Asian stock markets are in full risk on mood following the huge selloffs in Chinese shares at the start of the week, now responding favourably to the first rate hike from the Federal Reserve meeting overnight. The USD is still going strong against Yen but the Aussie dollar is pushing higher after the latest domestic unemployment print, pushing up through the 73 handle. Meanwhile oil prices are somewhat contained with Brent crude still just below the $100USD per barrel level as gold is trying to find a bottom here after rallying post the Fed rate hike, currently at $1935USD per ounce:

Mainland Chinese shares continued their sharp bounceback with the Shanghai Composite currently up more than 2% to 3235 points while the Hang Seng Index is putting in another very strong day, up nearly 6% as it advances past the key 20000 point barrier, currently at 21298 points. Japanese stock markets have advanced fast as well with the Nikkei 225 closing 3.6% higher at 26631 points with the USDJPY pair still on track albeit on a much more sustainable trajectory here as it continues well above the 118 handle:

Australian stocks did well, again overshadowed by the Chinese rallies with the ASX200 finishing 1% higher to get back above the 7200 point level, closing at 7250 points. Meanwhile the Australian dollar lifted through the 73 handle after the unemployment print and is pausing here before the London session for a try at last week’s high:

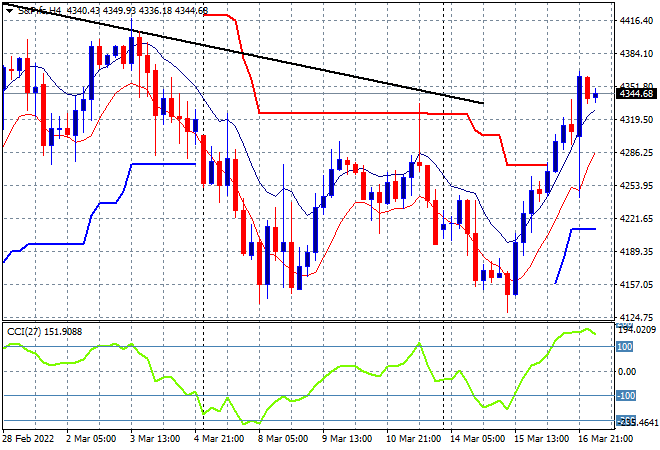

Eurostoxx and Wall Street futures are up more than 0.5% as they double down on the bounceback in risk sentiment and pullback in oil prices. The S&P500 four hourly chart shows price ready to tackle the next layer of strong resistance at the 4400 point level that hasn’t been breached for several weeks, but short term momentum is quite strong for now:

The economic calendar follows up the FOMC interest rate hike with the BOE meeting tonight, then US initial jobless claims.