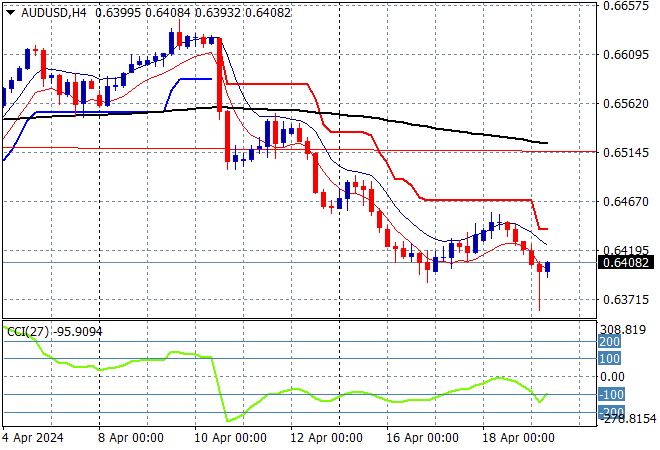

Asian stock markets are having a bad end to the trading week due to the Israeli/Iranian conflict across the Middle East, with a strong safe haven bid in USD pushing all of undollars down further. The Australian dollar was trying to rebound after its recent large reversal but failed as it was briefly pushed below the 64 cent level this afternoon in the risk off mood.

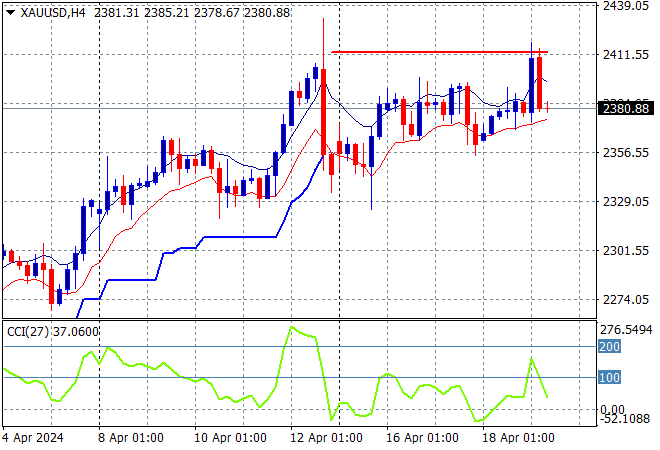

Oil prices are seeing much increased volatility, to be expected with Brent crude retracing sharply down to the $87USD per barrel level before recovering while gold is also having a wilder session today, touching the $2400USD per ounce level before stabillsing:

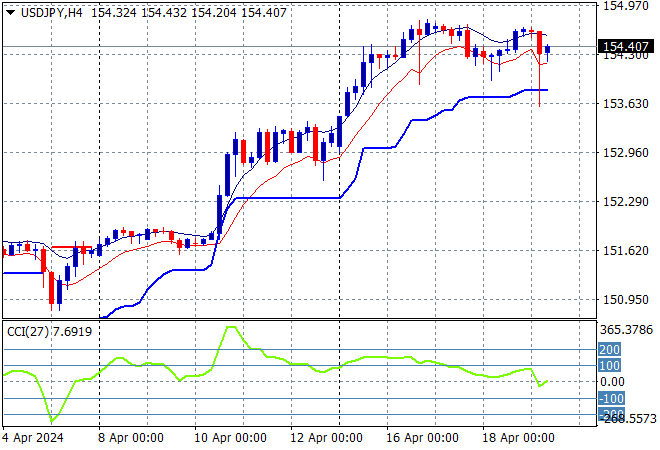

Mainland and offshore Chinese share markets are moving in the same direction again, this time down with the Shanghai Composite off by 0.3% going into the close while the Hang Seng Index has lost more than 1% to 16190 points. Japanese stock markets are seeing the worst results however with the Nikkei 225 slumping some 2.6% to finish at 37068 points with the USDJPY pair briefly pushed below the 154 level before stabilising this afternoon:

Australian stocks had a tough session with the ASX200 finishing nearly 1% lower at 7567 points while the Australian dollar is failing to get off the floor, briefly breaking below the 64 cent level on the safe haven bid in USD:

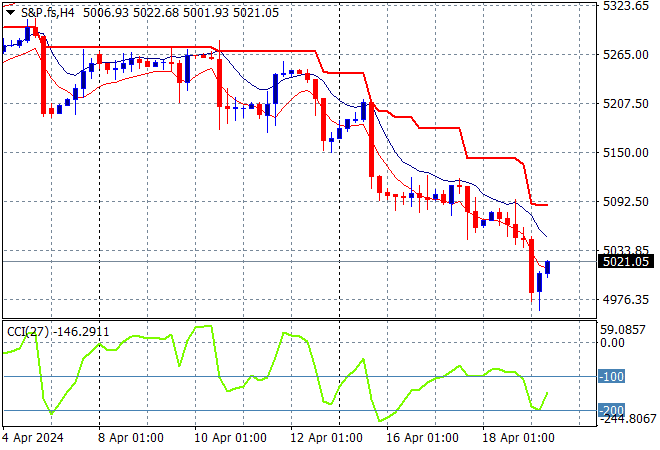

S&P and Eurostoxx futures were down sharply this afternoon but are trying to get back to normalcy as we head into the London session with the S&P500 four hourly chart showing price action still in a steep downtrend, trying to find a bottom here at the 5000 point zone:

The economic calendar finishes the week with a nearly empty schedule, with a few Fed/BOE speeches but nothing else.