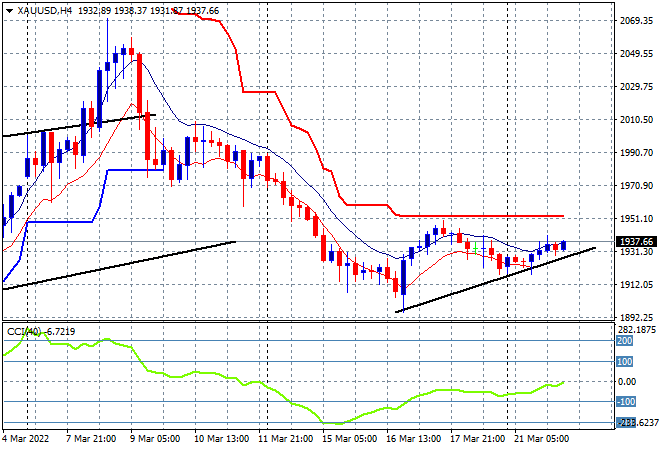

Asian stock markets are having a better session today following what was a poor performance overnight on Wall Street as bond market volatility abated somewhat amid another surge in USD strength, particularly Yen and Euro although Aussie is just being held back as commodity prices especially iron ore keep lifting. Oil prices are on the rise again with Brent crude advancing up to the $120USD per barrel levels as gold tries to make better headway here as it continues to deflect off of short term resistance at the $1950USD per ounce level:

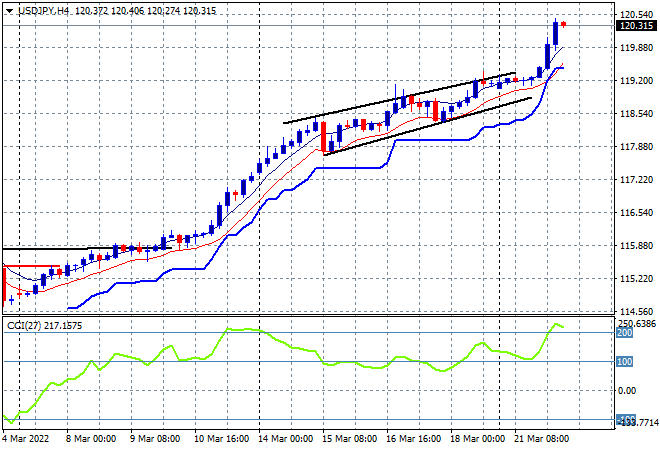

Mainland Chinese shares are returning to solid form with the Shanghai Composite currently up 0.3% to be at 3263 points while the Hang Seng Index is having a great session, bouncing nearly 2% to be at 21634 points. Japanese stock markets returned from another long weekend with the Nikkei 225 closing 1.3% higher at 27184 points while the USDJPY pair has surged right through the 120 handle for yet another historic high:

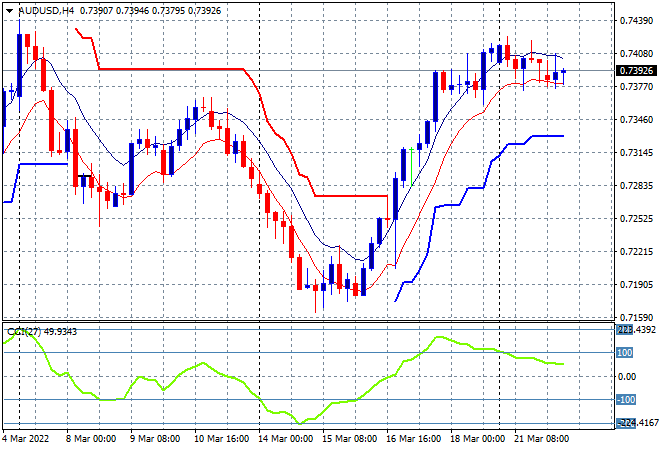

Australian stocks were able to translate into good returns, with the ASX200 lifting 0.8% to 7341 points. Meanwhile the Australian dollar is treading water as the 74 handle turns into short term resistance, having been able to breach it on Friday night, but still just under the previous weekly high:

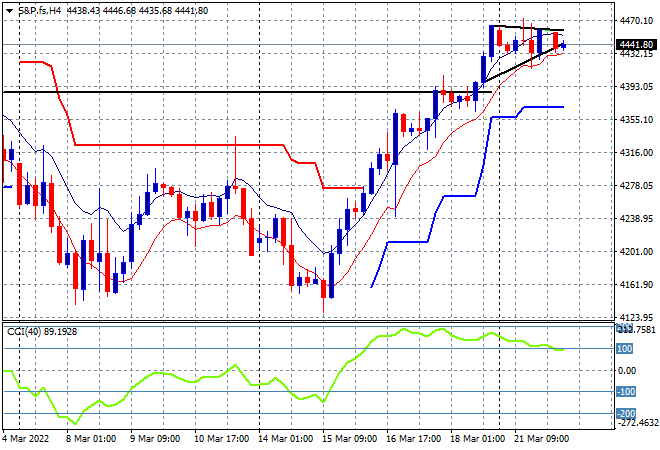

Eurostoxx and Wall Street futures have pulled back slightly with the S&P500 four hourly chart showing a pause continuing after Friday night’s surge. Resistance here at the 4400 point level has been taken out however, so it should act as short term support going forward:

The economic calendar is again relatively quiet tonight with a few more ECB and Fed speeches to look out for and some tertiary manufacturing numbers from the US.