Street Calls of the Week

A more positive session across Asian share markets to finish the trading week with not much in the way of economic catalysts to spoil the broth. Futures for Wall Street look positive with the USD still remaining strong although Euro and Pound Sterling will have some volatile sessions due to some key economy events tonight. The Australian dollar was an outlier however, breaking down in afternoon trade to almost cross below the 66 cent level in a new weekly low.

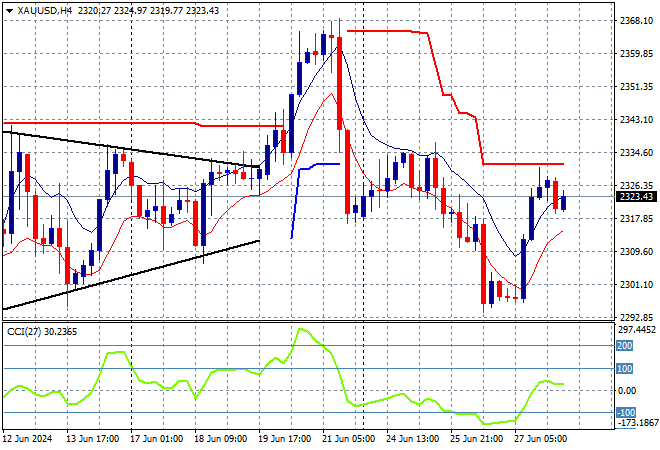

Oil prices are still holding on without much intrasession volatility with Brent crude pushing slightly higher above the $85USD per barrel level while gold continues to struggle, despite a surge overnight its given up some gains to be just above the $2320USD per ounce level:

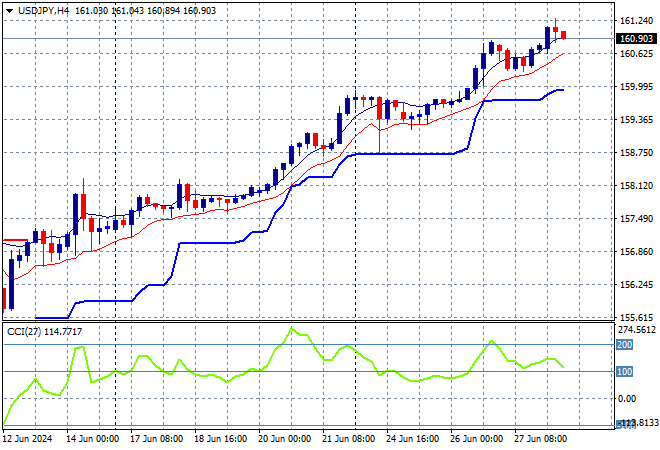

Mainland Chinese share markets are making a comeback with the Shanghai Composite up nearly 1% but still below the 3000 point barrier while the Hang Seng Index is up nearly 0.5% to 17797 points. Meanwhile Japanese stock markets are also getting back on trend with the Nikkei 225 about to close some 0.4% higher to 39497 points as the USDJPY pair consolidates above the 160 level and looks to push above the 161 level next:

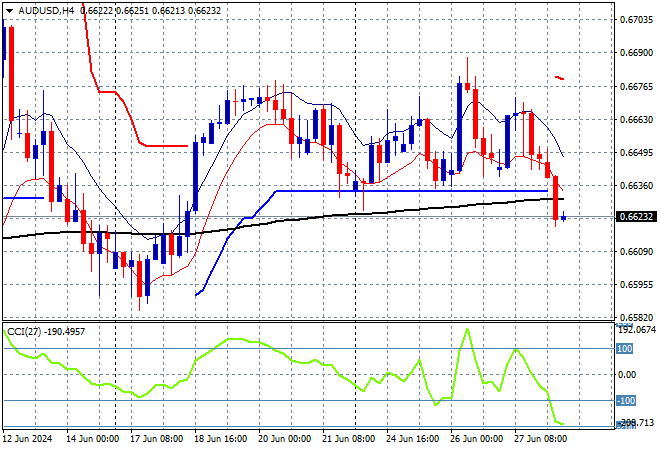

Australian stocks were the worst performers relatively speaking with the ASX200 putting on just 0.1% to 7768 points while the Australian dollar broke down to a new weekly low to almost crack the 66 cent level:

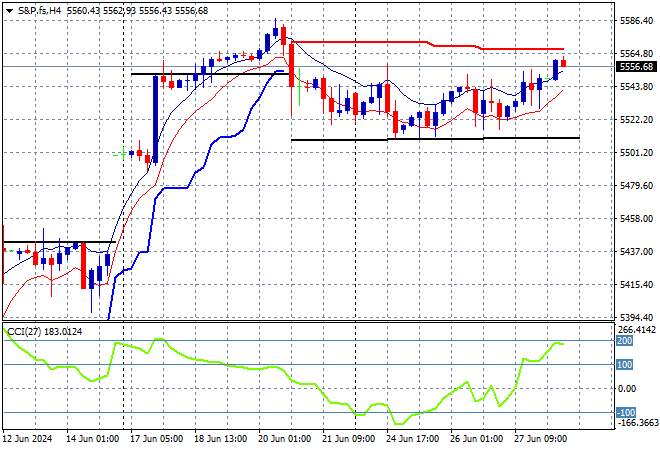

S&P and Eurostoxx futures are lifting slightly as we head into the London session with the S&P500 four hourly chart showing price action wanting to bounce off the 5500 point level which must hold as support:

The economic calendar concludes the trading week with a busy night, with the UK GDP print, the latest German unemployment then the US PCE Core inflation results.