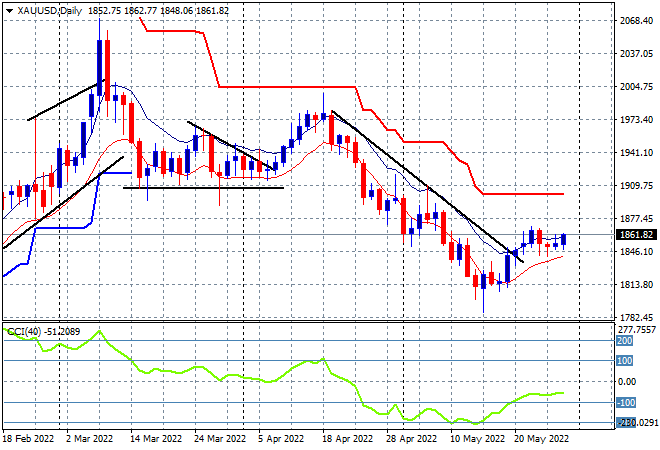

Asian share markets have had a very solid start to the trading week, following through on the good mood from Friday night that saw multiple breakouts across risk markets. In currency land, USD is getting weaker despite the long weekend off for US traders, with Euro and Pound Sterling surging while the Australian dollar is trying to push up through the 72 cent barrier. Oil prices are steady with Brent crude hovering just above the $116USD per barrel level while gold is now pushing well above the $1860USD per ounce level after stabilising on Friday night:

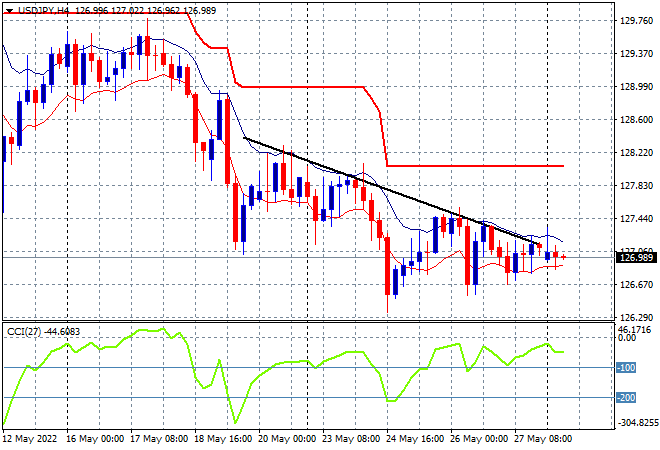

Mainland Chinese share markets have continued their rebound with the Shanghai Composite currently up 0.6% to 3148 points while the Hang Seng Index is building on its Friday gains, now up another 1% at 21103 points. Japanese stock markets are the strongest in the region however, with the Nikkei 225 index gaining more than 2% to be at 27376 points while the USDJPY pair remains contained below the 127 level as Yen defensive buying has not yet abated despite the surge in risk markets:

Australian stocks are putting in a very solid session to start the trading week, with the ASX200currently up more than 1% at 7273 points while the Australian dollar continues its move above the 71 handle against USD after being contained most of last week, currently just below the 72 level:

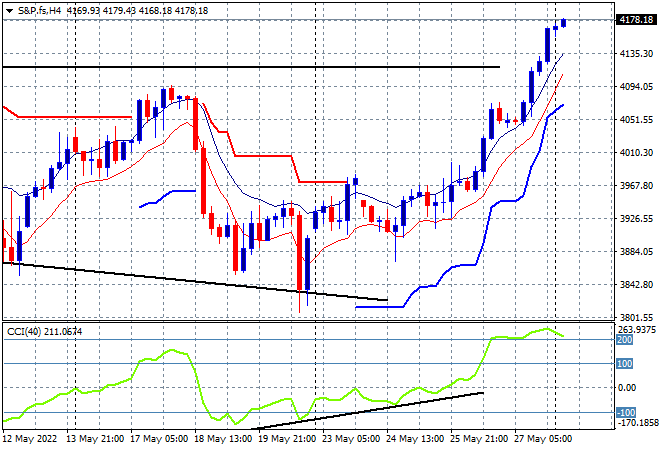

Eurostoxx and Wall Street futures are moving higher as we head into the European open although with closed US markets, it may end up being directionless. The S&P500 four hourly chart shows price heavily overextended after its Friday night surge through the 4100 point level with short term momentum nearly off the charts, so I expect a high probable retracement when it reopens tomorrow:

The economic calendar starts the week with a Euro focus, with Eurowide consumer confidence, then the all important German inflation print for May.