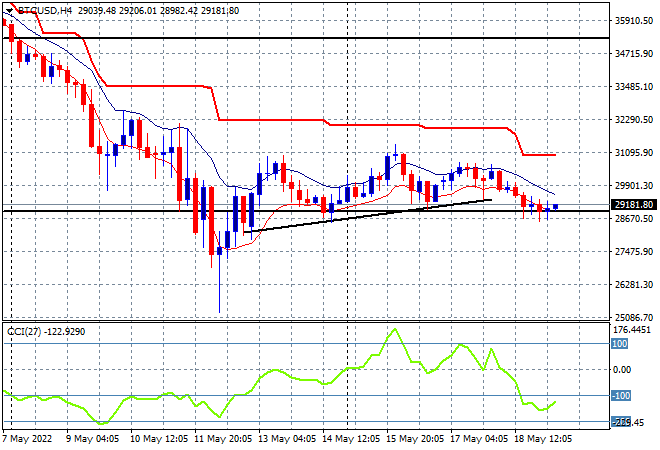

Asian share markets did relatively well all things considering after last night’s crash on Wall Street, with losses in the 1-2% range, but still looking very shaky as the recent bounceback in correlated risk markets is over before it started. Currency markets are seeing more ground lost to USD as the Australian dollar has slipped back below the 70 level on today’s unemployment print. Oil prices are trying to clawback the previous session losses with Brent crude now hovering just above $109USD per barrel while gold is struggling as it remains anchored at the $1800USD per ounce level. Meanwhile Bitcoin looks like rolling over again, barely hanging on just above the $29K level, ready to break below key monthly support again:

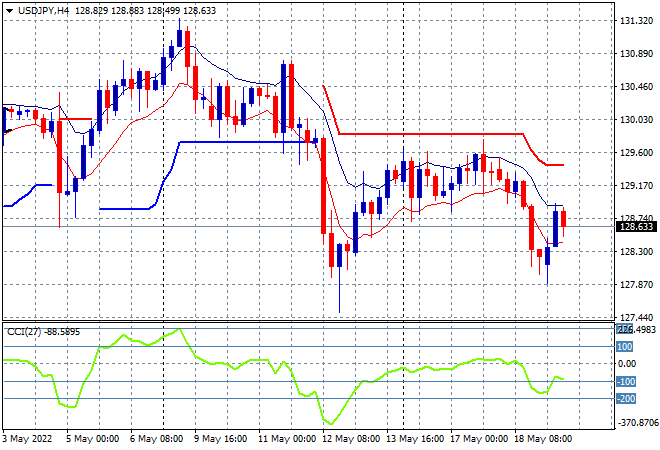

Mainland Chinese share markets are doing okay with the Shanghai Composite currently up 0.1% to 3082 points while the Hang Seng Index has gone down swiftly, losing more than 2% to be at 20168 points. Japanese stock markets are also on the downbeat, with the Nikkei 225 index closing nearly 2% lower at 26402 points while the USDJPY pair has put in a very mild bounce, currently just above the mid 128 level after its steep drop overnight on Yen defensive buying:

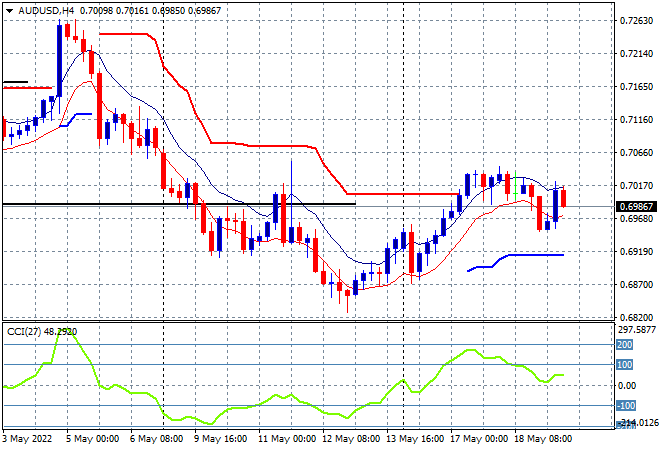

Australian stocks dropped but not as far as many expected, with the ASX200 finishing some 1.6% lower at 7064 points, keeping the 7000 point level intact for now. Meanwhile the Australian dollar has roundtripped following the numberwang print, retracing back below the 70 level and still unable to put in a new weekly high:

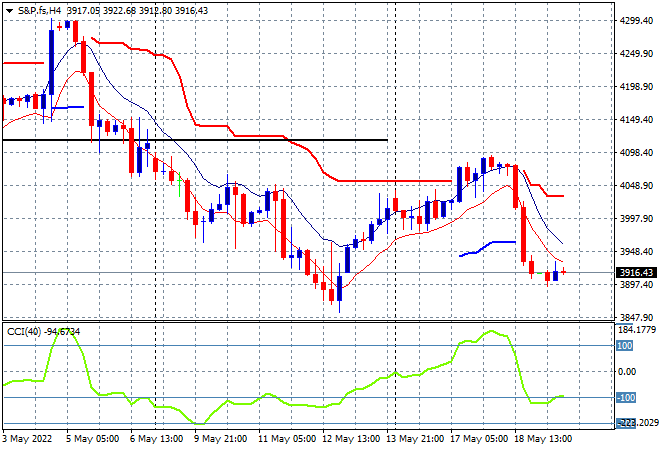

Eurostoxx and Wall Street futures are down about 0.7% as we head into the European open with the S&P500 four hourly chart showing price still anchored below the 4000 point level after last nights shemozzle of a walloping, wiping out all of this nascent bounceback on inflation concerns:

The economic calendar lightens up tonight, with US initial jobless claims the only big ticket item to watch.