Last night saw quiet markets due to the US long weekend with bond markets also sanguine, with European shares advancing slightly. The USD was basically unchanged with an almost empty economic calendar as the Australian dollar able to get off the floor and back above the 65 cent level.

10 year Treasury yield futures are implying a start around the 4.3% level while oil prices are still lifting with Brent crude extending further above the $83USD per barrel level. Meanwhile gold continued its fight back after being under pressure following the US CPI print and has started the new trading week out at the $2020USD per ounce level.

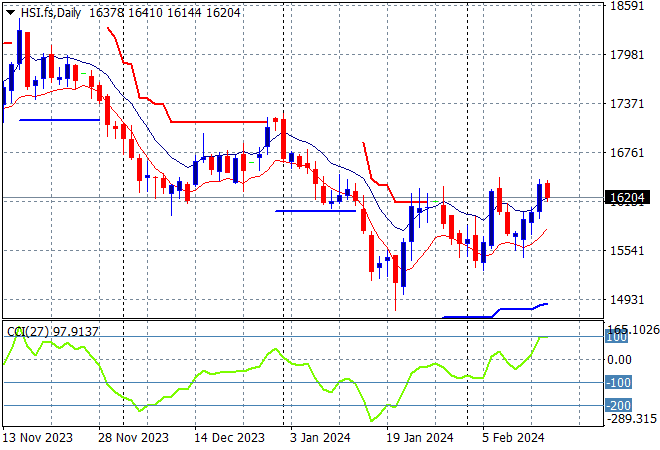

Mainland and offshore Chinese share markets reopened from the Chinese New Year holiday with the Shanghai Composite up nearly 1.5% while the Hang Seng pulled back just over 1% to close at 16155 points.

The daily chart is starting to look a bit more optimistic with price action bunching up around the 16000 point level, ready to possibly burst out here and make a run for the end of 2023 highs at 17000:

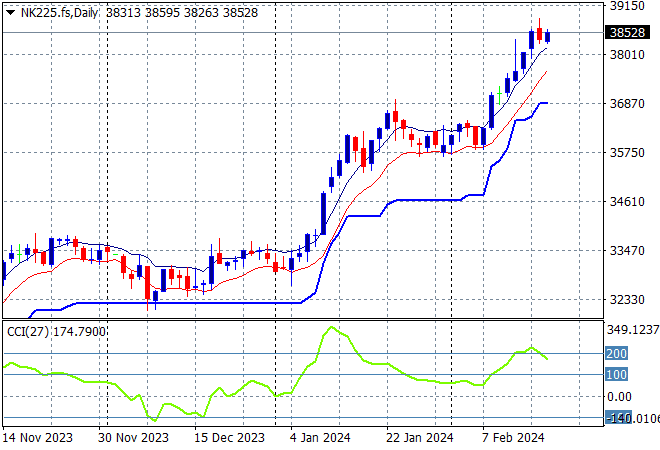

Japanese stock markets went nowhere with the Nikkei 225 closing some 0.1% lower at 38470 points.

Trailing ATR daily support was never threatened by price action after this bounce went beyond the September highs at the 33000 point level with daily momentum getting back to overbought readings with a significant breakout. A selloff back to ATR support at 32000 points remains unlikely as the November highs are wiped out in this breakout but I’m cautious of a strong pullback here on any volatility:

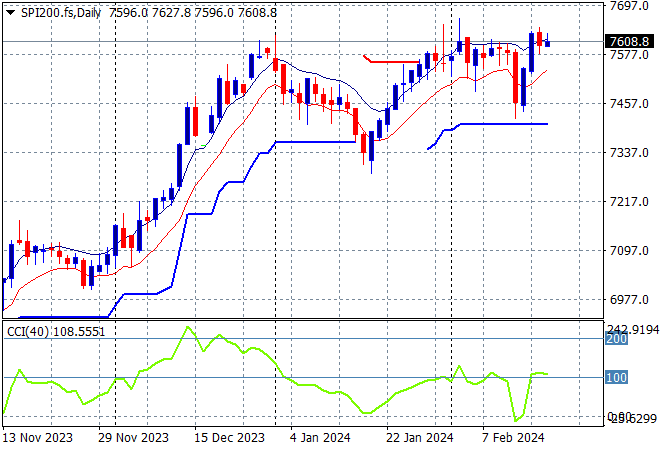

Australian stocks range traded throughout the session with the ASX200 closing just 0.1% higher at 7665 points.

