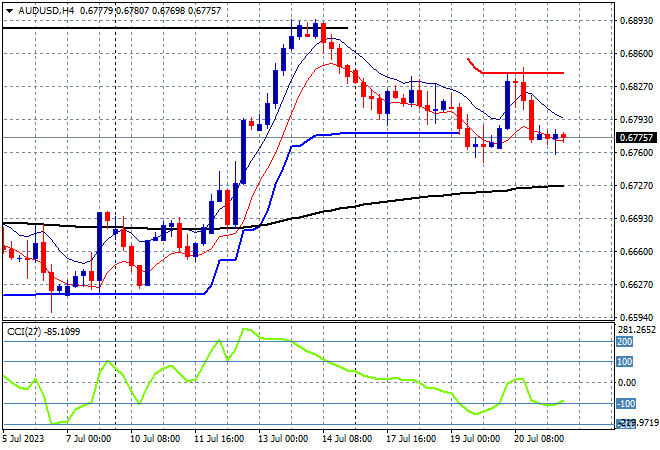

Asian stock markets are mixed yet again as we go into the end of the trading week with the fallout from the stronger Yuan yesterday and stronger USD overnight being felt by the risk complex as the former was again moved much more than expected by the PBOC. Meanwhile the latest CPI print from Japan came in stronger than expected although the BOJ keeps thinking this is transitory, with Yen barely affected. The Australian dollar remains unchanged despite a volatile 24 hours at just below the 68 cent level with almost no net change due to the stronger than expected unemployment print yesterday.

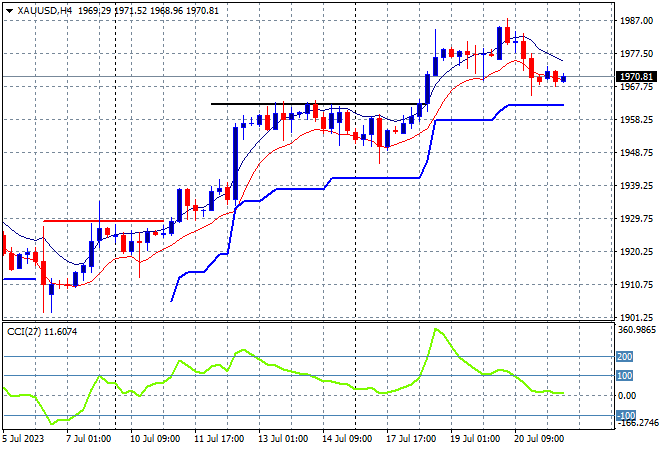

Oil prices are finding new life as the London session gets underway, pushing aside resistance as Brent crude gets back above the $80USD per barrel level while gold is holding on to its overnight dip, steady here at the $1970USD per ounce level:

Mainland Chinese share markets are still in deflation mode with the Shanghai Composite about to finish some dead flat at 3171 points while in Hong Kong the Hang Seng Index is trying to rebound after its recent selling, up 0.3% to 18999 points.

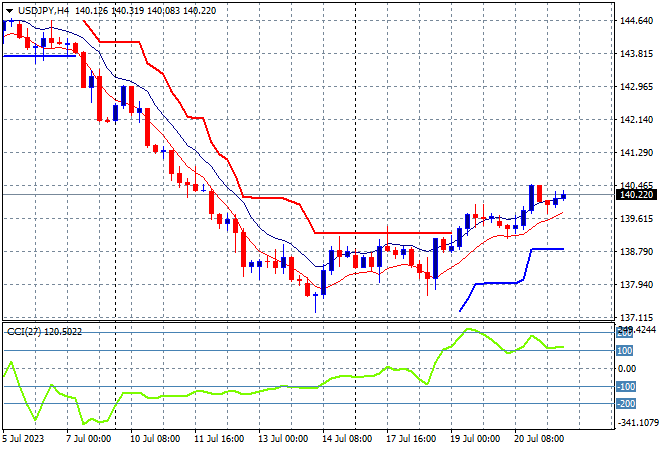

Japanese stock markets continue to deflate with the Nikkei 225 closing more than 0.5% lower at 32304 points while the USDJPY pair is still trying to convert its recent breakout above the 140 level into something more sustainable:

Australian stocks are putting in another flat session to end the week, with the ASX200 closing 0.1% lower at 7313 points. The Australian dollar was basically unchanged from its oscillation overnight to remain just below the 68 handle, likely putting in a new weekly low despite the unemployment print surprising to the upside:

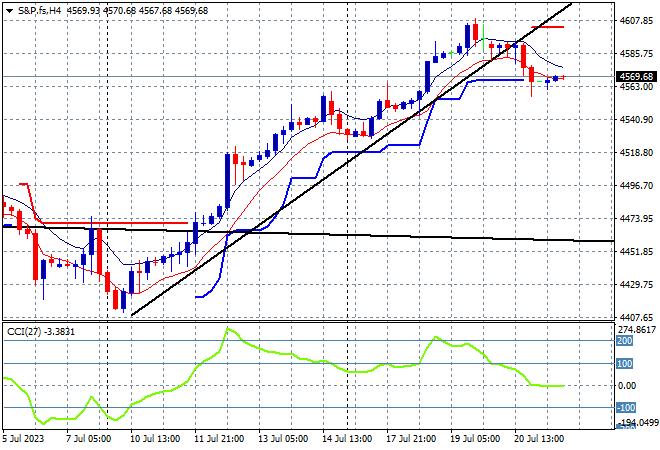

Eurostoxx and S&P futures are down 0.3% or so as the S&P500 four hourly chart still shows price action wanting to extend above the 4500 point level which had been staunch resistance but the two long week uptrend is now under threat:

The economic calendar ends the trading week with a whimper with UK and Canadian retail sales prints and not much else.