128 level:

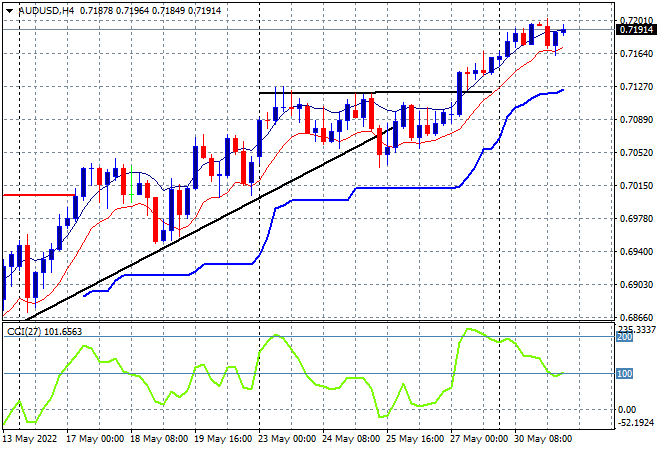

Australian stocks have turned tail and run after today’s current account and building approvals prints, with the ASX200 currently down more than 0.8% at 7273 points while the Australian dollar has paused in its move above the 71 handle against USD, still stuck just below the 72 level but poised to breakout:

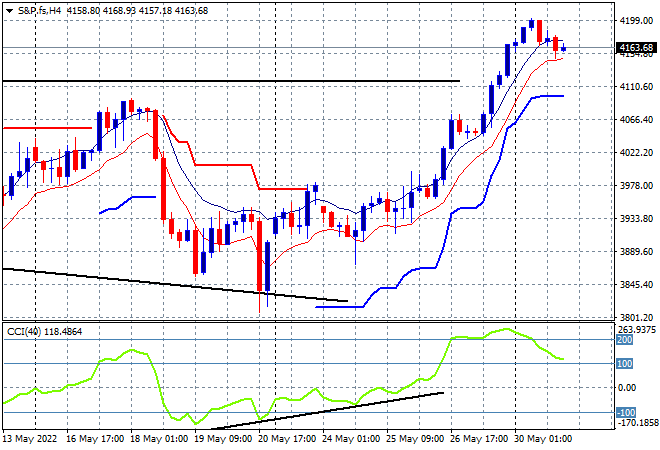

Eurostoxx and Wall Street futures are steady as we head into the European open as traders get ready for the Americans to rejoin the party. The S&P500 four hourly futures chart shows price heavily overextended after the Friday night surge through the 4100 point level with short term momentum retracing from a very overextended position, so a flat start is likely on the open tonight:

The economic calendar ramps up tonight with German unemployment, then the Euro wide core inflation print for May followed by US house prices and consumer confidence figures.