Share markets are unsteady here in Asia as we start a new trading week, and head into the end of the financial year. All eyes are on the crypto crash over the weekend, with Bitcoin bouncing back – if you could call it that – to the $20K level, while the USD is giving up some minor gains against most of the undollars, with the bounce in the Australian dollar again still unable to translate into anything above the 70 cent level. Oil prices are drifting sideways, with Brent crude just above the $113USD per barrel level after losing 4% on Friday while gold is up a handful of dollars as it struggles to get off the ropes here at the $1842USD per ounce level:

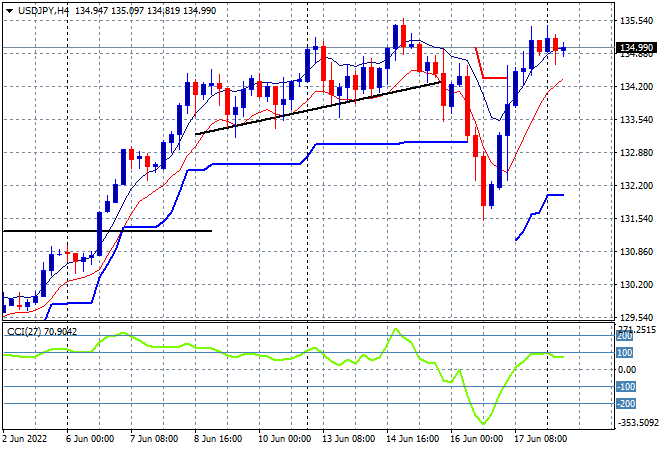

Mainland Chinese share markets are steady with the Shanghai Composite basically unchanged at 3328 points while the Hang Seng Index has slipped a handful of points to be at 21068 points going into close. Japanese stock markets are still in correction mode with the Nikkei 225 index closing 0.7% lower at 25771 points while theUSDJPY pair has stabilised from its Friday night bounce back to be just under the 135 handle:

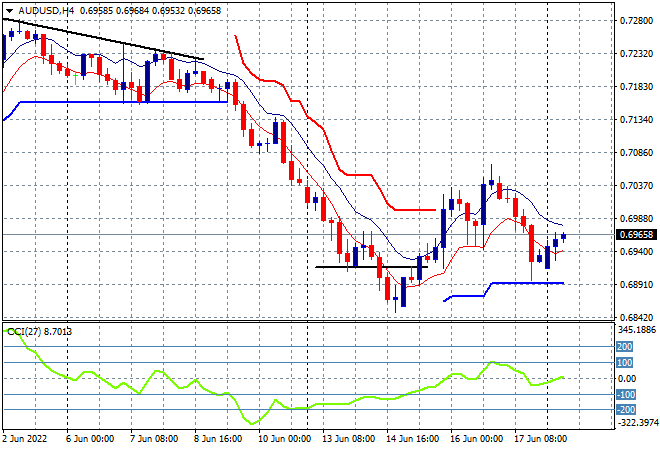

Australian stocks are also not doing well in their first session of the week with the ASX200 finishing some 0.7% lower at 6433 points. The Australian dollar has taken back about half of its Friday night losses but is still stuck here under the 70 cent level as four hourly momentum remains neutral:

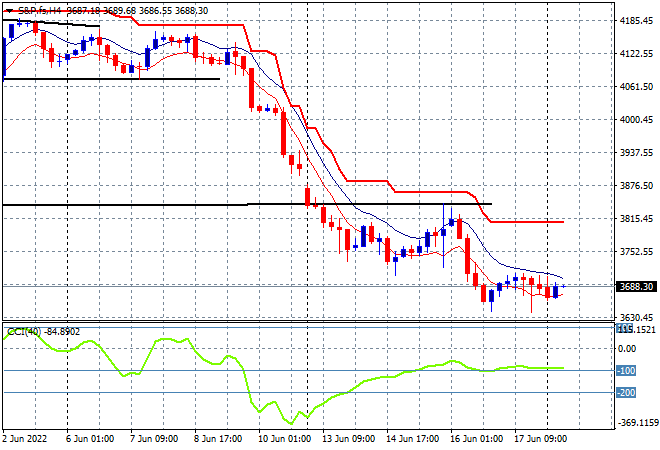

Eurostoxx and Wall Street futures are slowly drifting sideways going into the European open, with the S&P500 four hourly futures chart showing price action still crushed at the 3700 point level as the May lows (lower horizontal black line) turn into resistance here:

The economic calendar is very quiet tonight with a few BOE speeches, and Wall Street will be closed for a public holiday.