Street Calls of the Week

Asian share markets are mostly in a negative mood, with King Dollar still falling back slightly after its Friday night selloff while Wall Street is expected to open a little lower following the truncated session post Thanksgiving.

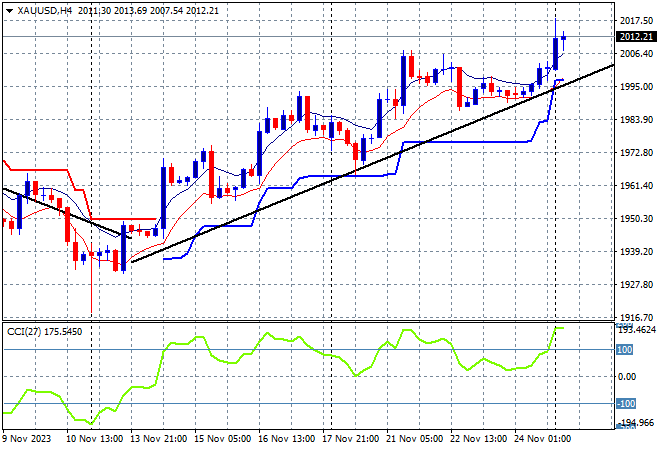

Oil prices are failing to stabilise with Brent crude pushed further below the $80USD per barrel level while gold is surging again after holding fast above the $2000USD per ounce level on Friday night, shoring up short term support:

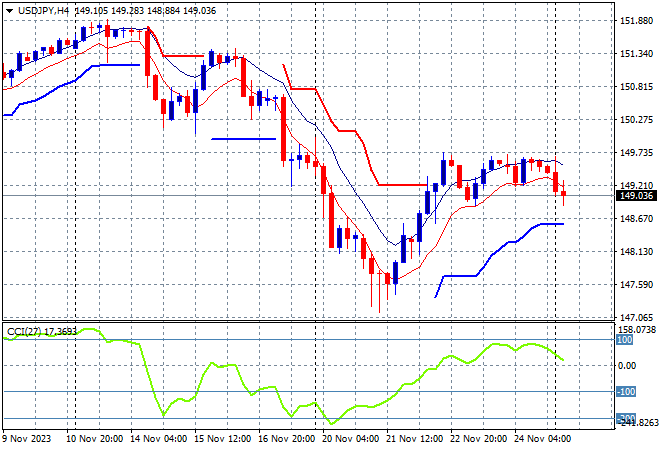

Mainland Chinese share markets are trying to get back into the green near the close with the Shanghai Composite still down 0.3% at 3030 points while in Hong Kong the Hang Seng Index has also lost some ground, currently down nearly 0.6% at 17449 points. Japanese stock markets couldn’t get back into the positive mood either with the Nikkei 225 taking back its recent gains to fall 0.5% to 33443 points while the USDJPY pair is slowly rolling over after the weekend gap to be just a smidge above the 149 level:

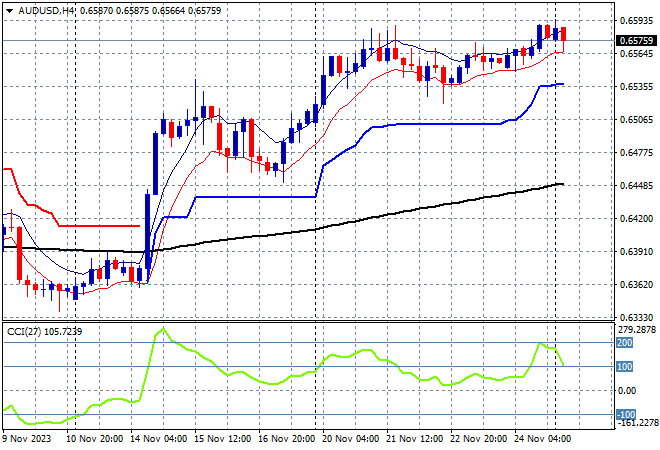

Australian stocks were unable to gain any momentum with the ASX200 closing some 0.7% lower, breaking the 7000 point support level to close at 6987 points while the Australian dollar has continued to hold above the mid 65 cent level after looking a little toppy at the recent new monthly high:

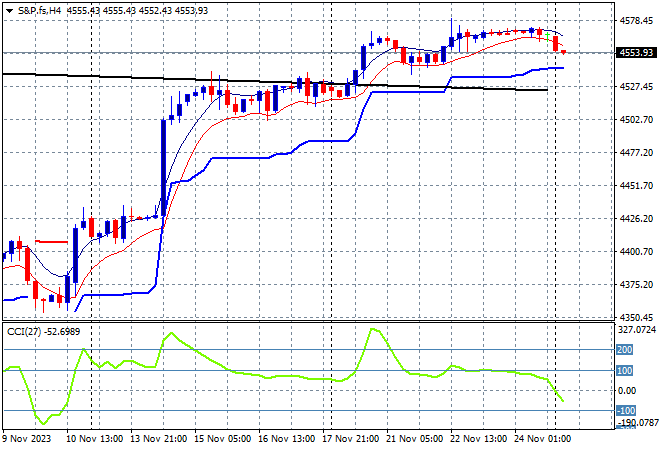

S&P and Eurostoxx futures are pulling back slightly going into the London open as the S&P500 four hourly chart shows support continuing to firm at the 4500 point level where price action is likely to test in tonight’s full session, following a series of large steps following the recent rebound above the 4300 point level:

The economic calendar starts the week slowly with a speech by ECB President Lagarde and then the latest US home sales data.