SPI futures are indicating a minor lift on the opening of the new trading week, up just 0.1% due to a lack of direction from a closed session on Wall Street overnight. The daily chart was looking firmer with the medium term uptrend and short term price action coming together to take out the previous December highs. As I said previously, watching for any continued dip below the low moving average could see a significant pullback but watch ATR support which has been defended so far:

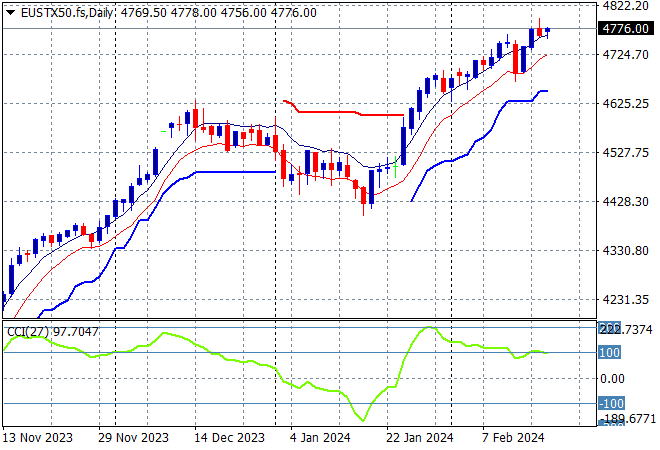

European markets only saw rises in the periphery with the German DAX unchanged which led to the Eurostoxx 50 Index eventually finishing some 0.1% lower at 4763 points.

The daily chart shows price action still on trend after breaching the early December 4600 point highs but daily momentum has now retraced from being well overbought with futures a pullback this evening. There were are hopeful signs this could turn into a larger breakout but markets were overextended but watch for any falls below the low moving average or ATR support proper:

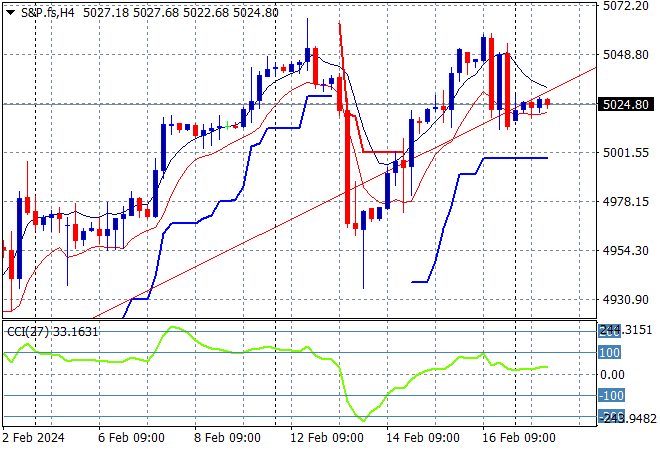

Wall Street was closed for the long weekend with futures implying that the S&P500 will start again tonight basically where it finished on Friday night to be just above the magical 5000 point level.

The four hourly chart shows short term momentum out of oversold territory with a classic buy the dip that has taken in back on trend and restoring some confidence. This fill above the 5000 point level proper is where to watch price action carefully if it rejects the former highs:

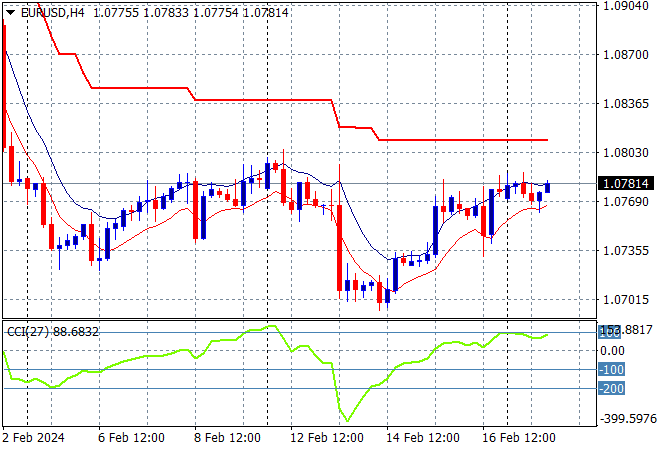

Currency markets were relatively calm given the lack of US traders overnight with the USD still strong the wake of the strong US inflation prints last week. King Dollar is still ruling although Euro managed to extend its gains above the 1.07 level as it rebounded above its recent weekly lows.

The union currency had already been at a new weekly low almost below the 1.07 level but this was taken out and then some for a new monthly low, hovering over that level this morning. Short term momentum has retraced out of oversold mode, with price action well contained below trailing ATR resistance:

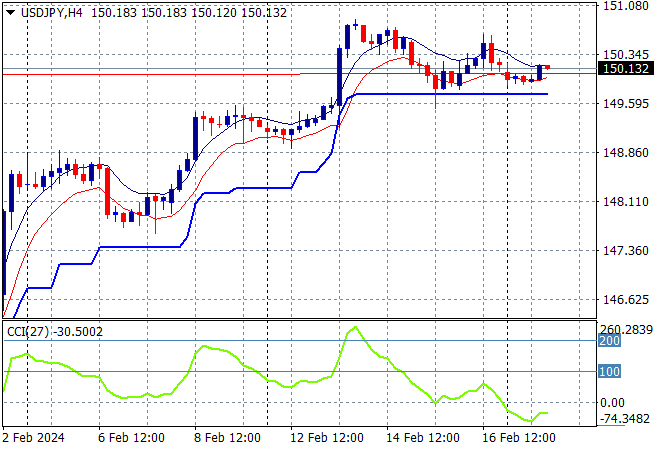

The USDJPY pair remains somewhat stable but almost retraced below the 150 handle after a minor late bounce last week, finishing this morning just above short term support.

