A sea of red across Asia today following the poor session overnight on Wall Street as US debt ceiling negotiations fail to find a way forward. This is causing increased hesitation around risk markets which has spilled over locally as currency markets remain in strong USD mode as the Australian dollar makes a new monthly low well below the 66 cent level.

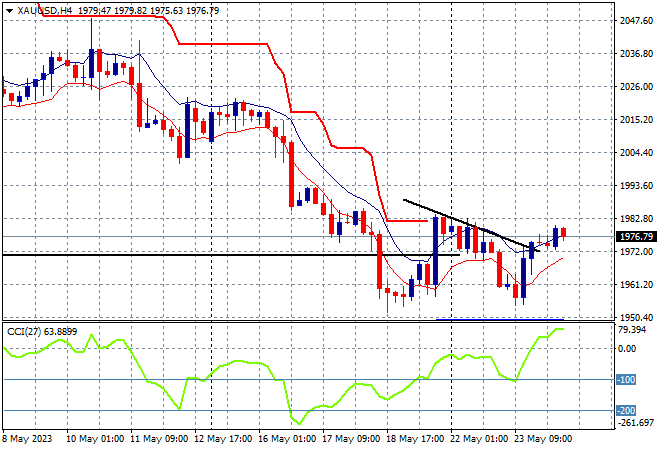

Oil prices are holding on to their overnight gains with Brent crude just above the $77USD per barrel level while gold has continued its tiny little bounceback, currently lifting up through the $1970 level but still well off the key $2000USD per ounce level:

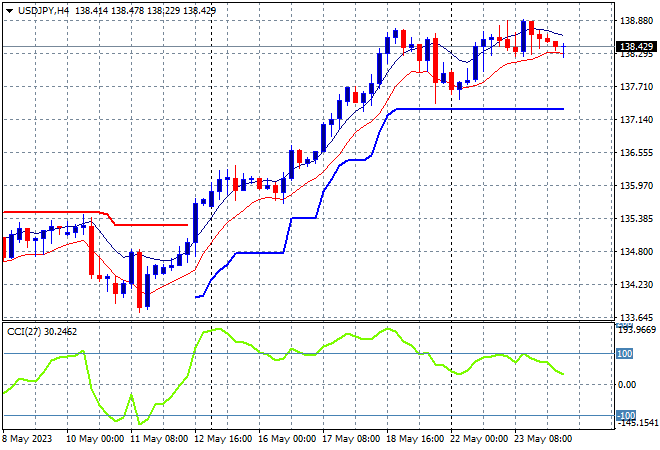

Mainland Chinese share markets are selling off sharply with the Shanghai Composite down over 1.2% to 3204 points while the Hang Seng is following suit, down 1.3% to threaten the 19000 point level, currently at 19165 points. Japanese stock markets are joining in on the selling fun with the Nikkei 225 closing 0.8% lower at 30682 points with the USDJPY pair slipping slightly down to the mid 138 level:

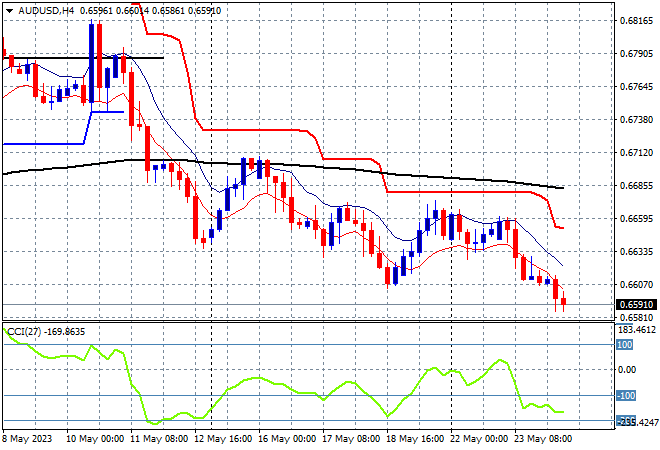

Australian stocks were again the best performers relatively speaking with the ASX200 closing 0.6% lower at 7203 points. The Australian dollar however is now in freefall having broken the 66 cent level for a new monthly low:

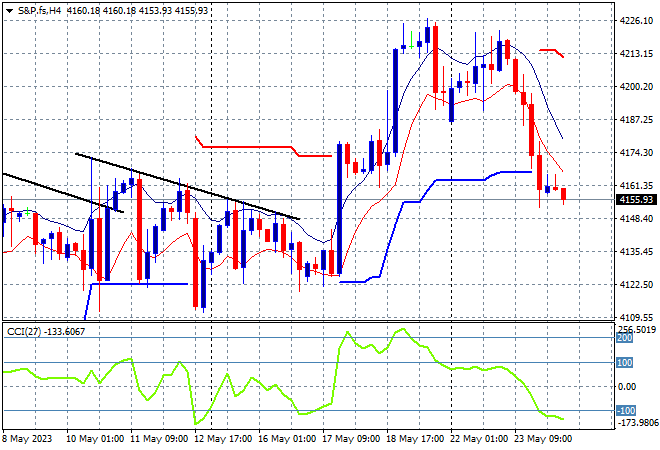

Eurostoxx and S&P futures are falling going into the London open with Wall Street reacting poorly to the lack of debt ceiling negotiations. The S&P500 four hourly chart is showing the breakdown to the 4100 point level still has room to grow with short term momentum readings nicely oversold:

The economic calendar ramps up again with the German IFO survey, followed by the release of FOMC minutes.