Street Calls of the Week

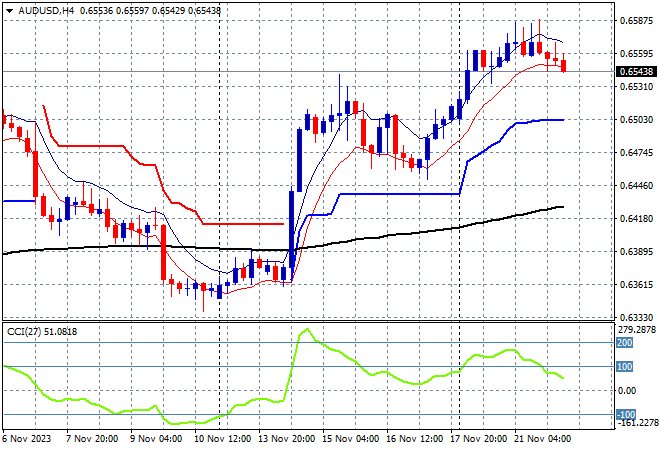

Asian share markets are mostly in a flat mood, reflecting the lack of positive sentiment across the risk complex with King Dollar still lifting slightly after its recent reversal, but the Australian dollar continues to hold on to its new monthly high above the 65 cent level.

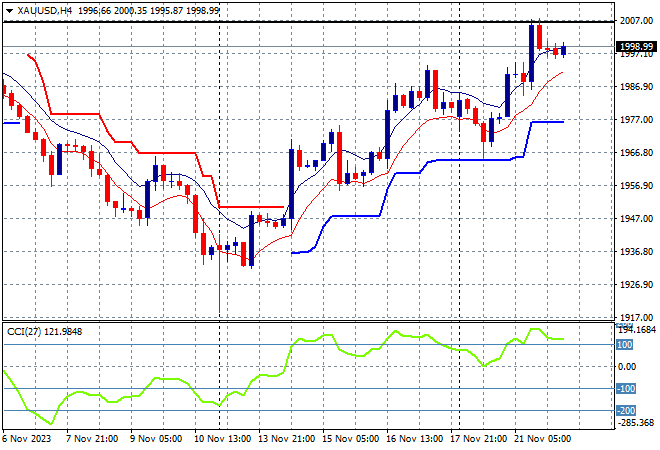

Oil prices are trying to stabilise but barely making any gains, with Brent crude still hovering just abovethe $82USD per barrel level while gold is consolidating at just below the $2000USD per ounce level, shoring up short term support:

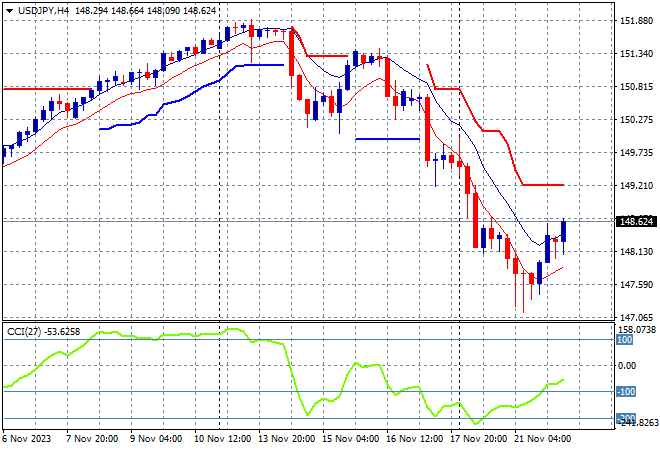

Mainland Chinese share markets opened in the red and have stayed there going into the close with the Shanghai Composite down 0.2% to 3060 points while in Hong Kong the Hang Seng Index has also put in a flat session, currently at 17728 points. Japanese stock markets are finally bouncing back after a selloff in Yen overnight with the Nikkei 225 putting on almost 0.4% to 33518 points while the USDJPY pair continues its bounceback to almost breach the 149 level:

Australian stocks were unable to gain any positive momentum with the ASX200 closing some 0.1% lower at 7072 points while the Australian dollar has continued to hold above the mid 65 cent level but its looking toppy here at the recent new monthly high:

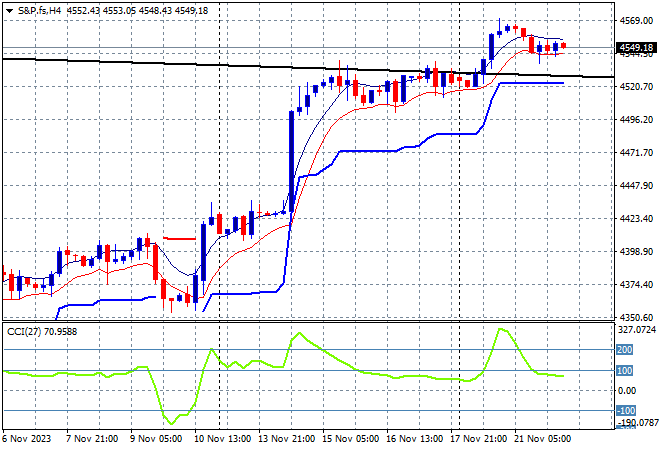

S&P and Eurostoxx futures are flat going into the London open as the S&P500 four hourly chart shows support continuing to firm at the 4500 point level as price action continues to move up a series of large steps following the recent rebound above the 4300 point level:

The economic calendar includes the latest US durable goods order and Michigan consumer sentiment print.