Risk markets started the trading week in mixed fashion with Japanese stocks under the pump at the domestic bond market nearly implodes while Wall Street had a holiday overnight leaving most of the risk complex listless although European shares put in small gains. The USD was largely unchanged except against Yen with a rebound after last weeks dramatic decline while the Australian dollar fell back below 70 cent level. US bond markets were closed while the commodity complex saw thin trade as well with Brent crude hovering around the $85USD per barrel level. The shiny undollar gold also moderated after its too far and too fast rally, consolidating around the $1900USD per ounce level.

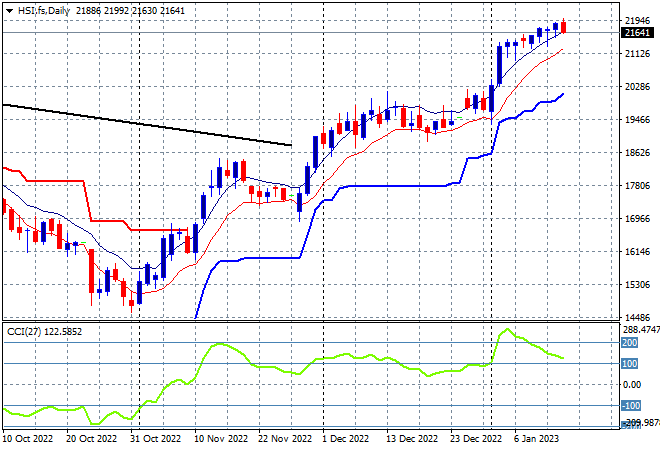

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets moved sharply higher with the Shanghai Composite closing up more than 1% to push well above the 3200 point level, finishing at 3227 points while the Hang Seng Index tried to play catchup but ended up with a scratch session to close at 21746 points. The daily chart continues to look quite boisterous here with a series of step ups since the nadir in October last year as daily momentum begins to moderate out of its recent extreme overbought mode:

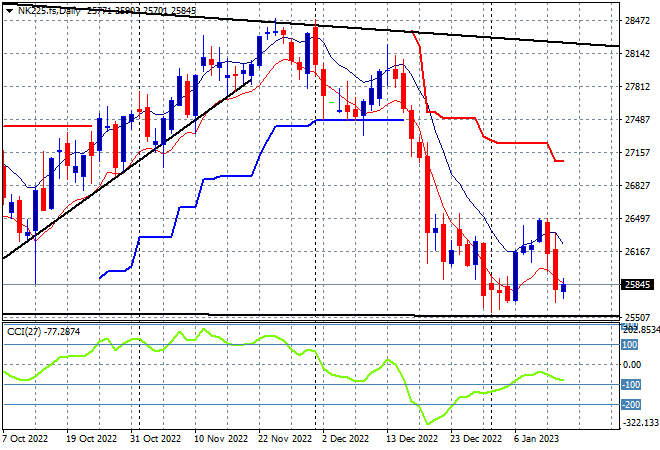

Japanese stock markets pulled back sharply as the BOJ tried to shore up the bond market troubles amid a much stronger Yen with the Nikkei 225 closing 1.1% lower at 25822 points. There was the potential for a swing long trade to develop further here after bottoming out at the 25000 point level but it failed after only one close above the high moving average with a return to the recent lows on the stronger Yen trade. Daily momentum never went positive with futures indicating another stalled open today:

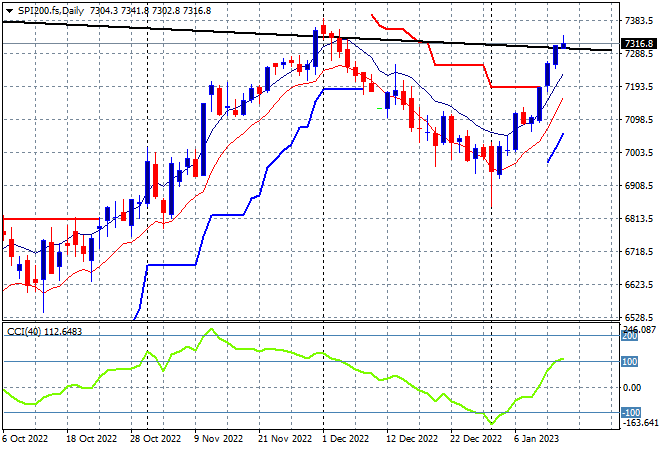

Australian stocks were able to hold on to solid gains with the ASX200 closing up nearly 0.9% higher to 7388 points. SPI futures are down nearly 0.3% due to the lack of a lead from a closed Wall Street overnight. The daily chart had been showing price action and daily momentum in a decline since the start of December with a breakout building here above the 7300 point level, with overhead ATR trailing resistance and the 7200 point level now pushed aside with the potential to exceed the November highs next:

