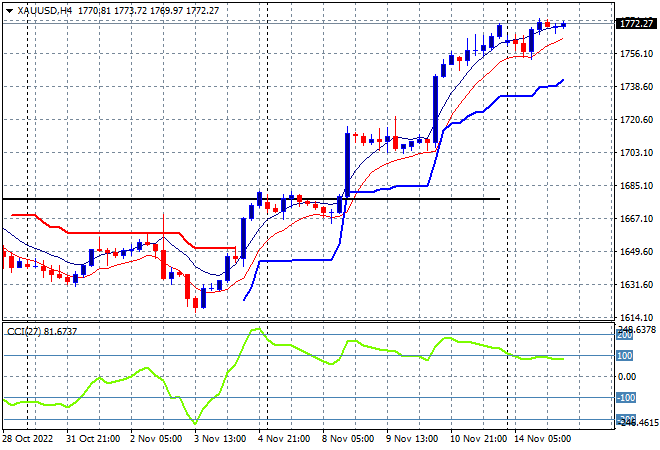

Another mixed session on Asian stock markets with Chinese markets zooming higher while the rest of the region takes a pause despite lower returns on Wall Street overnight. The USD remains weak but unchanged against most of the undollars through today’s session, similar to overnight volatility with Euro still holding above to the 1.03 level while the Australian dollar moved above the 67 cent level. Oil prices are still looking weak however with Brent crude retracing below the $93USD per barrel level while gold is surprisingly still holding on to its recent big surge, currently at the $1770USD per ounce level:

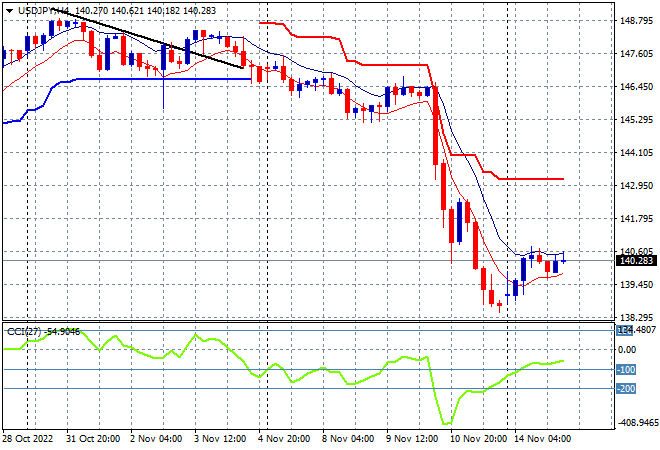

Mainland Chinese share markets are picking up going into the close with the Shanghai Composite looking to finish more than 1.3% higher, breaking through 3100 points while the Hang Seng Index is still surging, currently up more than 4% at 18334 points. Japanese stock markets were able to finally finish in the green, with the Nikkei 225 closing 0.2% higher at 28012 points, while the USDJPY pair has remained steady without moving anywhere during today’s session, holding just above the 140 handle:

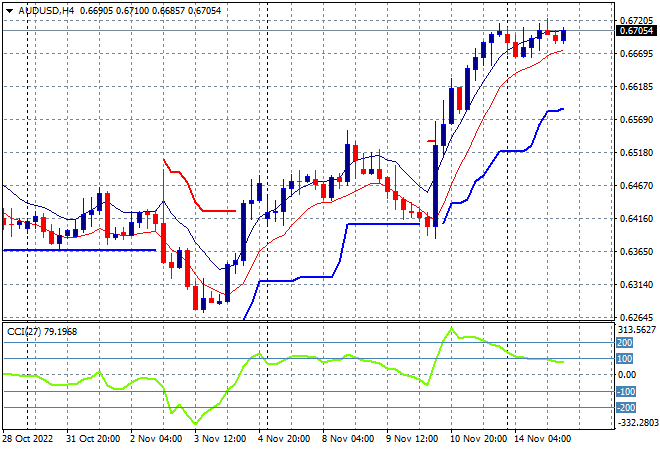

Australian stocks were again in scratch territory today with the ASX200 closing dead flat at 7141 points. The Australian dollar is treading water although its slowly getting back above the 67 handle, consolidating here after getting ahead of itself on Friday night with the four hourly chart showing resistance that needs to be cleared soon:

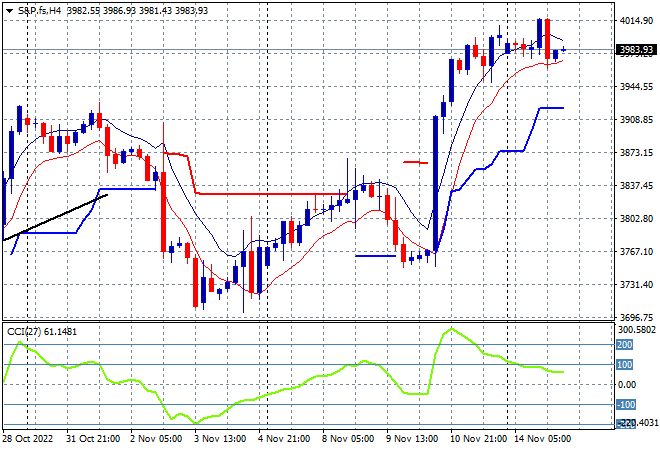

Eurostoxx and US futures are holding on with the former retracing slightly in response to the falls on Wall Street overnight, with the S&P500 four hourly chart showing price action still contained just below the 4000 point level:

The economic calendar is pretty packed tonight with UK unemployment, German ZEW survey and the latest US PPI print.