As the US earning seasons gets underway, there’s been mixed results across equity markets particularly with a lot of closures here in Asia as the trading week stumbles into the open, while macro concerns in Europe over Ukrainian grain and energy prices amid the heatwave put a damper on European shares.

Currencies pulled back slightly from their one way trade against USD again following the softer than expected CPI and PPI prints but Euro is holding firm above the 1.12 handle while the Australian dollar was pushed back to the low 68 cent level.

US bond markets saw a slight retracement in yields with the 10 year back to 3.8%, while oil prices also pulled back after putting in a new monthly high with Brent crude falling below the $79USD per barrel level. Gold held on to its bounceback with a welcome consolidation below the $1960USD per ounce level.

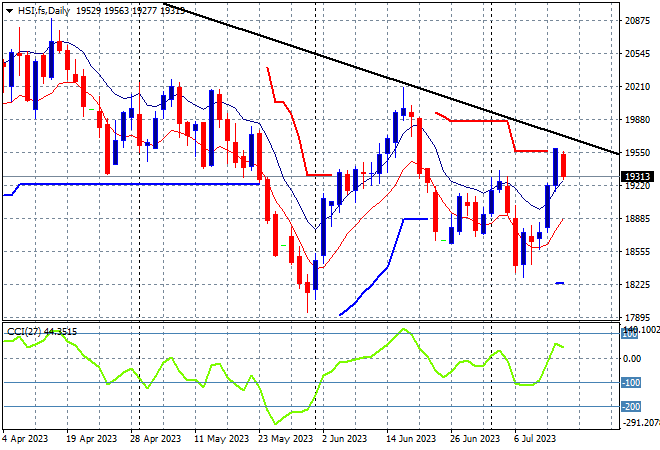

Looking at share markets in Asia from yesterday’s session with mainland Chinese share markets saw an immediate selloff in response to the GDP print with the Shanghai Composite finishing nearly 1% lower at 3202 points while in Hong Kong the Hang Seng Index was closed due to a typhoon.

The daily chart is still showing how the 19000 point level as a point of control below the dominant downtrend (sloping higher black line) but as confidence is trying to clawback here after almost touching the May lows we are coming to a possible breakout:

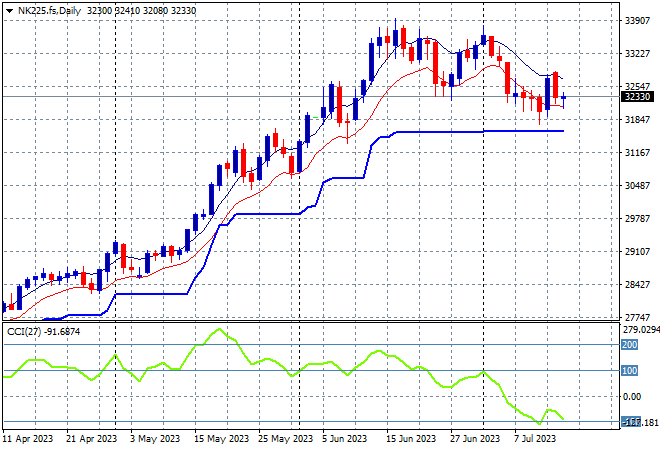

Japanese stock markets were closed due to a holiday with Nikkei 225 futures indicating a slight pullback when they reopen today.

Trailing ATR daily support has paused for sometime now as the market has been going sideways after a big lift recently, with a welcome consolidation above that level. Daily momentum has retraced from overbought to slightly negative settings with a further retracement back down to that support zone possible here this week as uncertainty builds:

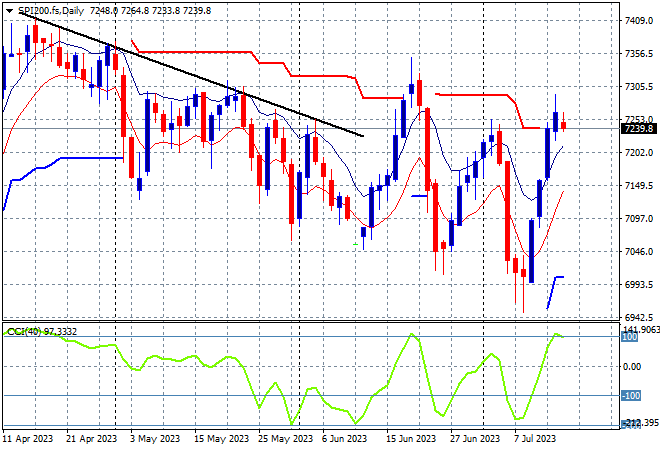

Australian stocks were able to struggle through the Chinese GDP print with the ASX200 closing 0.1% lower at 7298 points.