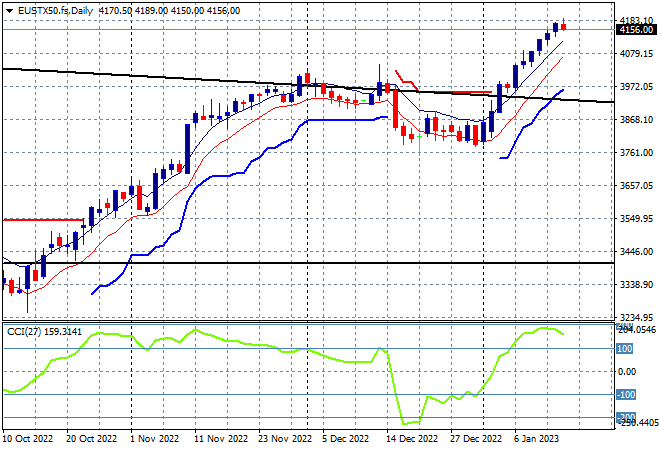

European markets remained on track with modest gains across the continent to start the trading week on a good note, despite a stubbornly high Euro as the Eurostoxx 50 Index closed 0.2% higher at 4157 points. This extends the trend well above the 4000 point level as the daily chart showed key overhead resistance at the 3900 point area under contention before the NFP print with daily momentum building up from a swing trade into a proper breakout. The 4000 point level is the key psychological resistance level that could be turned into support going forward:

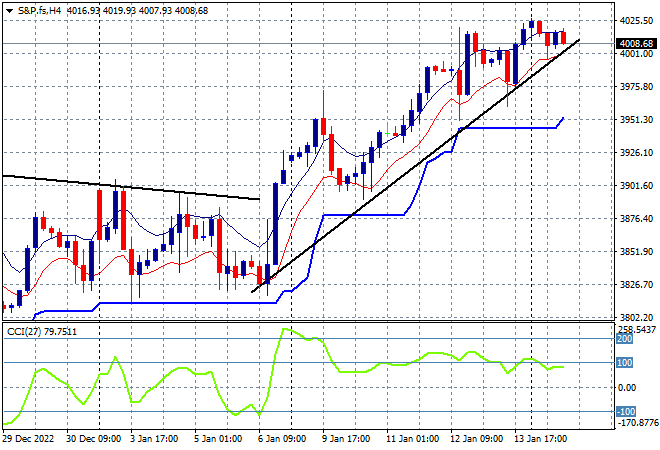

Wall Street was closed for a holiday with futures indicating the S&P500 will likely reopen slightly higher tonight to remain around the 4000 point level. After breaking the series of lower daily highs since Xmas, price action is pushing further above the dominant medium term trendline after hovering around weekly support at the 3800 point level, and its now punching through the December highs. The inability to decisively push through the 4000 point barrier after the inflation print is a bit telling however:

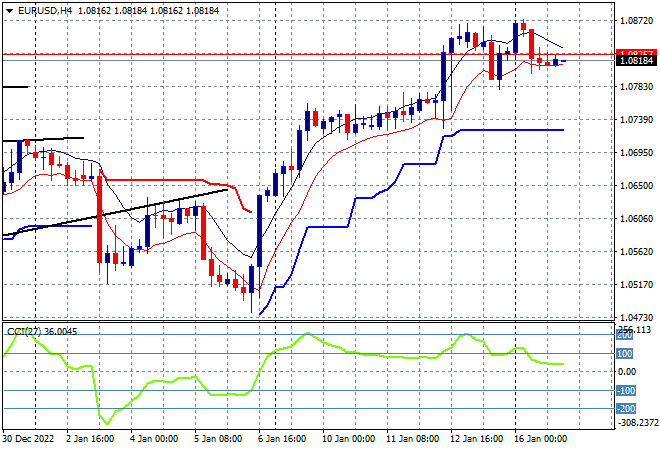

Currency markets remain basically in a holding pattern post the US inflation print with the USD slightly getting stronger overnight in the absence of US traders at their desks as the King is not yet dead against the majors. Euro continues to find more resistance to the upside here at the 1.09 handle. While price action is still well above the recent weekly highs and short term momentum remains somewhat overbought, there is little upside potential here if resistance cannot be cleared decisively:

