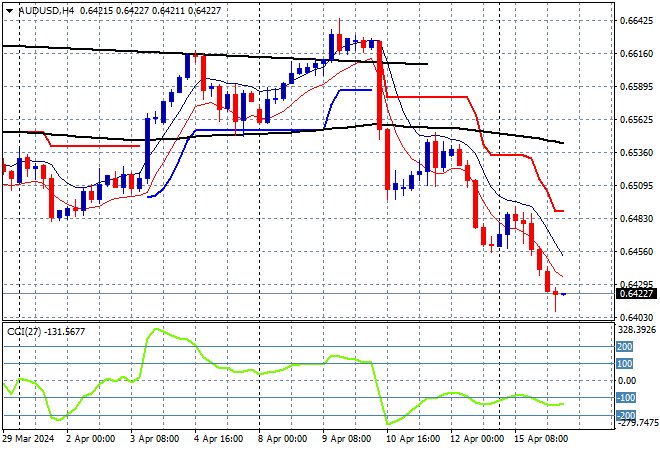

The rocky start to the trading week is deepening with stock markets in Asia losing significant ground in response to the escalation in conflict across the Middle East, with a further spike in USD and bond yields. The latest Chinese GDP print did little to assuage risk sentiment either. The Australian dollar is trying to rebound after its 100 pips plus reversal as it retraces back to just below the 65 cent level this afternoon.

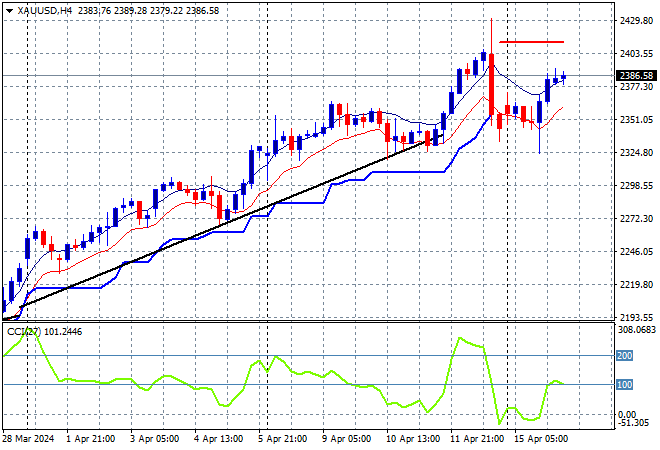

Oil prices are just holding on following the weekend of attacks across the Middle East with Brent crude still well above previous weekly resistance and the $90USD per barrel level while gold is fighting back after its own relatively minor selloff on Friday night, currently at the $2380USD per ounce level:

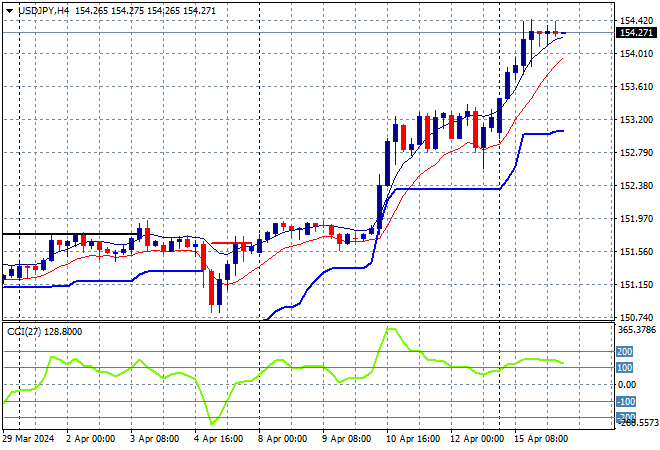

Mainland and offshore Chinese share markets are both falling with the Shanghai Composite down more than 1% while the Hang Seng Index is off by at least 1.9% to 16279 points. Japanese stock markets are leading the selloff however with the Nikkei 225 down more than 2% at 38375 points with the USDJPY pair breaking out on USD strength above the 154 level:

Australian stocks couldn’t escape the carnage with the ASX200 down more than 1.8% going into the close at 7611 points while the Australian dollar is failing to lift itself off the floor after the Friday night rapid selloff, about to cross below the 64 cent level:

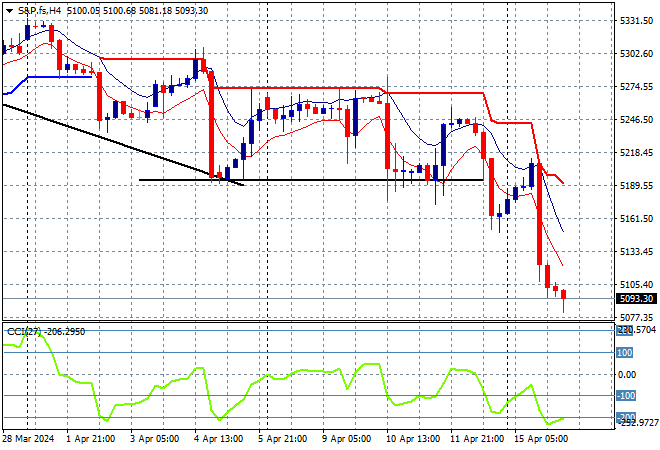

S&P and Eurostoxx futures are also failing to fight back from their selloff on Friday night as we head into the London session with the S&P500 four hourly chart showing price action still in a steep downtrend through a series of steps as it fails to recover from short term resistance:

The economic calendar ramps up with UK unemployment and the closely watched German ZEW survey tonight.