The central banker talkfest at Jackson Hole ramps up tonight and risk markets will completely hinge – or unhinge – on what Fed Chair Powell has to say with Wall Street extremely cautious after last night’s reversal that continued here in Asia. The USD is firming going into the London session after the overnight volatility with the Australian dollar barely holding on above the 64 cent level.

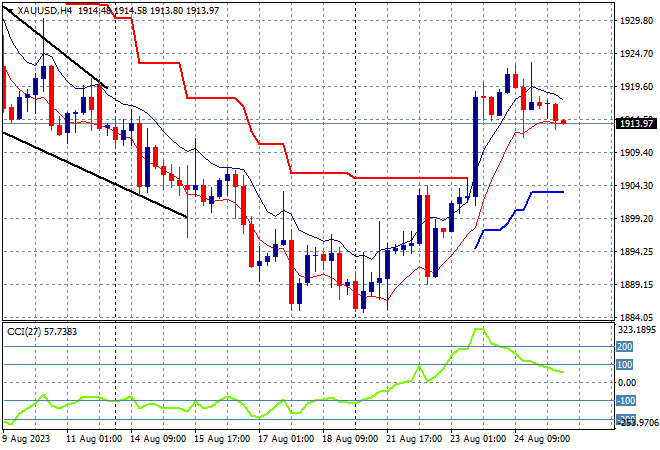

Oil prices are diverging a little with WTI crude still weak while Brent crude is slowly lifting off the $83USD per barrel level while gold is just holding on to its recent gains, hovering here and looking weak at the $1914USD per ounce level:

Mainland Chinese share markets are falling going into the close with the Shanghai Composite down nearly 0.7% at 3061 points while in Hong Kong the Hang Seng Index its been a near reversal, so far down 1.3% to 17973 points.

Japanese stock markets are also in full sell mode, with the Nikkei 225 off more than 2% at 31616 points while the USDJPY is trying to break free above the 146 level and get to the previous session highs – or create a very bearish triple top pattern in the process:

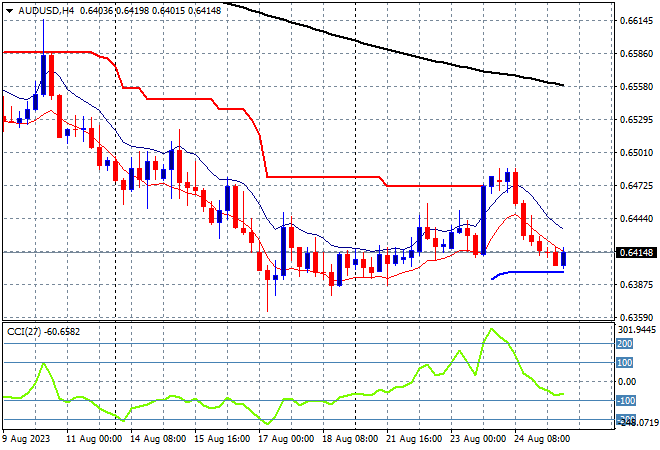

Australian stocks are off by more than 1% as the ASX200 looks to close at 7104 points while the Australian dollar is barely holding above the 64 cent level after retracing its upside move last night:

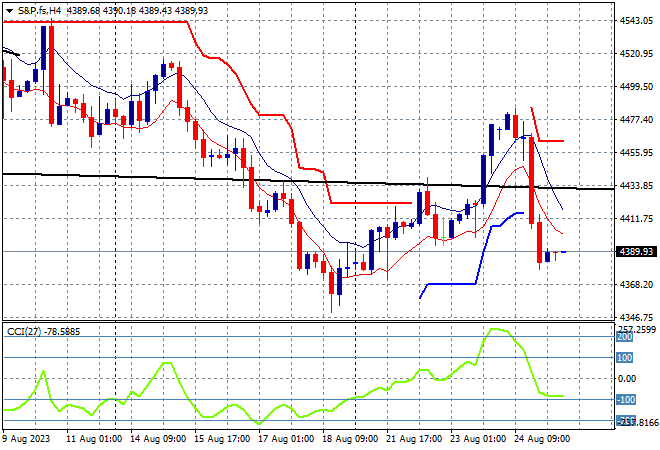

Eurostoxx and S&P futures are trying to dust themselves off from last night’s reversal but are going nowhere with the S&P500 four hourly chart showing a return to the previous bottom at the mid 4300 point level after failing to push aside resistance the 4500 point area:

The economic calendar concludes the trading week with the long awaited Jackson Hole conference, with German GDP and IFO survey plus US consumer sentiment to contend with.