Street Calls of the Week

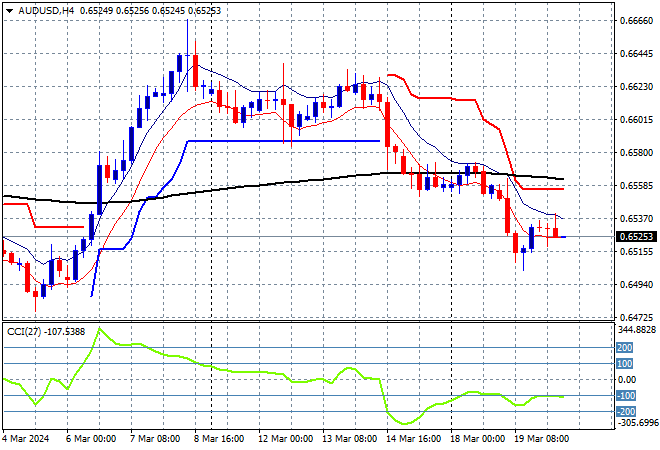

Asian share markets are in a fairly good mood but all eyes remain on what the Fed will say and do overnight at its FOMC meeting with currency markets largely unchanged. Australian stocks are going nowhere after the RBA meeting as the Australian dollar is still in the doldrums, almost crossing below the 65 handle.

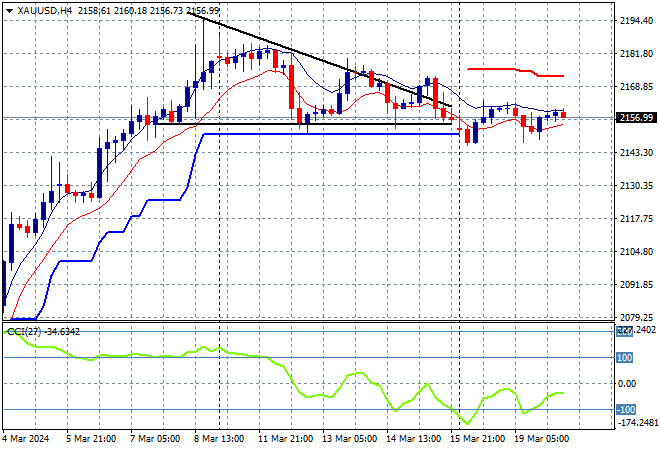

Oil prices are continuing their breaking out after the Ukrainian attack on Russian refineries as Brent crude remains well above weekly resistance at the $87USD per barrel level while gold is almost breaking down after its recent gains to fall below the $2160USD per ounce level:

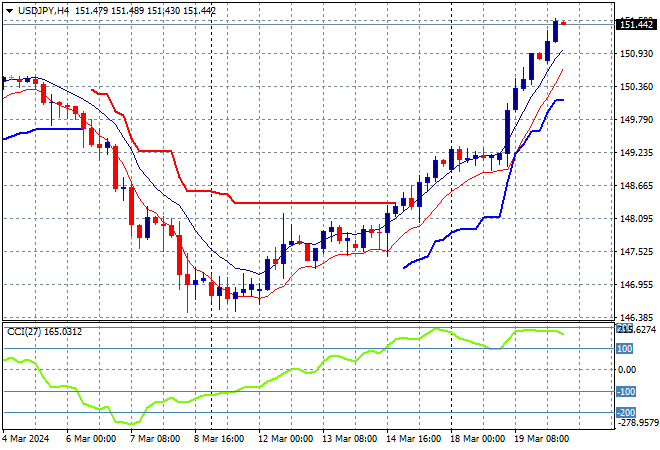

Mainland and offshore Chinese share markets are trying to get back on track with the Shanghai Composite rising sharply in late afternoon trade, up nearly 0.5% while the Hang Seng is treading water somewhat at 16559 points. Japanese stock markets were the big movers again with the Nikkei 225 closing more than 0.5% higher at 40006 points while the USDJPY pair has zoomed up above the 151 level, extending recent gains:

Australian stocks were the odd ones out with a slight loss today, as the ASX200 retreated 0.1% to close at 7695 points while the Australian dollar is again dicing with the 65 handle due to the dovish move at Martin Place:

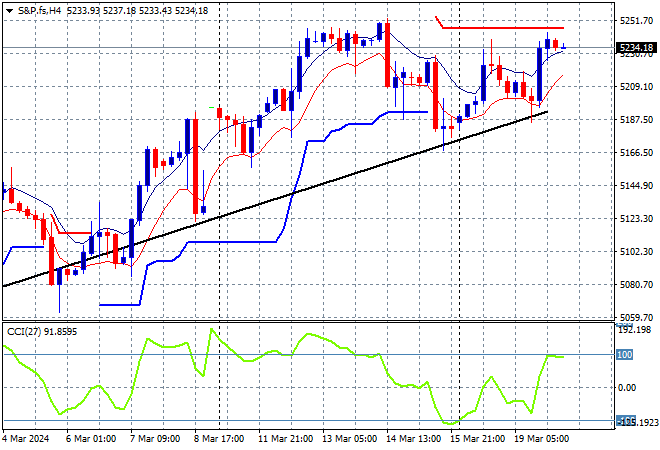

S&P and Eurostoxx futures are trying to extend their overnight gains as we head into the London session with the S&P500 four hourly chart showing price action trying to get above the 5200 point level with short term support shoring up:

The economic calendar will be dominated by tonight’s Fed FOMC meeting.