This was looking very optimistic as Yen sells off due to BOJ meanderings with momentum now retracing to slightly negative settings in the short term, so I’m watching for any major pullback to the 150 level proper as part of a mid trend consolidation:

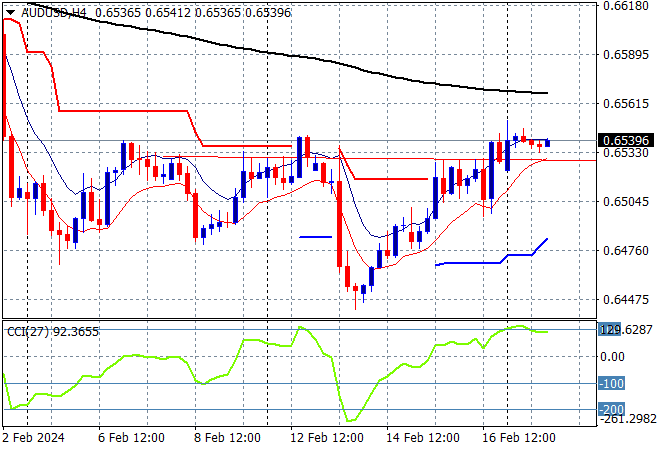

The Australian dollar is no longer experiencing its recent pressure cooker following the US inflation prints and some possible direction from the RBA, with today’s minutes release possibly providing another relief valve.

The Aussie has been under medium and long term pressure for sometime with the short term moves above the 65 level setting up for another breakout the mid 65 cent area:

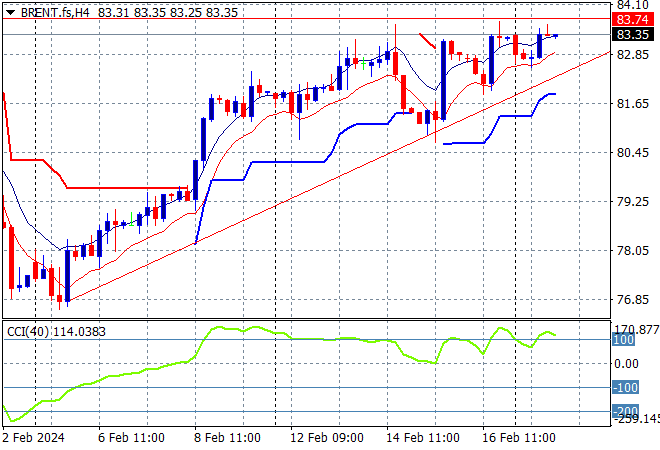

Oil markets continue to lift higher with Brent crude staying well above the $83USD per barrel level in quiet sessions overnight.

After retracing down to trailing ATR daily support at the $77 level, price is still above the weekly resistance levels that so far have held from the January false breakout with the short term target the late January highs above $84 still the next target:

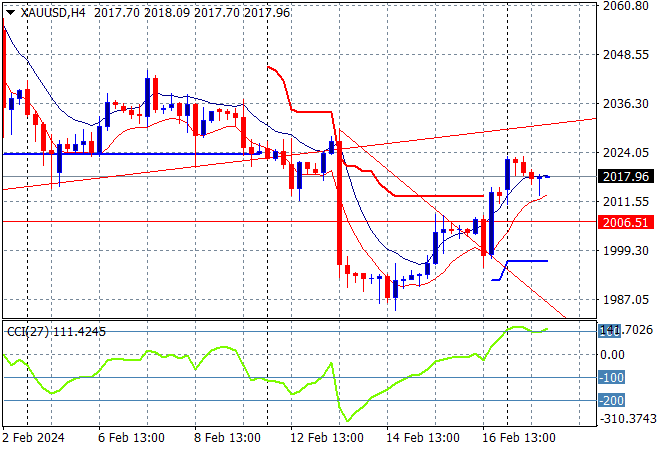

Gold is now trying very hard to get out of it depressed state following the US CPI print last week with its rebound on Friday night holding fast above the $2000USD per ounce level but still below recent levels of support.

Daily momentum is still well oversold with short term support at the $2000 level the critical area to watch with a further session highs and a bounce above short term ATR resistance required to get back on trend: