A drab start to the trading week across Asian stock markets mainly due to lower expectation of Chinese growth and interest rates while a slightly higher USD also didn’t help. Local stocks were the best in the region however with the Australian dollar pulling back below the 69 cent level amid other undollar weakness.

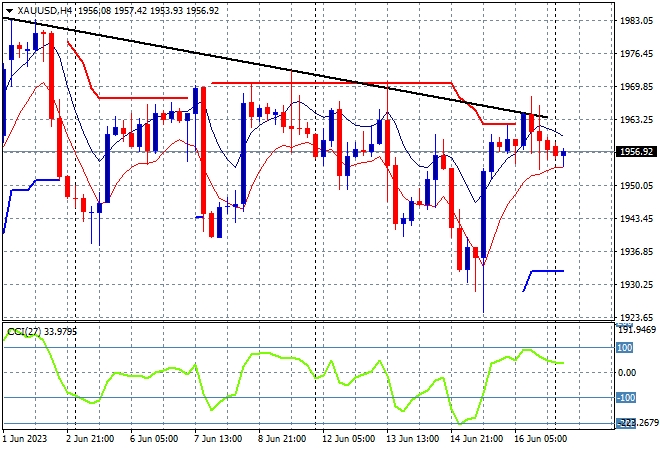

Oil prices are starting off flat with Brent crude holding just above the $75USD per barrel level while gold is struggling to make new highs as it pauses just above the $1950USD per ounce level:

Mainland Chinese share markets were down all session and remain off going into the close with the Shanghai Composite down some 0.6% to revert back to the mid 3200 point level while the Hang Seng Index sunk more than 1% lower to pull back below the 20000 point level at 19805 points.

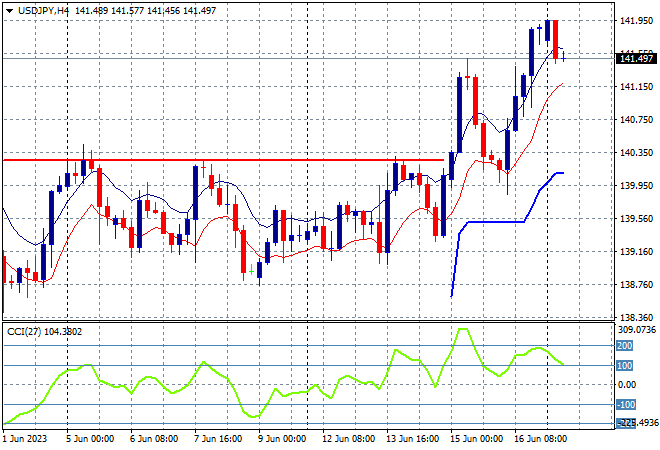

Japanese stock markets are also having another breather with the Nikkei 225 starting the week 1% lower to 33370 points with the USDJPY pair pulling back from its Friday night high to just above the 141 level:

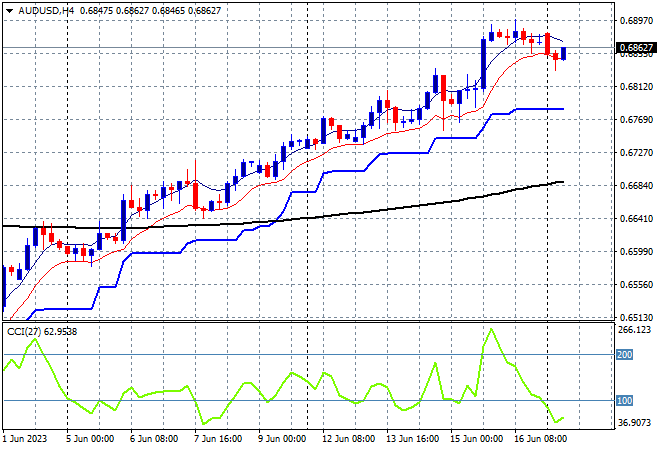

Australian stocks are the odd ones out with the ASX200 upbeat for a change, closing 0.6% higher at 7294 points. The Australian dollar was holding just below the 69 handle before the weekend gap but couldn’t hold it in this morning, almost falling back to the mid 68 level as short term momentum reverts sharply:

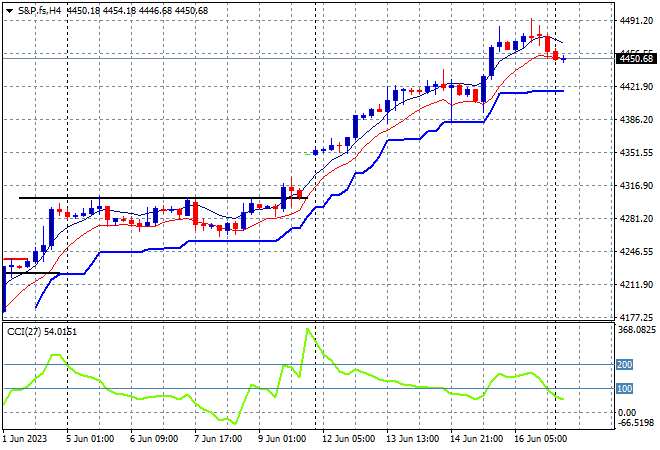

Eurostoxx and S&P futures are lower going into the London open with Wall Street looking to have a pause here despite the latest Fed pause on rate hikes amid the lower USD mood.

The S&P500 four hourly chart is showing a desire to get above the 4500 point level after bursting through resistance at the 4300 area last week:

The economic calendar starts the week quietly with some US housing data and a few central bank speeches but not much else.