Street Calls of the Week

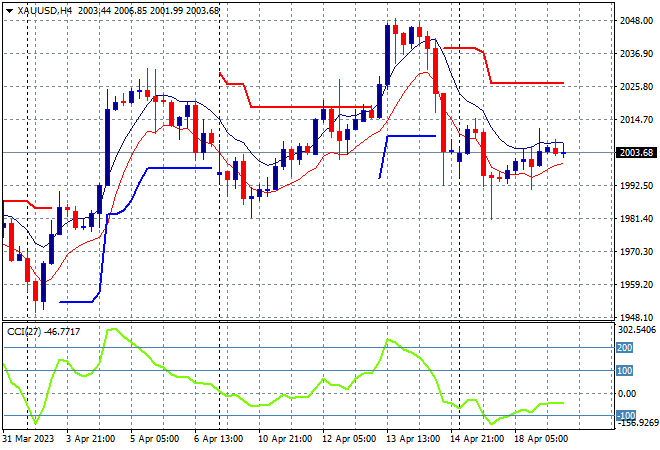

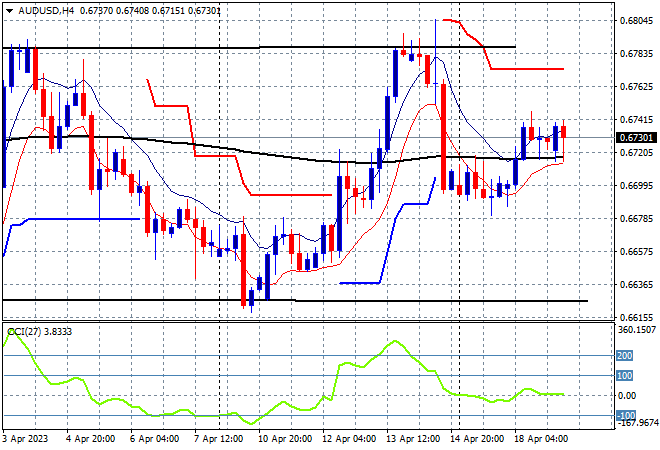

Asian stock markets are having quite a mixed session with a failure to put on any gains as sentiment around earnings surprises on Wall Street (hello Netflix!) overnight send a mixed signal to risk markets. US and European stock futures are down slightly as well with the Australian dollar an outlier as the recent RBA minutes continue to give it a boost above the 67 level. Oil prices are holding on after losing further ground overnight with Brent crude just above the $84USD per barrel level while gold is trying to fight back after its recent push below the $2000USD per ounce level after a failed breakout on Friday night:

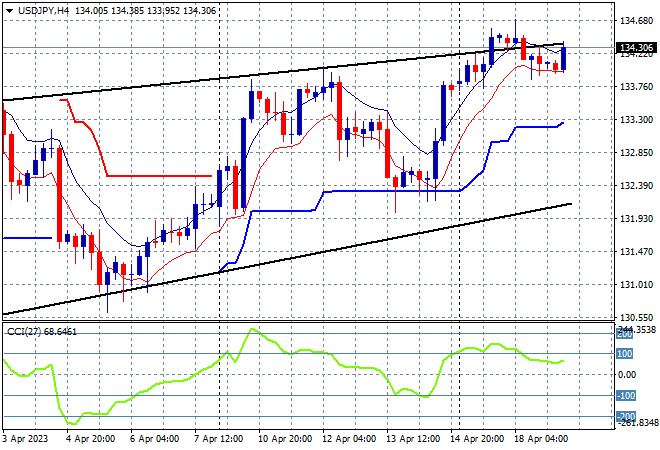

Mainland Chinese share markets are failing to gain traction as they head into the close, with the Shanghai Composite down over 0.3% to remain below the 3400 point barrier at 3386 points while the Hang Seng has pulled back even further, down another 0.5% at 20549 points. Japanese stock markets lost their new found confidence with the Nikkei 225 closing nearly 0.4% lower at 28553 points despite a much weaker Yen with the USDJPY pair holding on to a bounce above the 134 level:

Australian stocks are treading water with the ASX200 likely to finish dead flat and still below the 7400 point level at 7360 points. The Australian dollar has been unable to gain further on yesterday’s release of the RBA Minutes as speculation another rate rise is around the corner, but the Pacific Peso is still stuck just above the 67 handle:

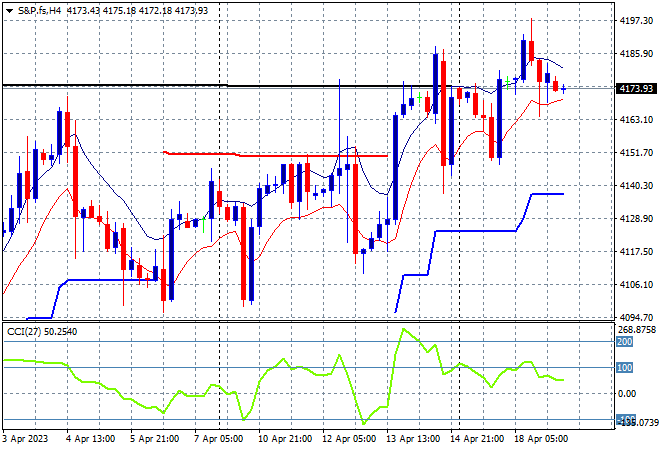

Eurostoxx and US futures are down about 0.2% or so with earnings surprises dominating risk sentiment as the S&P500 four hourly chart shows price action wanting to burst out above overhead resistance after clearing a point of control at the 4150 point level but still quite stuck. The next psychological level to clear is obviously 4200 points:

The economic calendar ramps up again tonight with both UK and EU core inflation prints.