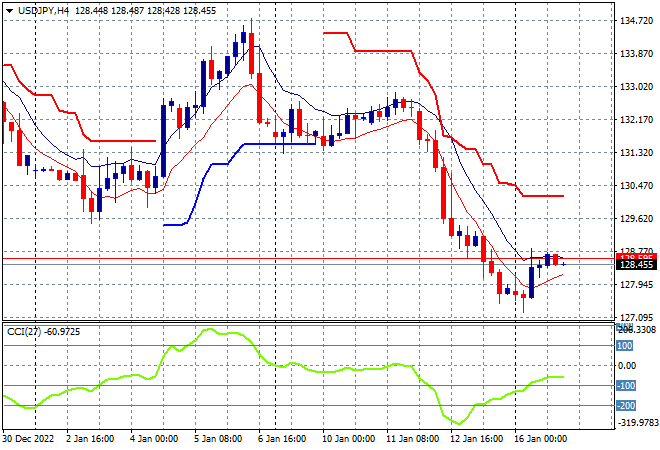

The USDJPY pair is fighting back a little more however after a big Yen safe haven trade in isolation to other USD macro concerns, as last week’s breakdown finally found a bottom around the 127 handle as the local bond market problems remain delicate. This small overnight move higher keeps the pair below the start of year position and could still be setting up for more downside below if it doesn’t translate into a proper swing rally soon:

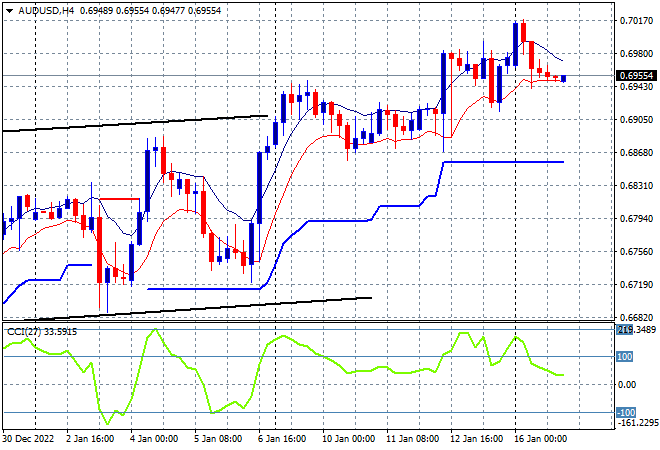

The Australian dollar was again unable to extend its own recent gains, managing to stay above the 69 level but retracing from a temporary move above the 70 cent level on Friday night. The recent surge back above the 68 handle had found resistance again just below the 69 level but cast that aside, pushing price action well above the broad weekly uptrend channel limits, which could now accelerate into a new trend if the recent highs are breached:

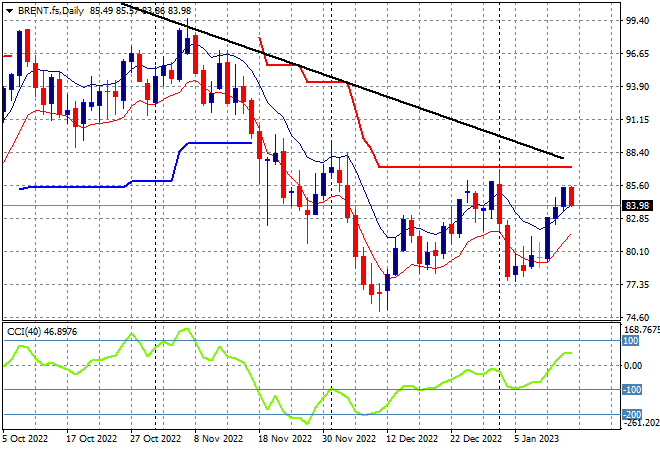

Oil markets remain under pressure as energy prices falter in a warm northern hemisphere but this recent snap rally is not yet translating into a breakout with thin trade seeing Brent crude slide back below the $85USD per barrel level. After hovering around the December lows last week, price action wants to get moving as daily momentum returns to positive settings but the overall trend shows price still below overhead ATR resistance and the dominant downtrend remains in play:

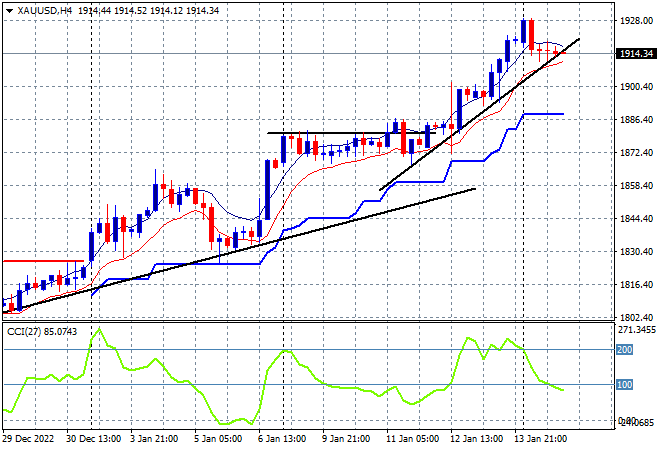

Gold moderated as well after accelerating too fast above the $1900USD per ounce level on Friday night, easing off the throttle only a little to finish at $1914 overnight. Trailing ATR support keeps ratcheting higher – in fact too fast as daily momentum remains in overextended territory. This market is ripe for a pullback and some selling to start the week is likely on the cards, at least to take some heat out of price action: