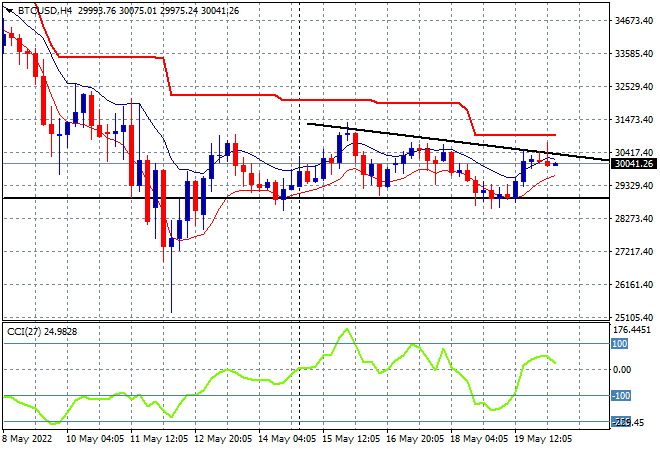

Yet another bounceback with Asian share markets green across the board today to finish the trading week still unsettled. Currency markets are also clawing back more ground against USD as the Australian dollar firms above the 70 level. Oil prices are stabilising with Brent crude now hovering just above the $111USD per barrel level while gold is holding on to its one session gain, currently at the $1845USD per ounce level. Meanwhile Bitcoin looks like rolling over again, barely hanging on just above the $30K level, ready to break below key monthly support again:

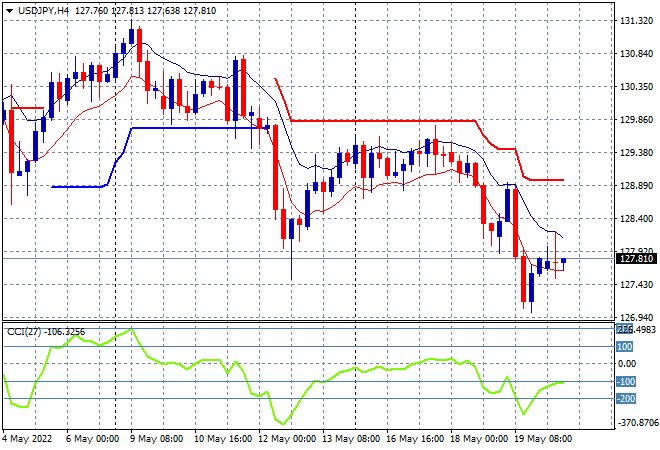

Mainland Chinese share markets are doing well with the Shanghai Composite currently up 1.4% to 3140 points while the Hang Seng Index has taken back most of its previous losses, up 2% at 20535 points. Japanese stock markets are not losing out either, with the Nikkei 225 index about to close nearly 1.4% higher at 26744 points while the USDJPY pair has not moved since last night, currently just below the 128 level as Yen defensive buying has not yet abated:

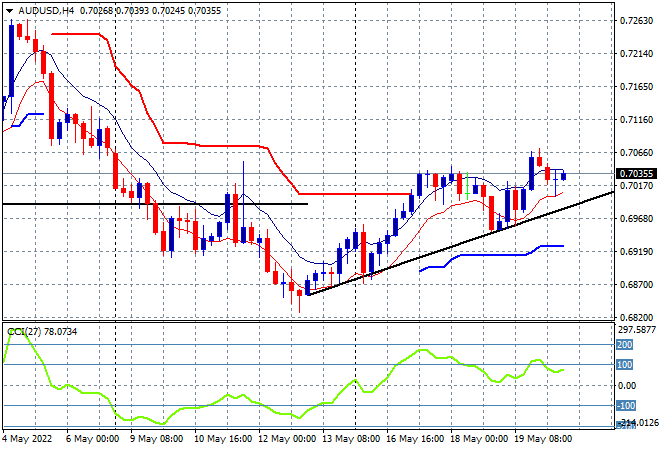

Australian stocks are firming again with the ASX200 about to finish 1% or so higher, currently at 7140 points, keeping the 7000 point level intact for now. Meanwhile the Australian dollar has wobbled a little throughout the session but still holding well above the 70 level and ready to put in a new weekly high:

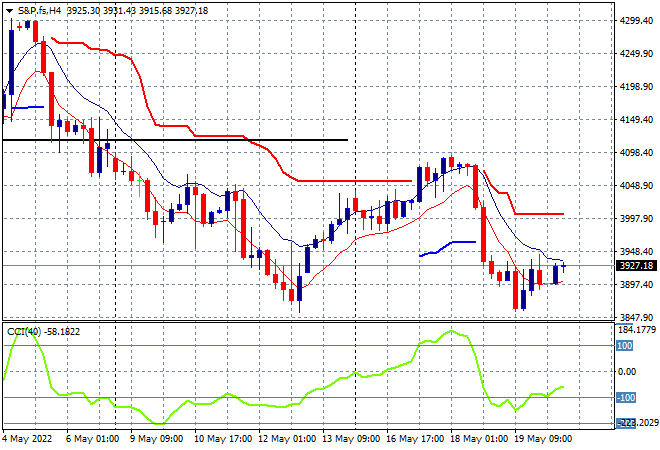

Eurostoxx and Wall Street futures are up very modestly% as we head into the European open with the S&P500 four hourly chart showing price still anchored well below the 4000 point level although a swing trade is possibly brewing here as momentum inverts:

The economic calendar finishes the week with UK retail sales and not much else.

Oh and I’ll be manning the BBQ at our local school making “democracy sausages” while I watch the conga line of voters hopefully throw the LNP out.