A mixed session for Asian share markets as they react to the overnight retracement on Wall Street and other risk markets as traders await the latest speech by Fed Chair Powell at the Jackson Hole symposium/central banker extravagance. The USD returned to strength overnight but that seems to have dissipated with bond markets leading the way again. Stock futures are flat again going into tonight’s session so we’re likely to end this trading week without much volatility – although who knows! The Australian dollar has clawed back some of its overnight loss to remain above the 67 cent level.

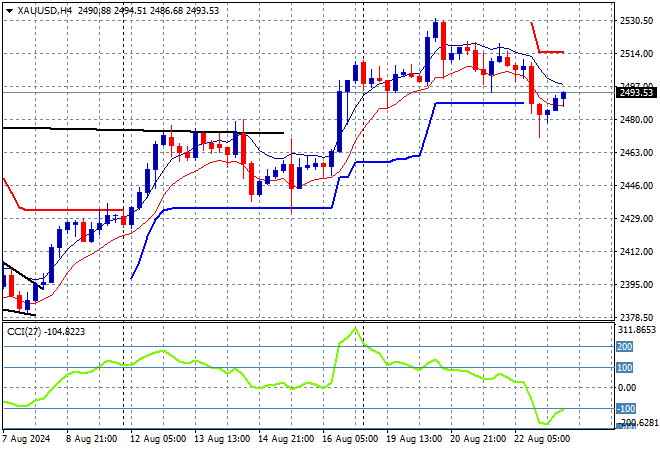

Oil prices are trying to get back on trend with a slight bounceback overnight as Brent crude gets back above the $77USD per barrel level while gold is also trying hard to return above the $2500USD per ounce level after last night’s retreat:

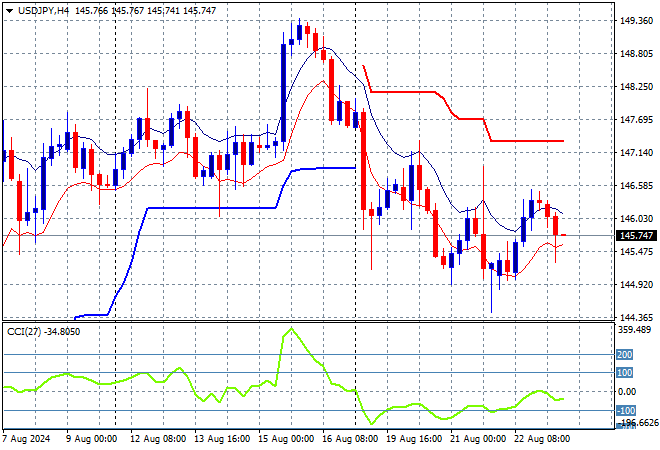

Mainland Chinese share markets are directionless again with the Shanghai Composite unchanged while the Hang Seng Index has lost round, currently down 0.4% to 17569 points. Meanwhile Japanese stock markets are still lifting despite continued Yen volatility with the Nikkei 225 about to close 0.5% higher to 38397 points while trading in USDPY has pulled back to below the 146 level negating the overnight upside move:

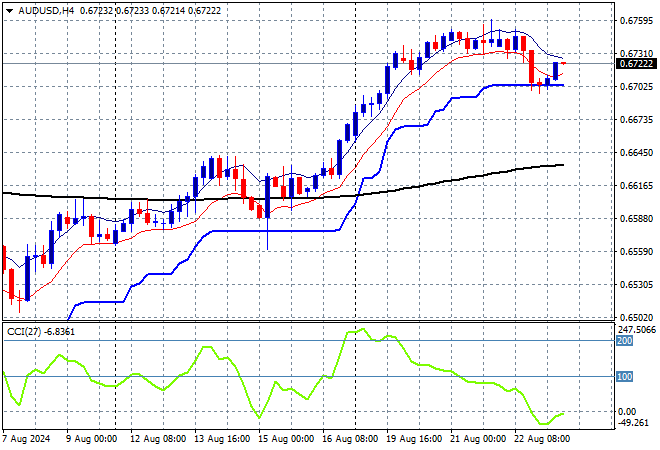

Australian stocks were unable to finish on a good note with the ASX200 down 0.2% but still holding above the 8000 point level and short term support while the Australian dollar was able to get back above the 67 cent level in a quiet session:

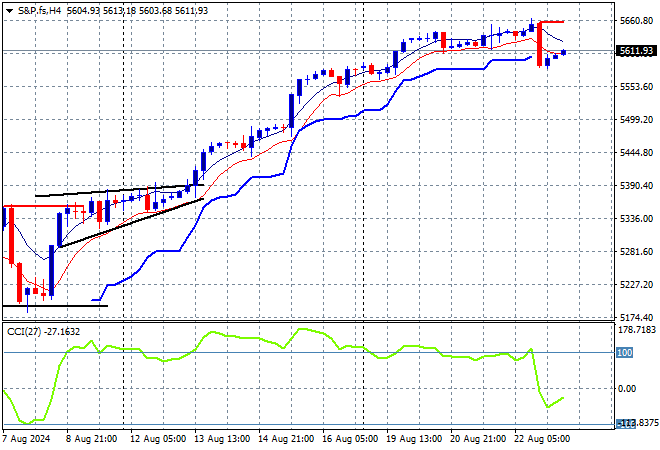

S&P and Eurostoxx futures are barely tracking higher going into the London session with the S&P500 four hourly chart showing momentum is back into the negative zone after last night’s retracement with a neutral setting giving no direction so far:

The economic calendar finishes the trading week with the eagerly awaited speech by Fed Chair Powell at the Jackson Hole Symposium.