Asian share markets all not quite in bath of blood territory but risk is spooked out there as traders weigh up a slowing down China amid a politically charged US and Europe not inspiring confidence either. There could be some upside tonight with better expected earnings for tech stocks for Wall Street, but that remains to be seen. Currency markets are all going to safe havens with USD and Yen appreciating while the Australian dollar has decidely broken below the 66 cent level.

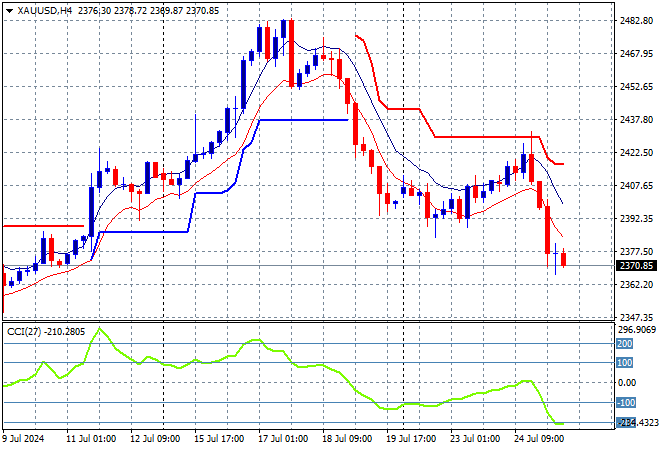

Oil prices are starting to slip again with Brent crude looking to cross below the $81USD per barrel level while gold is selling off again, breaking well below the $2400USD per ounce level:

Mainland Chinese share markets are still going down with the Shanghai Composite losing more than 0.4% while the Hang Seng Index is following suit, down by over 1.3% to 17011 points. Meanwhile Japanese stock markets were the worst off with the Nikkei 225 slumping more than 3% to close at 37859 points as the USDJPY pair also continues its decline to break below the 153 level in afternoon trade:

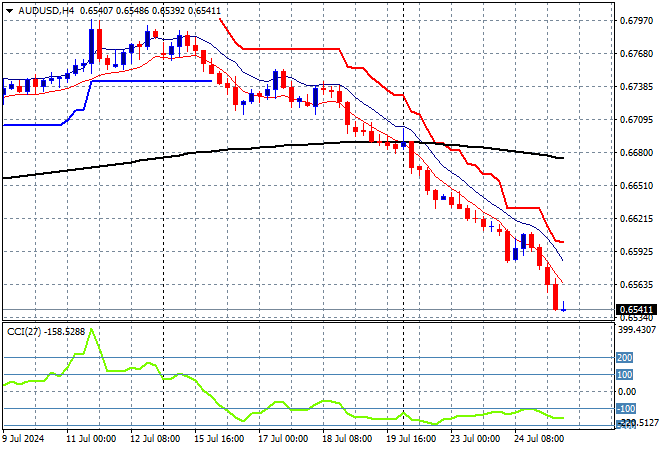

Australian stocks weren’t able to escape the carnage with the ASX200 closing 1.3% lower at 7861 points while the Australian dollar continues its retreat, now well below the 66 cent level as momentum goes into extreme oversold mode:

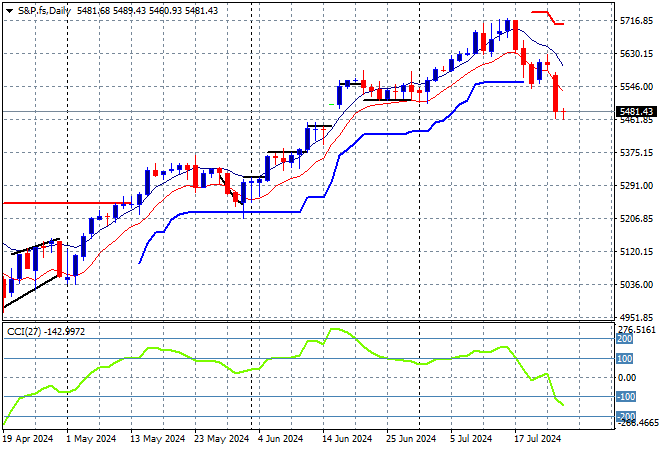

S&P and Eurostoxx futures are down slightly as we head into the London session with the S&P500 daily chart showing how much has been lost so far in the new financial year with the next target below at 5200 points if this dip isn’t turned around:

The economic calendar is packed tonight – just the right time! with German IFO survey, then US durable goods orders plus the latest GDP estimates and weekly initial jobless claims.