Red across the board again for Asian stock markets except local shares as the latest RBA Minutes were released showing less desire to raise rates as the board wants unemployment to tick higher. The USD was lifting against most of the majors but is falling back as London opens while the Australian dollar slumped below the 69 cent level on the minutes.

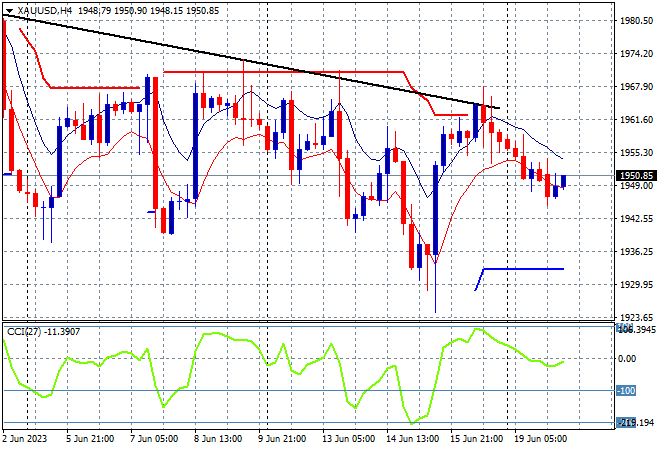

Oil prices are starting off flat with Brent crude holding just below the $76USD per barrel level while gold is struggling here after drifting down all day yesterday, currently right on the $1950USD per ounce level:

Mainland Chinese share markets have bene down all session gain and remain off going into the close with the Shanghai Composite losing 0.5% to revert back to the 3200 point level while the Hang Seng Index sunk more than 1% lower to remain well below the 20000 point level at 19577 points.

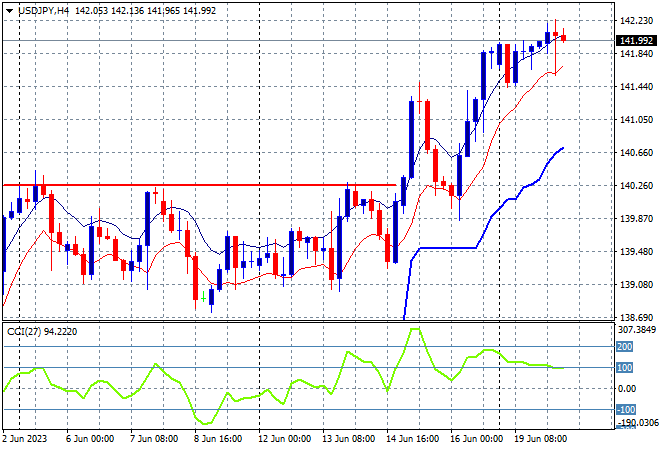

Japanese stock markets are also having another breather with the Nikkei 225 losing just 0.2% to 33330 points with the USDJPY pair holding on toits Friday night high to just below the 142 level:

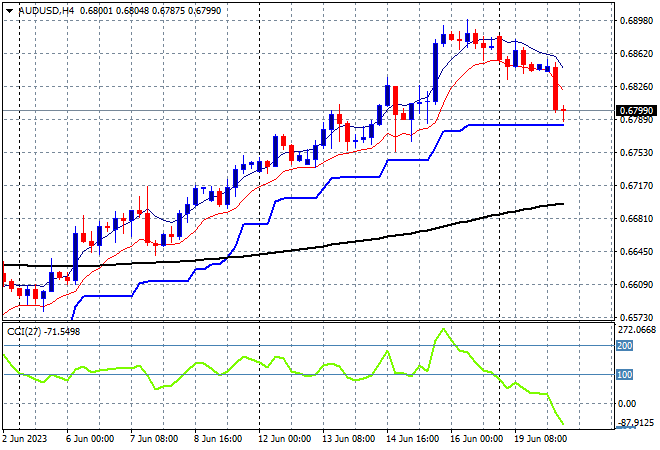

Australian stocks are the odd ones out again with the ASX200 lifting nearly 0.9% to close at 7357 points. The Australian dollar was slammed back below the 68 handle due to the release of the RBA minutes and subsequent talky-talk as short term momentum reverts sharply:

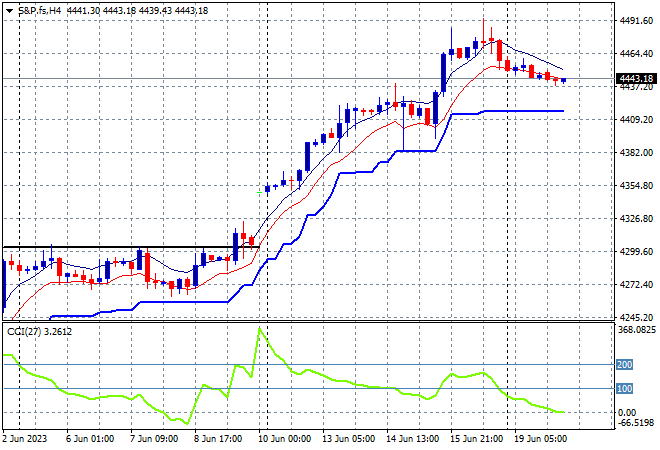

Eurostoxx and S&P futures are slightly lower going into the London open with Wall Street reopening after a long weekend to absorb the somewhat risk averse markets and a slightly higher USD.

The S&P500 four hourly chart is showing a desire to get above the 4500 point level after bursting through resistance at the 4300 area last week but short term momentum is waning:

The economic calendar ramps up with US building permits plus quiet a few central banker speeches from the ECB and the Fed.