Street Calls of the Week

Asian share markets are trading lower following another weekend of macro events and renewed focus on the Middle East with more safe haven buying in USD. The Kiwi was the biggest performer due to the election while the Australian dollar tried to get out of its funk but is still very weak at the 63 cent level..

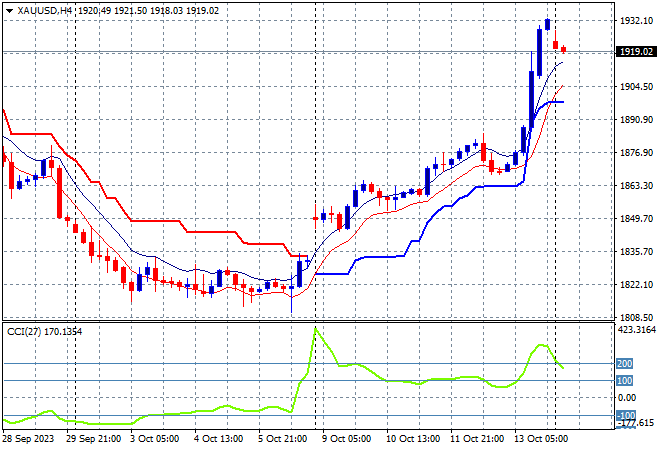

Oil prices are holding on to their Friday breakout gains, with Brent crude consolidating above the $90USD per barrel level while gold gave back a tiny amount of its outsized gains, currently trading just above the $1915USD per ounce level at a new monthly high:

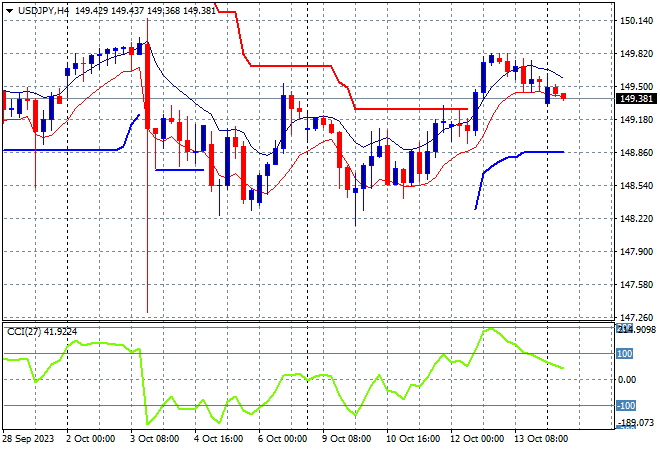

Mainland Chinese share markets have dropped somewhat with the Shanghai Composite down 0.5% going into the close at 3072 points while in Hong Kong the Hang Seng Index is in a similar boat, off by 0.6% to 17710 points. Japanese stock markets were the worst of the bunch with the Nikkei 225 closing nearly 2% lower at 31673 points. Trading in the USDJPY was somewhat muted with a small gap lower over the weekend, but still holding above the 149 level:

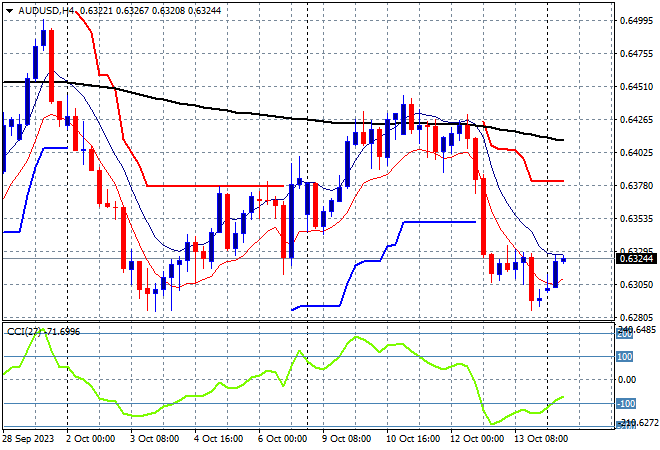

Australian stocks were the best in the region, relatively speaking with the ASX200 closing just 0.3% lower at 7026 points while the Australian dollar was able to gap slightly higher to return to the Friday night session starting point just above the 63 cent level, but with heavy resistance overhead:

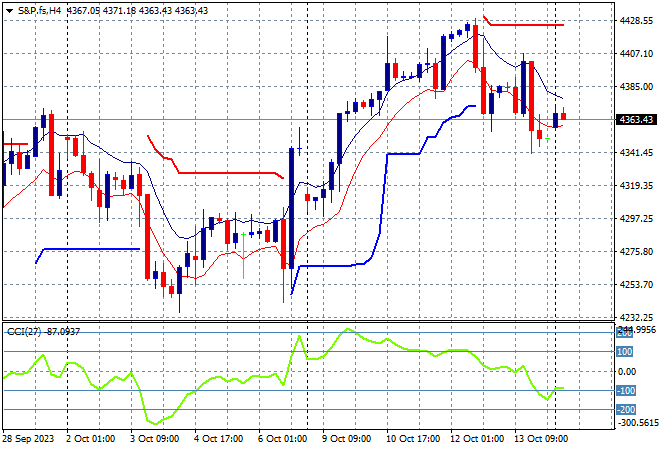

S&P and Eurostoxx futures are holding on to their gains as the S&P500 four hourly chart shows consolidation above the previous weekly high at the 4370 point level, keeping well above the Friday night close but losing some short term momentum:

The economic calendar is dominated by speeches from central bankers, including BOE, the ECB and the FED. But not much else..