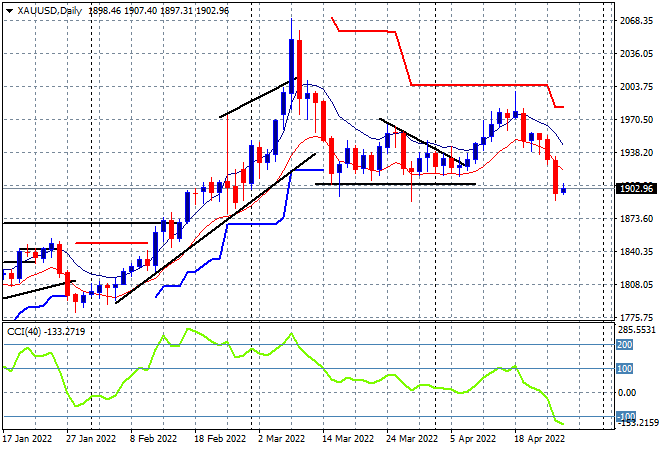

A very mixed reaction to the volatility on overnight markets here in Asia with Australian stocks playing catchup with the biggest falls as Chinese markets continue to selloff under global recession and local COVID concerns. The USD remains firm against all the majors although the Australian dollar was able to bounce back a little this afternoon after being sold off so sharply in the last couple of trading sessions. Oil markets are trying to stabilise again with Brent crude still hovering just above the $100USD per barrel level while gold is also struggling following the recent slump below the $1900USD per ounce level, as daily momentum is about to turn negative:

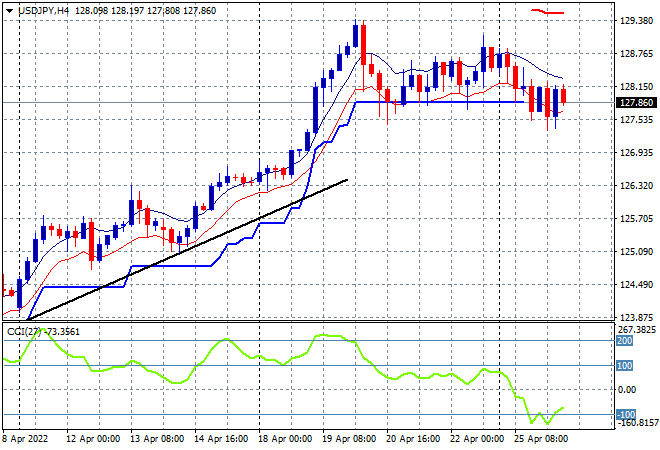

Mainland Chinese share markets are selling off again going into the close with the Shanghai Composite down more than 1% at 2896 points while the Hang Seng Index is actually holding on to be up nearly 0.5% at 19973 points. Japanese stock markets are also stabilising somewhat with the Nikkei 225 closing 0.4% higher at 26700 points while the USDJPY pair remains under pressure as it hovers just below the 128 handle at trailing short term ATR support:

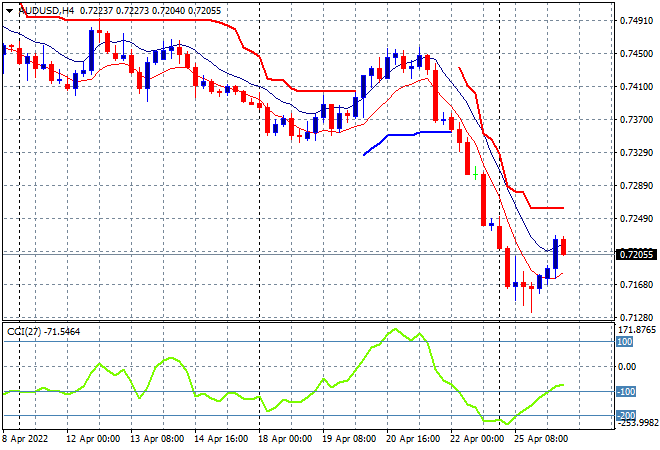

Australian stocks were the worst performers in the region with the ASX200 losing over 2% to start its truncated trading week in poor form, closing at 7318 points. Meanwhile the Australian dollar has bounced back above the 72 level after being swiftly sold off overnight as traders re-assess the RBA response to tomorrow’s highly anticipated, but late and very inaccurate CPI print:

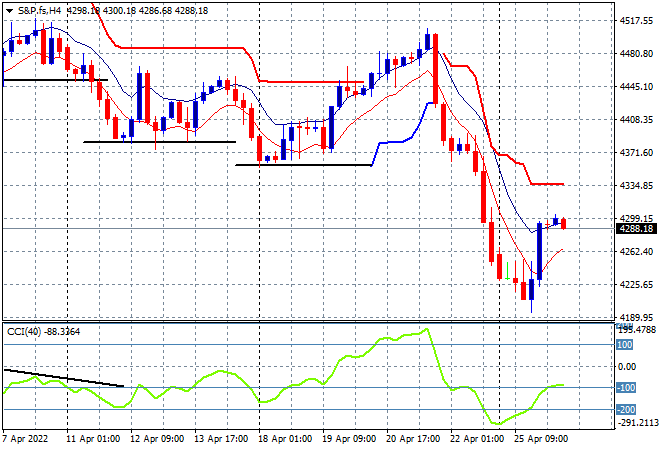

Eurostoxx and Wall Street futures are playing catchup with each other as the former hopes the late night BTFD team will cross the Atlantic and help out, although they could be stretched thin as the S&P500 four hourly chart shows price unwilling to get back to the previous weekly lows around the 4400 point level:

The economic calendar will focus on the latest US durable goods orders print tonight, followed by the CB consumer confidence release.