SPI futures however are indicating another pullback despite the lift on Wall Street overnight with the 7300 point level firming as short term resistance. Medium term price action remains on a downtrend with the daily chart just oscillating further down despite this continued bounce. Resistance overhead at the 7200 to 7300 point zone is the area to really watch:

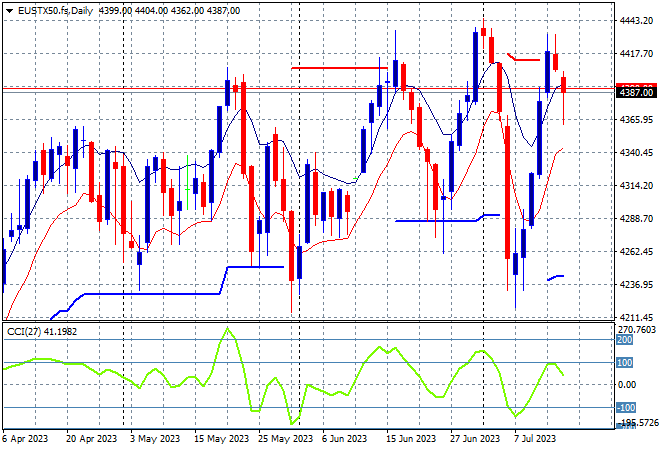

While European markets have been able to clawback most of their recent big losses they look like stalling again with the Eurostoxx 50 Index falling nearly 1% overnight to start the new trading week below the 4400 point level, closing at 4356 points..

The daily chart showed this potential bull trap building even though weekly support at 4200 points had been continually defended, with weekly resistance at the 4350 points level the actual area to beat. Support has been broadly defended at 4200 points, touched three times now in as many months but the 4400 point resistance level is now firming so watchout below:

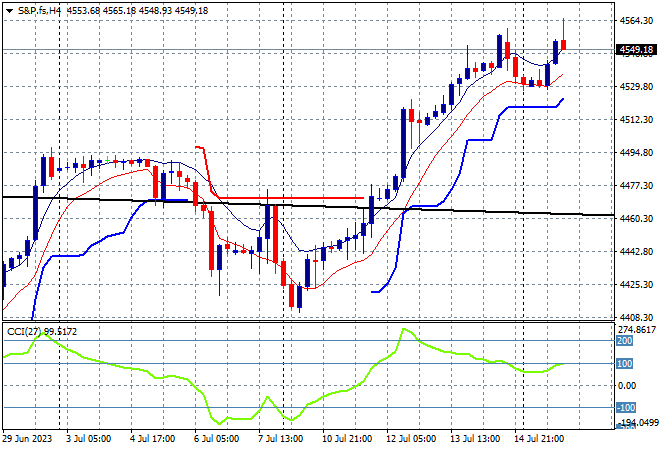

Wall Street however is having a better time of it with good earnings sending the NASDAQ up 0.9% while the S&P500 lifted 0.4% to finish at 4532 points.

The daily chart showed robust support around the 4400 point level after the market continued to stall against the monthly downtrend from the 2021 highs (upper sloping black line). Another test of the 4500 point level is now probable as uncertainty of the Fed’s direction is cleared up but there’s a lot of intrasession selling pointing in the last daily candles that are pointing to a retracement:

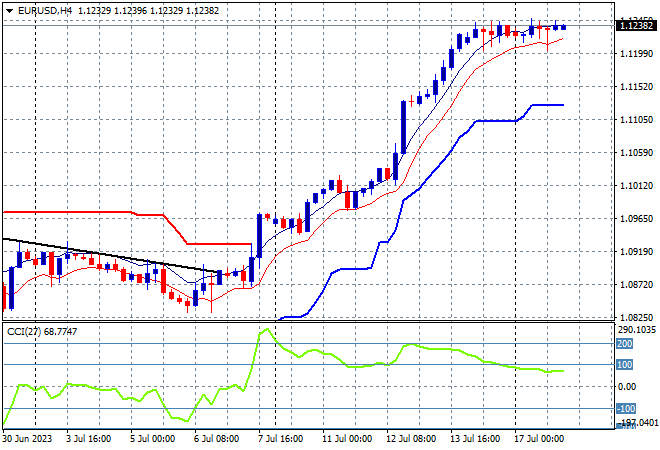

Currency markets are still in an anti-USD mood and without any catalysts overnight nothing much has changed as Euro holds fast just above the 1.12 handle.

The union currency had been on a weekly downtrend with a small bounce but that has now turned into a new monthly high as the 1.10 is tested and found supportive for further upside. This move takes out all of the recent downside action, with short term momentum retracing out of extreme overbought mode but price action not moving – usually a sign another explosive move higher?

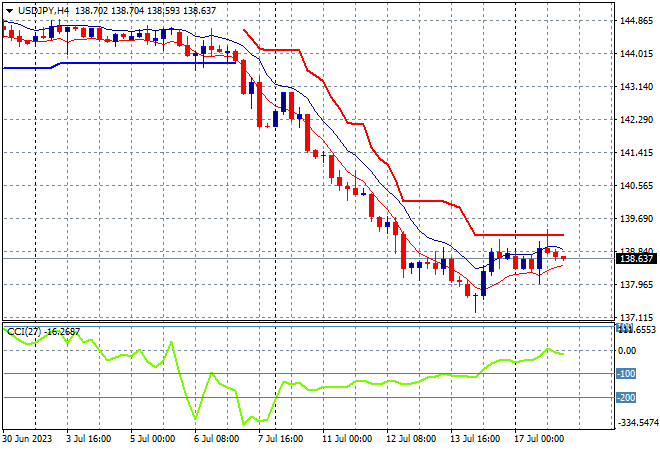

The USDJPY pair went nowhere as Japanese traders were on holiday with the last 24 hours being quite dull indeed as it hovers just below the 139 handle following an epic selloff last week.

