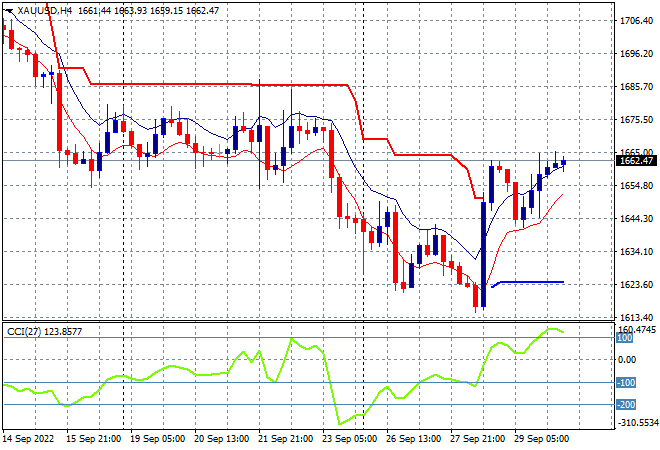

Asian stock markets are generally across the region, although a better than expected Chinese manufacturing print kept Chinese stocks from selling off. The USD has regained most of its lost ground against the commodity currencies, as Euro and Pound Sterling continue their bounceback. Meanwhile oil prices are failing to stabilise with Brent crude rolling over again back down to the $85USD per barrel level while gold is trying to melt higher although its still crushed below former support at the $1700USD per ounce level, currently at $1662:

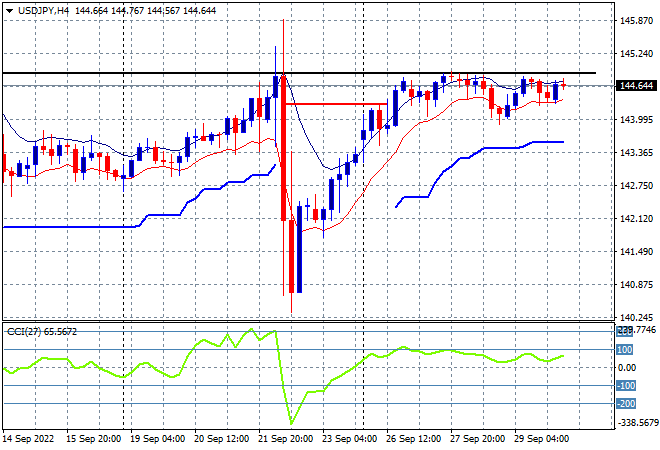

Mainland Chinese share markets are doing relatively well compared to their peers with the Shanghai Composite down a handful of points to 3034 points while the Hang Seng Index is putting in a scratch session, currently at 17150 points. Japanese stock markets are the worst in the region, with the Nikkei 225 about to close 2% lower at 25815 points while the USDJPY pair is hovering at its recent weekly highs just below the 145 handle:

Australian stocks are weathering the storm, with the ASX200 down just over 1% at the 6480 point level, now back to its recent monthly low. The Australian dollar has tried to melt up again but is rolling over in late afternoon trade, unable to head back above the 65 handle in a bounce that has proven to be shortlived already:

Eurostoxx and US futures are again treading water with the latter pulling back a little as we go into the London session. The S&P500 four hourly futures chart shows price action unable to get back to the 3700 point level, instead retracing to the recent lows. Medium term and possibly psychological long term resistance at the 4000 point level seems unattainable at the moment with support at 3800 points a distant memory, as price has been unable to get above trailing resistance:

The economic calendar finishes the week with a bang, namely UK GDP, German unemployment and US personal consumption expenditure, which the Fed will hinge on for its next big rate hike.

Have a good long weekend, see y’all Tuesday.