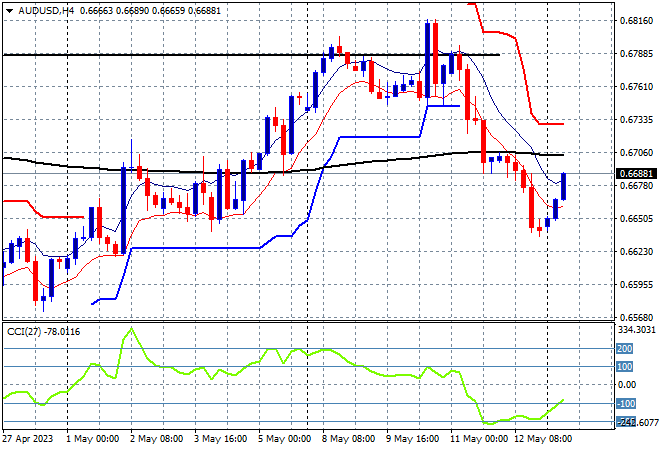

A generally positive start to the new trading week for Asian stock markets with green across the board, albeit in small numbers as traders await continued negotiations over the ridiculous US debt ceiling shenanigans. Meanwhile currency markets are still being dominated by a run to safety to USD although the Australian dollar has put in a fightback to try to get back above the 67 cent level.

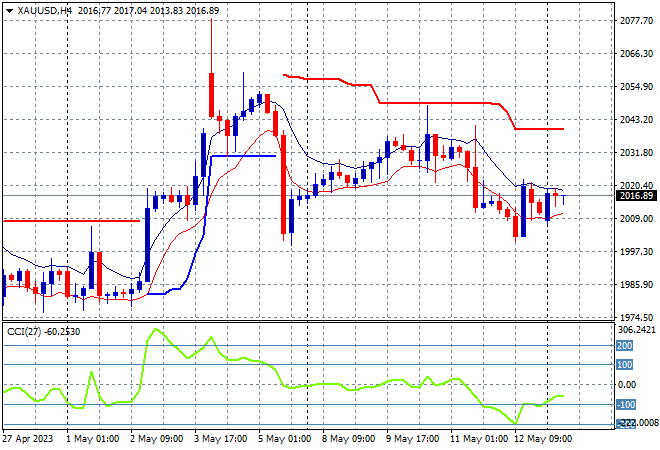

Oil prices remain depressed after losing further ground on Friday night with Brent crude pushing slightly below the $74USD per barrel level while gold is holding on after strong resistance from the USD, still floating along at the $2016USD per ounce level.

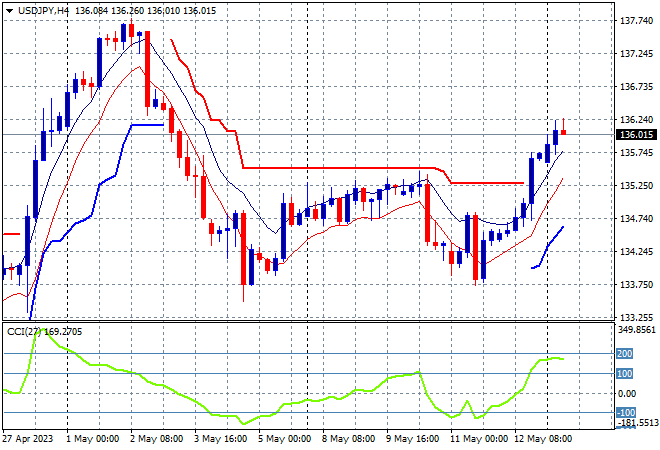

Mainland Chinese share markets are rebounding going into the close after a reversal on the open, with the Shanghai Composite up nearly 0.9% at 33– points while the Hang Seng has zoomed nearly 2% higher to just get above the 20000 point level. Japanese stock markets are also doing well, with the Nikkei 225 lifting nearly 1% higher at 29626 points with the USDJPY pair again lifting.

Australian stocks were hesitant once again as local traders failed to find any direction but the ASX200 still managed to close nearly 0.2% higher at 7267 points. The Australian dollar has rebounded after its Friday night selloff but is still holding on to new weekly lows here at just below the 67 cent level vs USD.

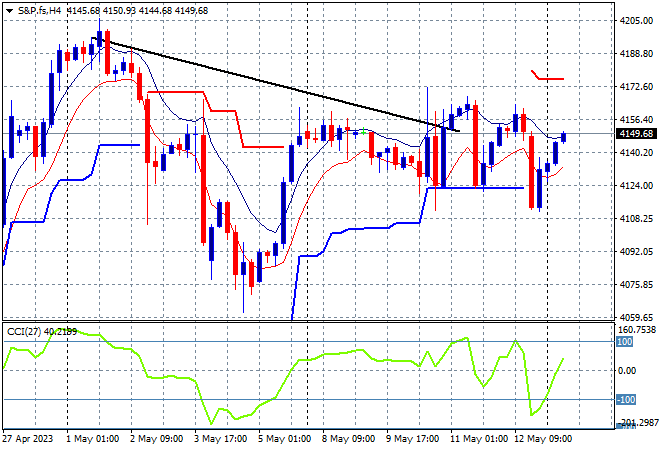

Eurostoxx and S&P futures are moving slightly higher despite debt concerns on both sides of the Atlantic with the S&P500 four hourly chart still showing price action trying to hold on around the 4100 point area.

The economic calendar starts the week with Euro-wide industrial production, and about five Federal Reserve official speeches to keep an ear to the ground.