Four hourly momentum was looking to get out of oversold mode with the return well below the June lows at the 140 level providing a possible support level and we’ve seen a small bounce here but short term ATR resistance at the 139 zone is not yet under threat:

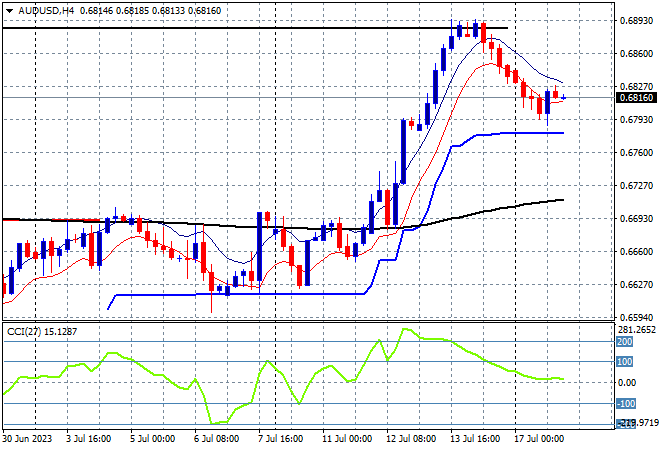

The Australian dollar is consolidating after failing to hold on to its June highs late last week, retracing to just above the 68 cent level overnight but looking steady as short term momentum remains positive.

Recent price action put ATR resistance and 200 EMA (black line) levels under threat but once the 67 handle was broken just before the CPI print this led the floodgates open, although short term momentum was overextended and the usual pullback has now transpired. Now we wait to see if the Pacific Peso can hold on or if it trends back to ATR support at the 68 handle proper:

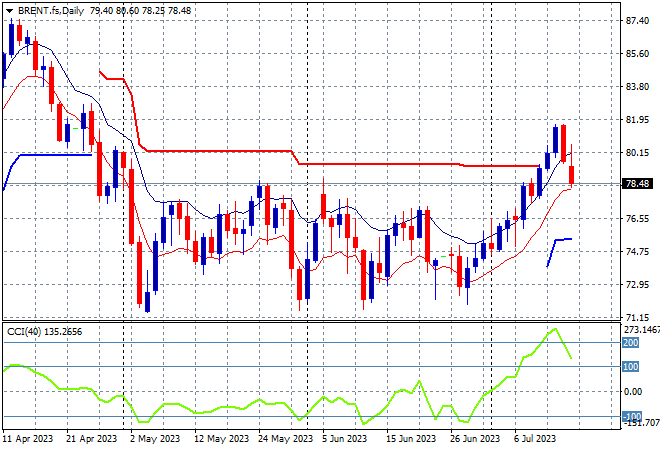

Oil markets are reverting to mean somewhat in the wake of macro factors in Europe with the slightly stronger USD not helping also as Brent crude pulled back below the $79USD per barrel level overnight in more profit taking.

Price had been anchored around the December levels – briefly dipping to the March lows – with the latest move matching the small blip higher in May and now trying to get above overhead resistance at the $80 level. Daily momentum has picked up strongly into overbought readings with price action now clearing the last couple months of resistance but there’s an obvious overshoot happening here to bring it back:

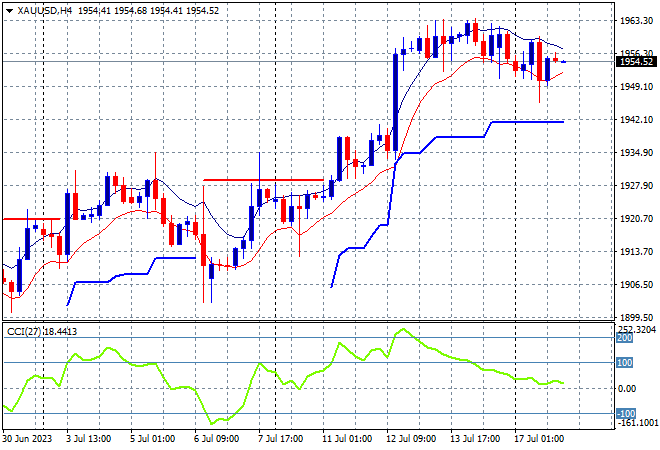

Gold had been helped along by the weaker USD all last week after recently threatening to rollover through the $1900USD per ounce level, but is continuing its consolidation at just below the $1960 level as momentum stalls here.

The four hourly chart shows a new attempt at getting back up to the psychologically important $2000USD per ounce level, with the potential to return to short term ATR support on any blip higher in USD strength as momentum moderates: