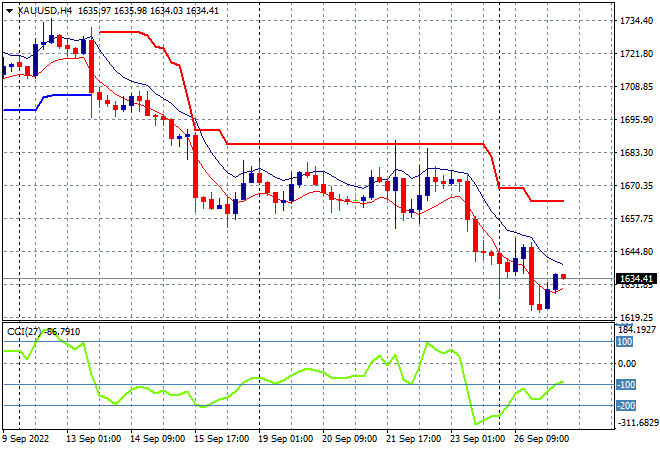

A mild bounce for Asian stocks following a dreadful start of the trading week but risk markets remain extremely nervous and this is likely to be shortlived as recession fears mount amid rising interest rates. The USD has slipped a little against the major currencies, but its all relative given the near collapse in Pound Sterling and Euro and others. Meanwhile oil prices are trying to stabilise with Brent crude hovering above the $85USD per barrel level while gold has had a mild bounce after being crushed below former support at the $1700USD per ounce level, currently at $1634:

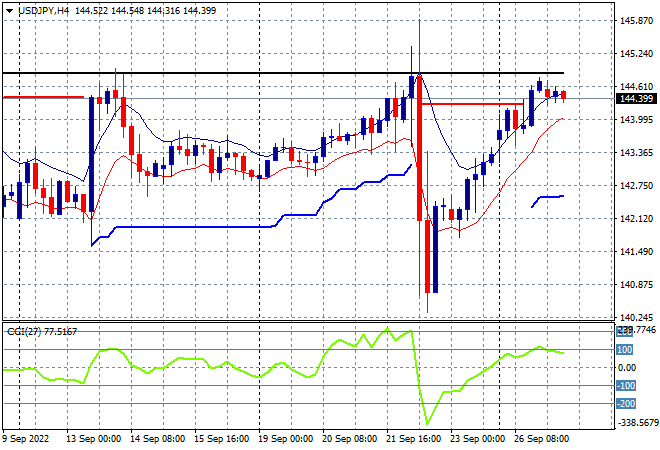

Mainland Chinese share markets are lifting heading into the close with the Shanghai Composite up 0.8% to 3058 points while the Hang Seng Index is still being crushed, down another 0.7% at 17725 points. Japanese stock markets lifted a little, with the Nikkei 225 closing some 0.4% higher at 26531 points while the USDJPY pair is treading water here despite other currencies lifting slightly against USD, still at its previous weekly high just above the 144 handle:

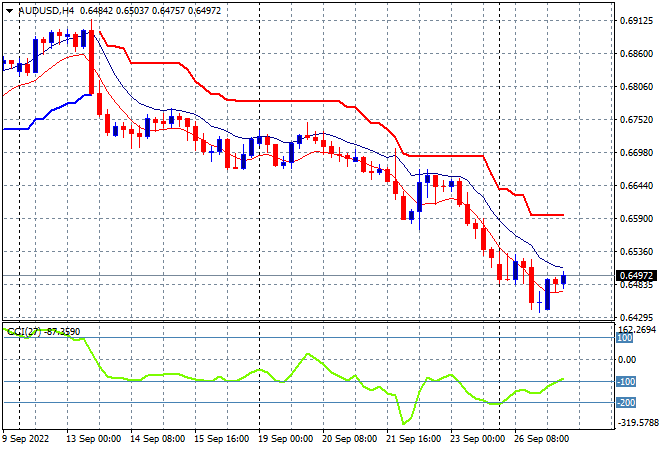

Australian stocks were able to also put in a mild bounce, with the ASX200 gaining nearly 0.5% to nearly close above the 6500 point level, staving off a new monthly low. The Australian dollar also moved higher after yesterday’s gap lower, almost reaching the 65 handle later this afternoon, but the four hourly chart shows this may be illusory and short lived:

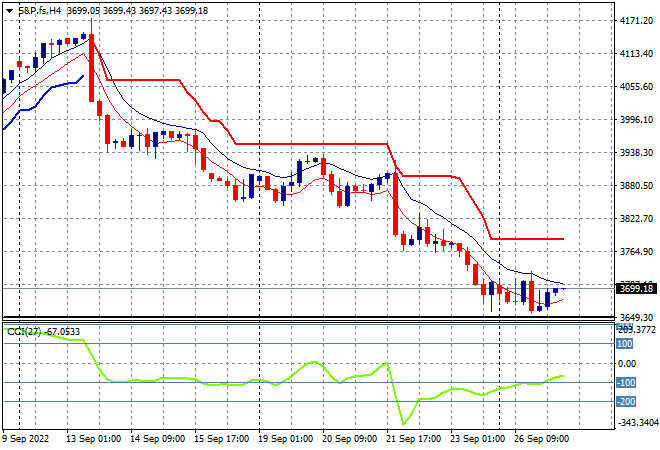

Eurostoxx and US futures are trying to get off the floor as we go into the London session with the S&P500 four hourly futures chart showing price action hovering at the 3700 point level. Medium term and possibly psychological long term resistance at the 4000 point level seems unattainable at the moment with support at 3800 points a distant memory:

The economic calendar will include the latest US durable goods orders and consumer confidence prints.