Asian stock markets are selling off sharply as risk appetites dry up with tonight’s BOE meeting possibly adding fuel to the fire as another central bank that is likely to hike going into recession fears as inflation remains unquelled.

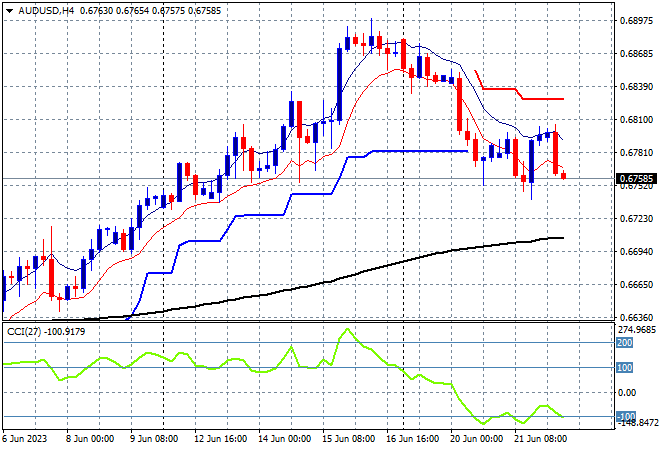

The USD is gaining against most of the majors – except Pound Sterling – while the Australian dollar keeps slipping below the 68 cent level.

Oil prices are falling back slightly as volumes return to normal with Brent crude holding just below the $77USD per barrel level while gold is still struggling with a series of lower low session, barely holding here just below the $1930USD per ounce level:

Mainland Chinese share markets were down all session again with the Shanghai Composite losing more than 1.3% to cross below the 3200 point level while the Hang Seng Index was closed for a holiday.

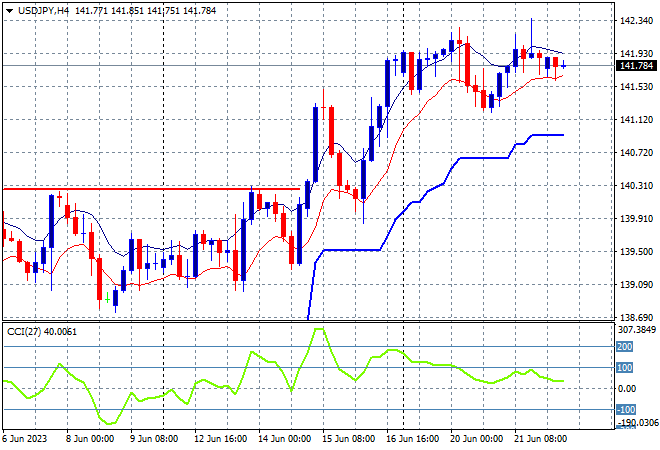

Japanese stock markets are also on a slump with the Nikkei 225 closing nearly 1% lower to 33267 points with the USDJPY pair is holding on here to its recent gains just below the 142 level:

Australian stocks had a shocker with the ASX200 closing nearly 1.6% lower at 7195 points. The Australian dollar was held below the 68 handle yet again and is looking tenuous here as short term momentum reverts sharply:

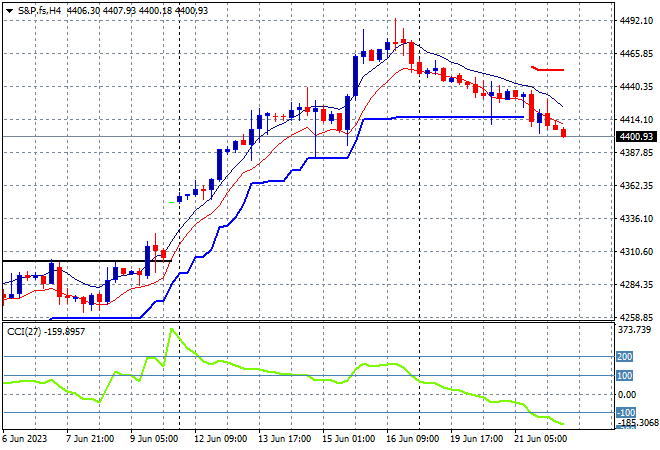

Eurostoxx and S&P futures are down at least 0.8% as we head into the London open with the S&P500 four hourly chart looking to open probably 0.3% or more lower as the stock rout continues. After retracing down to ATR support at the 4400 point level this is looking ominous as short term momentum goes oversold quicklyd:

The economic calendar will focus squarely on the Bank of England meeting than US initial jobless claims for the week.