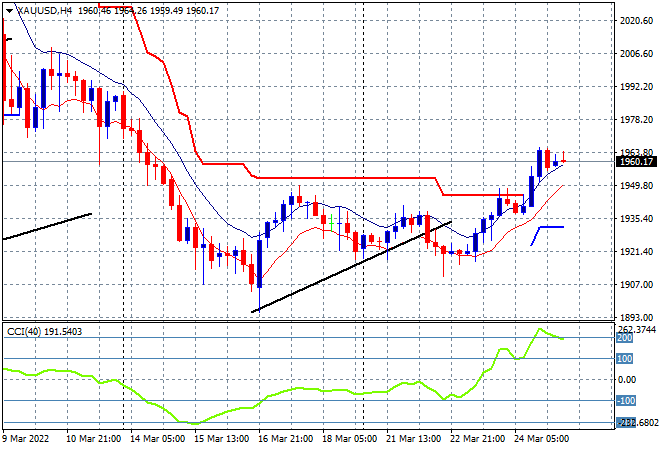

Asian stock markets are in pullback mode despite the solid bounceback on Wall Street overnight. The USD is wavering against Yen and Euro with the latter breaking out of its near week long funk, while the Aussie dollar is unchanged, still climbing above the 75 level. Oil prices remain elevated with Brent crude trying to push back above the $120USD per barrel levels as gold generally moved sideways during the Asian session after yet another late surge overnight, putting aside short term resistance at the $1950USD per ounce level:

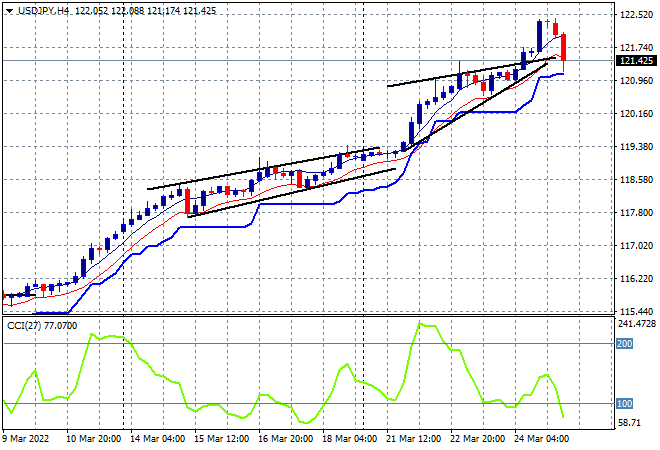

Mainland Chinese shares are falling sharply mid session with the Shanghai Composite currently down 0.5% at 3235 points while the Hang Seng Index has succumbed to another selloff, down 1.6% to be at 21590 points. Japanese stock markets are about to put in scratch sessions with the Nikkei 225 down around 0.15% to 28062 points while the USDJPY pair is finally reversing course after shooting up too high and too fast, but still remains above the 121 handle:

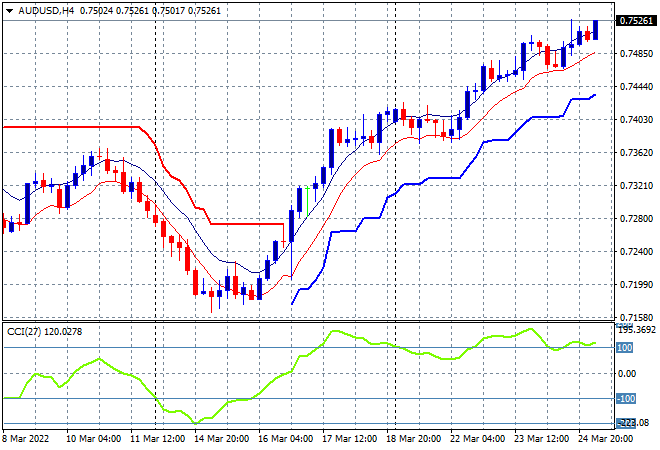

Australian stocks have had the best session in the region with the ASX200 closing some 0.4% higher to finish the week above the 7400 point level. Meanwhile the Australian dollar is continuing its climb above the 75 level, pushing aside stronger resistance that had developed there and looking ready to go further higher:

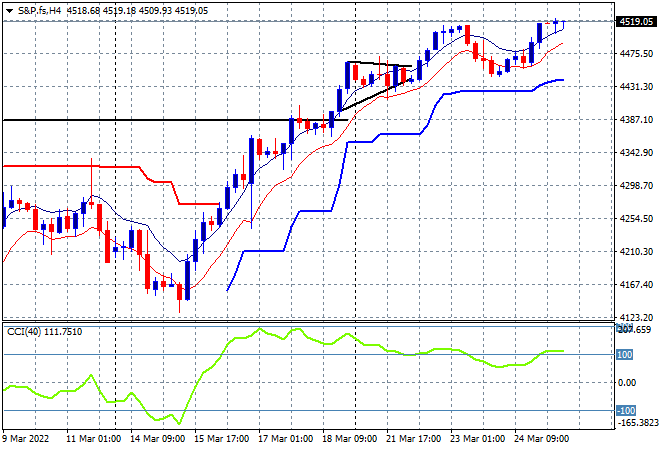

Eurostoxx and Wall Street futures are again trying to inch higher with the S&P500 four hourly chart showing a desire to bounce back for a new weekly high well above the 4500 point level after recently confirming support at the 4400 point area:

The economic calendar finishes the trading week with UK retail sales, the German IFO survey and then the US Michigan consumer sentiment survey.