Street Calls of the Week

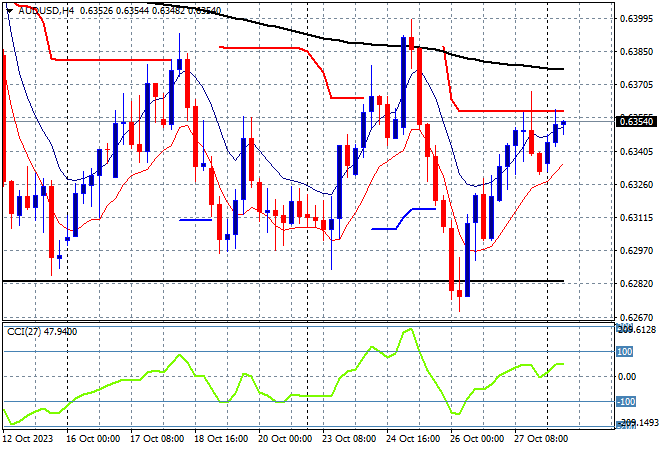

A sea of red across Asian share markets as the new trading week gets underway under the shadow of war and inflationary concerns. The Australian dollar has gapped slightly higher and pushed further on the upside surprise in retail sales figures to be just above the mid 63 cent level as a result, but this still keeps it near a monthly low.

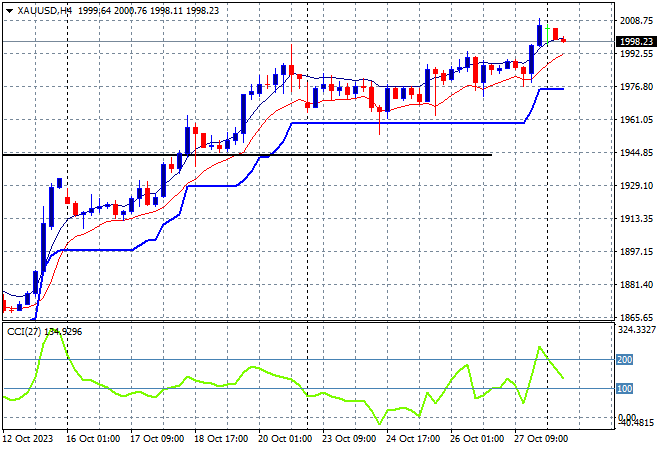

Oil prices have pulled back slightly from their reversal on Friday night, with Brent crude consolidating around the $89USD per barrel level while gold is taking the foot off the throttle, edging just below the $2000USD per ounce level:

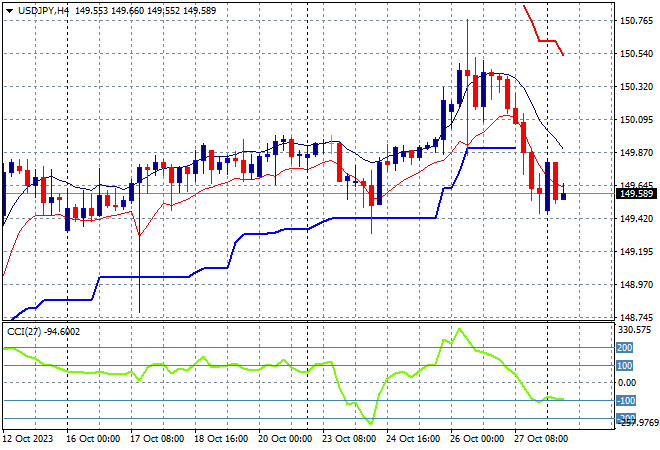

Mainland Chinese share markets have lifted higher with the Shanghai Composite gaining nearly 0.3% to close at 3027 points while in Hong Kong the Hang Seng Index they’ve gone the other way, currently down 0.3% to 17350 points. Japanese stock markets had the worst run with the Nikkei 225 closing some 1% lower at 30696 points. Trading in the USDJPY saw an immediate gap higher but this was pulled back to the mid 149 level:

Australian stocks weren’t the worst in the region but it was close with the ASX200 closing 0.8% lower at 6772 points, still breaking down below former support at 7000 points while the Australian dollar was able to continue its Friday night bounceback, currently at the mid 63 level:

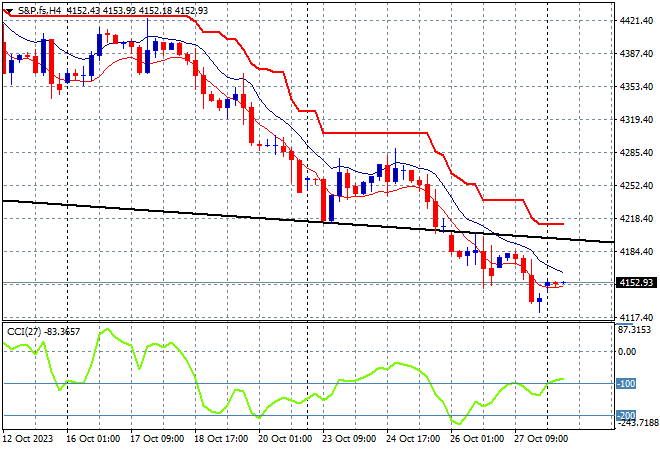

S&P and Eurostoxx futures have gapped up slightly on the weekend trade going into the London open as the S&P500 four hourly chart shows support trying to shore up at the 4150 point level as short term momentum remains very negative:

The economic calendar starts the trading week with the closely watched German inflation numbers for October.