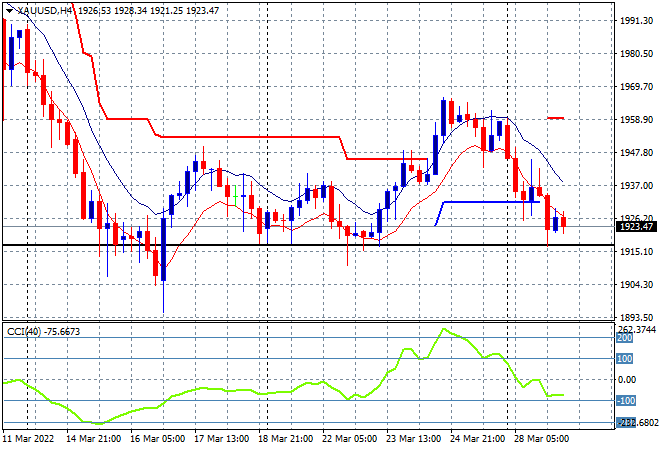

Asian stock markets are having a better session today despite some volatile moves in bond and commodity markets with the twin lead from Wall Street and Europe overnight helping. The USD is pushing higher against Yen and Euro while the Aussie dollar is trying to get back above the 75 level. Oil prices are pulling back again, with Brent crude remaining below the $110USD per barrel level as gold retraces back to its previous weekly lows, currently just above the $1920USD per ounce level:

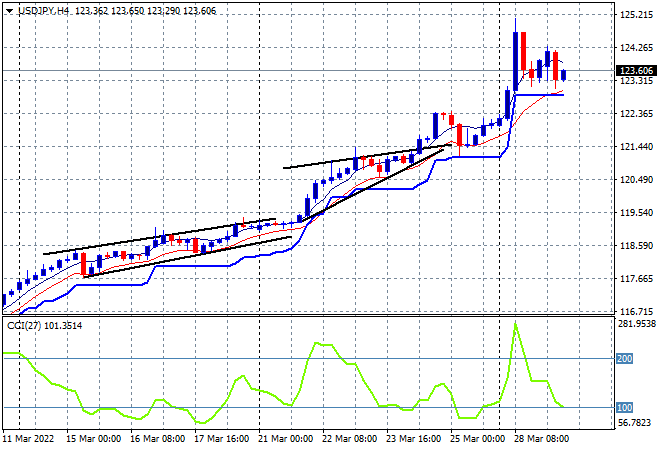

Mainland Chinese shares a bit better but lost their confidence mid session, with a scratch session on the way for the Shanghai Composite, currently up 0.1% to 3217 points while the Hang Seng Index has bounced back again to climb 0.7%, currently at 21834 points. Japanese stock markets are also rebounding with the Nikkei 225 up 0.7% to 28162 points while the USDJPY pair is holding ground here going into the London session after a large pullback from its blowout start to the trading week, holding above the 123 handle in its unstoppable move higher:

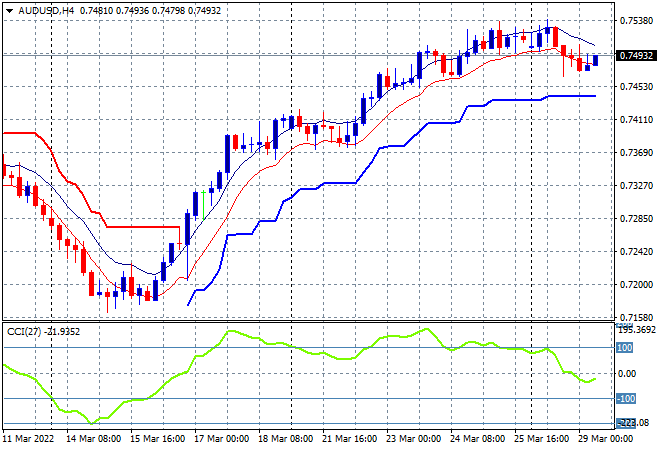

Australian stocks had a great session with the ASX200 closing 0.7% higher to 7464 points as Budget speculation builds. Meanwhile the Australian dollar has picked up slightly in the afternoon session to be just below the 75 level after running out of puff overnight, continuing to lose momentum in the short term:

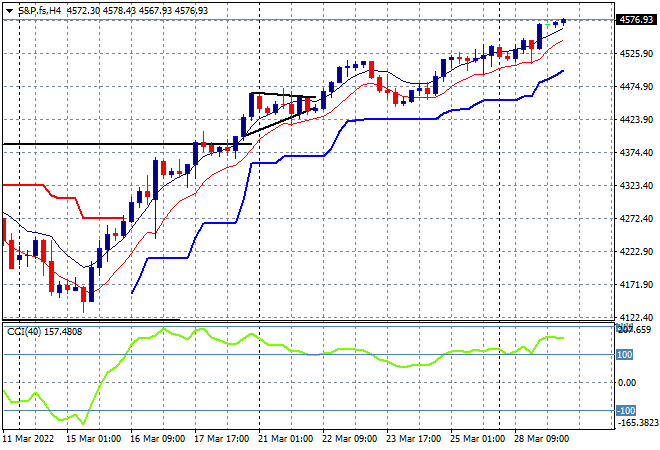

Eurostoxx and Wall Street futures are starting to swiftly move higher with the S&P500 four hourly chart showing a desire to climb up to the 4600 point level after last week confirming support at the 4400 point area as daily and four hourly momentum remain in overbought mode:

The economic calendar includes German and US consumer confidence, plus the latest US house price indices.