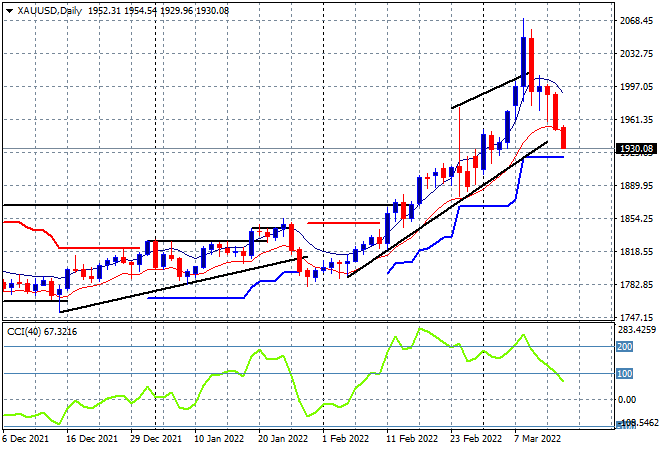

Asian stocks are selling wide selloffs due to a huge spike in Chinese COVID cases, with only Japanese shares lifting as European futures indicate another pullback on the open. The USD remains strong against everything undollar, particularly Yen but also the Australian dollar as commodities selloff sharply. Oil has retraced again with WTI under $100USD per barrel while Brent slips to just above that level, while gold is being pushed even further below the $2000USD per ounce level, currently at $1930 as other metals take a dive:

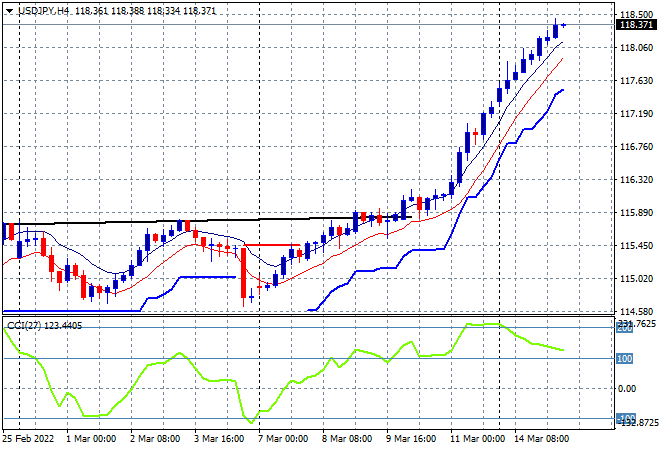

Mainland Chinese shares are selling off with the Shanghai Composite currently down more than 2% to 3133 points while the Hang Seng Index is backtracking, down over 3% as it crashes well below the key 20000 point barrier, now at 18899 points. Japanese stock markets however are the odd ones out, helped by a much lower Yen as the Nikkei 225 is looking to close around 0.3% higher at 25372 points with the USDJPY pair continuing its epic breakout albeit slightly slower as it heads above the 118 handle in a very over-extended move:

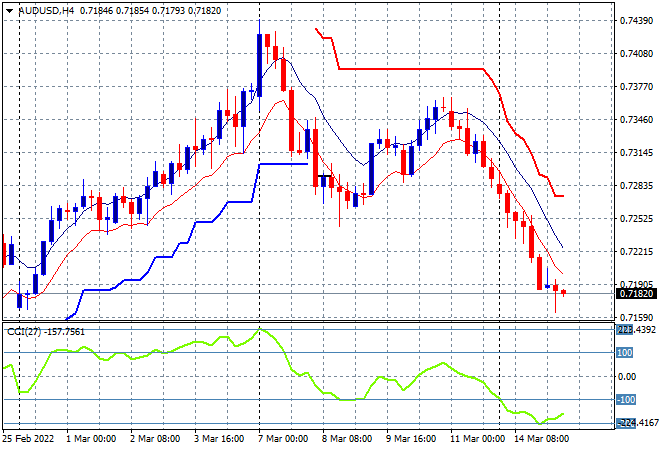

Australian stocks are selling off mainly due to commodity weakness with the ASX200 finishing 0.7% lower to retrace again below the 7100 point level, closing at 7097 points. Meanwhile the Australian dollar is finally slowing down after its rout but remains well below the 72 handle as the commodity selloff gathers pace:

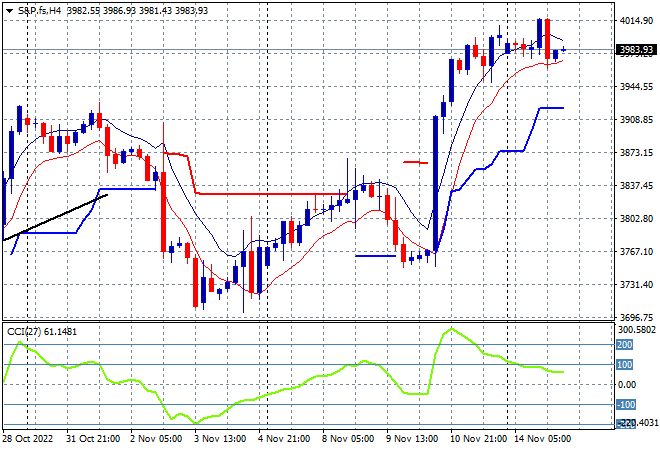

Eurostoxx and Wall Street futures are down at least 0.5% or more across the board as the S&P500 four hourly chart still shows considerable overhead resistance that just can’t be cleared with short and medium momentum quite negative as price pulls back to recent weekly lows:

The economic calendar ramps up tonight with UK unemployment, the latest German ZEW sentiment survey then the US monthly PPI print.