Asian stock markets are putting in mostly positive finishes to the end of the trading week in reaction to softer than expected producer and consumer inflation prints in the US which is sending King Dollar down against everything, lifting risk markets in the process.

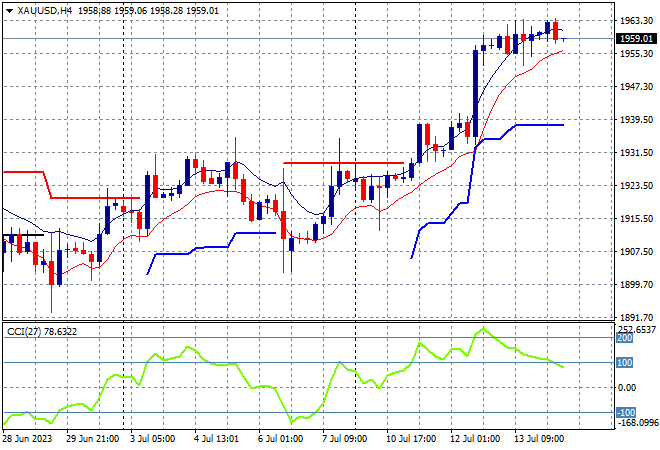

Oil prices are pausing after a big run this week with Brent crude holding above the $80USD per barrel level while gold is also finding a bit more life here, steadying at the $1960USD per ounce level:

Mainland Chinese share markets are in hesitation mode in the final session with the Shanghai Composite about to finish just 0.2% higher at 3241 points while in Hong Kong the Hang Seng Index is also dragging along, up only 0.3% to 19417 points, but capping off a great week.

Japanese stock markets were flat across the board, with the Nikkei 225 closing just 0.1% higher at 32449 points. The USDJPY pair is still sliding down after an epic selloff this week with a fall below the 138 level – now off nearly 700 pips in less then two weeks:

Australian stocks were able to push through another key level with the ASX200 closing 0.8% higher at 7306 points. The Australian dollar however pause its breakout as traders absorb the new RBA Governor and give the Pacific Peso some relief just below the 69 handle to match the June highs:

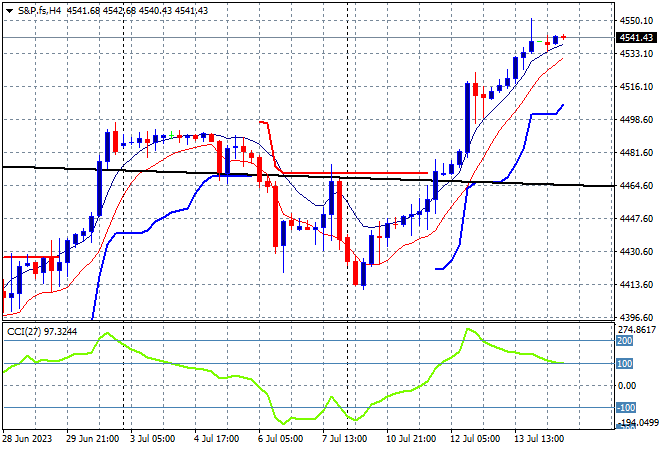

Eurostoxx and S&P futures are relatively flat with the S&P500 four hourly chart showing price action wanting to extend above the 4500 point level which had been staunch resistance before the series of soft CPI and PPI inflation prints:

The economic calendar concludes the trading week with some European trade figures and the latest Michigan consumer sentiment print.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI