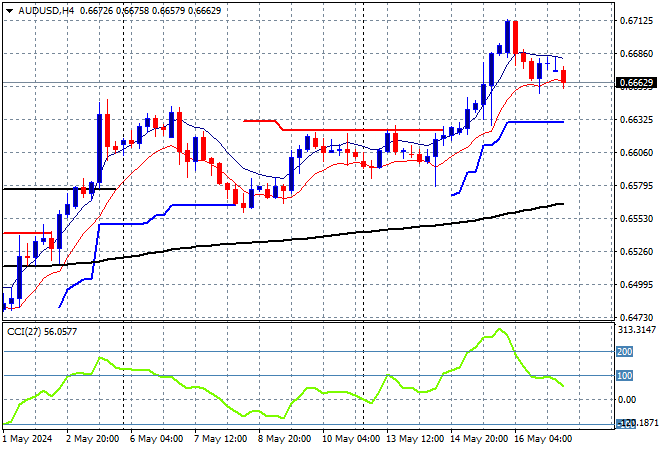

A mixed reaction to the slip on Wall Street overnight across Asian stock markets with local stocks losing their risk on mood the most, while Chinese shares are sanguine after the latest fixed asset investment numbers were released. The USD is still coming back against the majors, particularly against Yen while the Australian dollar is struggling to hold just above the mid 66 cent level.

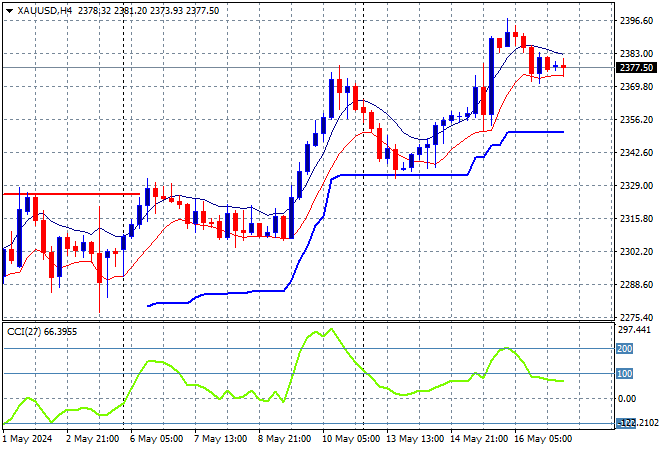

Oil prices are finding a little bit more upside momentum after their recent sharp falls with Brent crude still above the $83USD per barrel level while gold is holding here after a small retracement to sit just below the $2380USD per ounce level this afternoon:

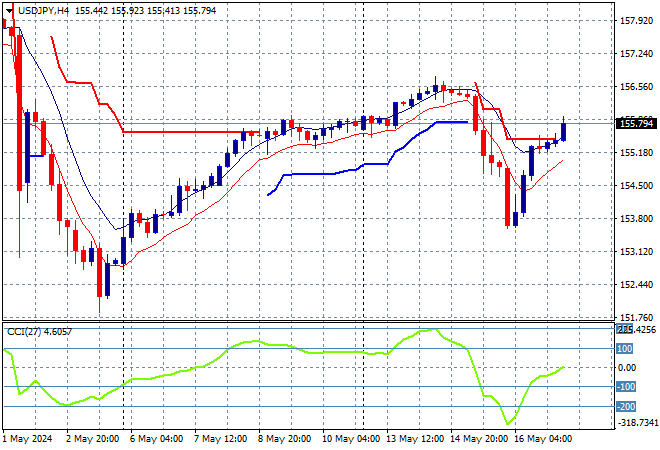

Mainland Chinese share markets were doing well at first but are again sliding back going into the close with the Shanghai Composite down 0.2% while the Hang Seng Index is up about the same amount to 19433 points. Meanwhile Japanese stock markets however are falling a bit faster with the Nikkei 225 down 0.4% to 38775 points with the USDJPY pair recovering nicely from its recent reversal as it pushes well above the 155 level:

Australian stocks are the worst performers across the region with the ASX200 down over 0.7% to 7825 points while the Australian dollar remains well below the 67 cent level:

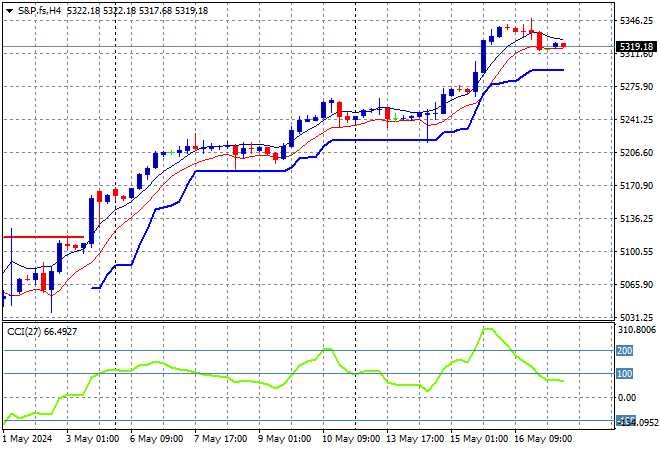

S&P and Eurostoxx futures are not looking healthy as we head into the London session with the S&P500 four hourly chart showing price action still holding above the 5300 point level:

The economic calendar ends the trading week with some Canadian inflation measures and a few Fed member speeches.